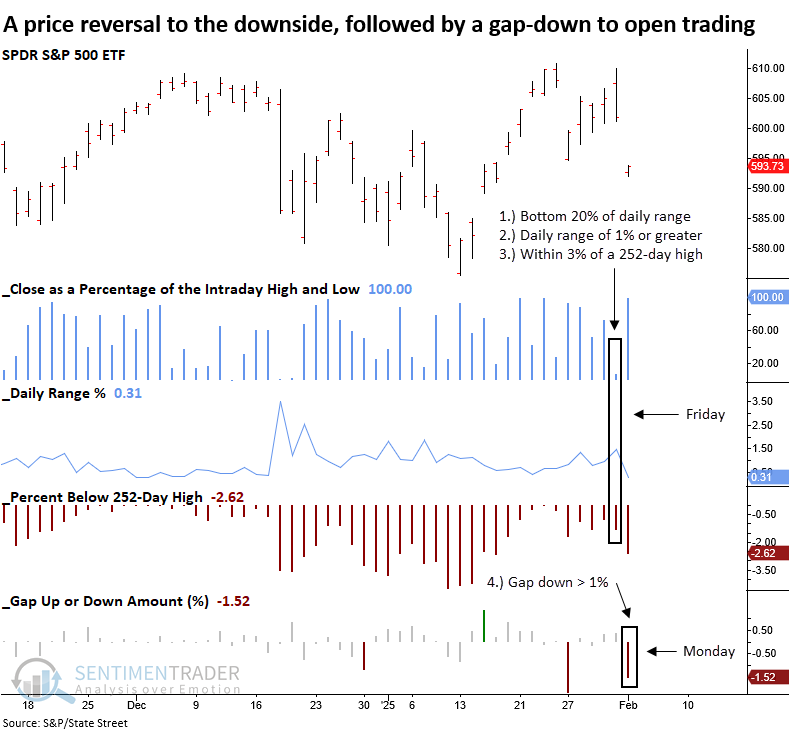

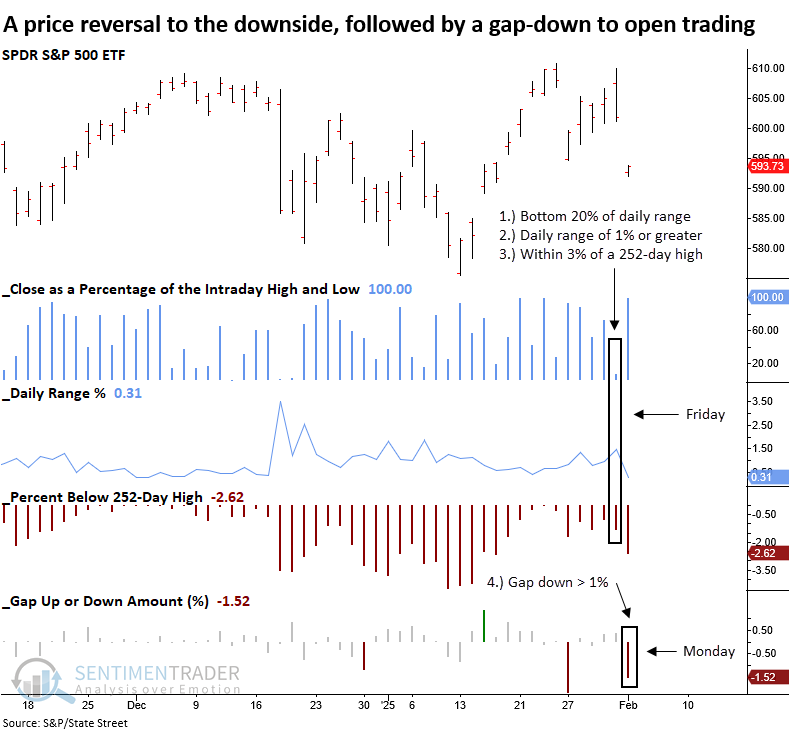

The S&P 500 formed a rare reversal and gap-down pattern

Key points:

- The S&P 500 reversed lower on Friday and gapped down over 1% at the open of trading today

- Similar price patterns suggest that the large-cap index could face short-term headwinds before rebounding

Does the S&P 500's price pattern signal trouble, or is it just noise within a bullish trend?

Last Friday, the stock market turned lower upon reports that the U.S. would impose tariffs on Canada, Mexico, and China. Confirmation over the weekend led to a signficant downside gap to open trading on Monday, sending traders into a frenzy.

Although this two-day price pattern, illustrated in the chart below, may seem alarming, it's crucial to remain objective. Throughout history, headlines have always fueled a sell first, ask questions later mentality from traders.

Successful investing, however, requires resisting emotional decision-making.

The S&P 500 ETF (SPY) was used for this study instead of the cash S&P 500 index, as it reflects price gaps-something the cash index cannot capture. While this results in fewer historical precedents, it provides the most comparable context to recent market conditions.

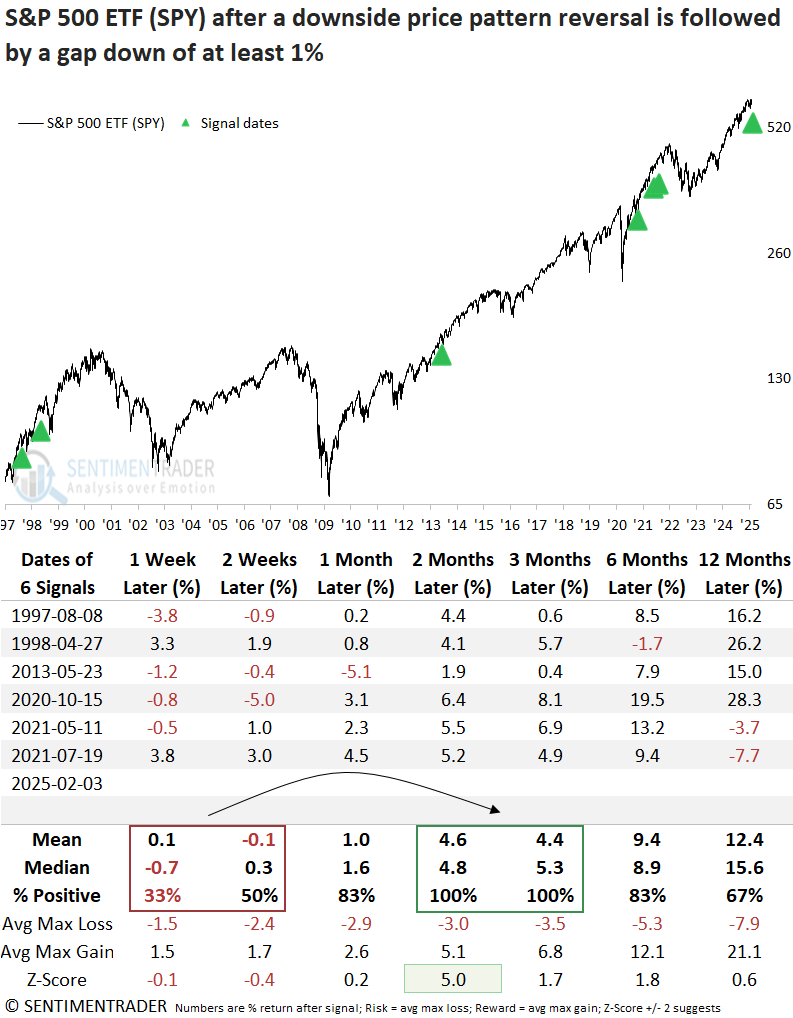

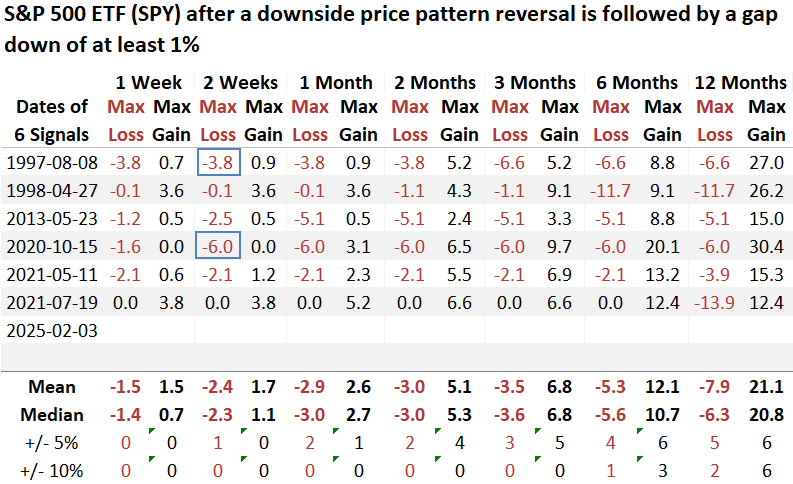

Comparable price patterns suggest stocks struggle in the next few weeks

Although the sample size is tiny, whenever a downside price pattern reversal was followed by a next-day gap-down of 1% or more, the S&P 500 struggled in the weeks ahead, with the most significant risk of further downside typically unfolding in the first week.

Once the shakeout concluded, the index rebounded, posting gains 100% of the time over the next two and three months.

The risk/reward profile moves from unfavorable in the first month to favorable in the second, with a maximum loss not exceeding 6%.

What the research tells us...

Short-term price patterns, like those observed over the past two sessions, often appear ominous at first glance, fueling bearish narratives. Yet, history suggests these setups rarely play out as the crowd expects, as they typically occur following a headline that surprises market participants. Once cooler heads prevail, the prior trend often resumes, leading to higher stock prices after a consolidation phase. Even if this time is different and tariffs prove disruptive, investors will likely have time to adjust portfolios, as significant market tops tend to develop gradually.