The Risk On/Off Indicator shifts to a bullish status

Key points:

- The Sentimentrader Risk On/Off Indicator shifted higher relative to its recent range

- Similar composite reversals produced a consistent upward bias in the S&P 500 across all time frames

- Precedents that occurred near a multi-year high, like now, still demonstrated promising results

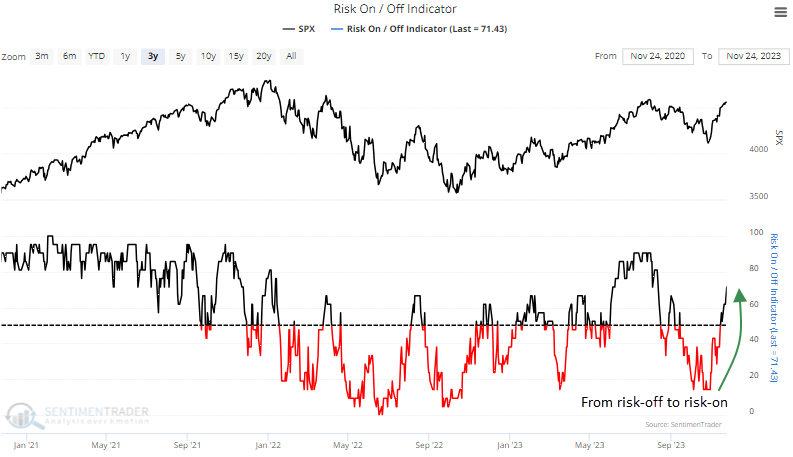

More and more breadth and sentiment indicators cycle from risk-off to risk-on

Sentimentrader's team emphasizes two indispensable market analysis concepts, along with many others, in our research notes: the strategic use of composite models and the identification of reversal signals.

The significance of composites lies in their ability to minimize the risk of failure, a common vulnerability associated with relying solely on a single indicator. Additionally, the utilization of reversal signals boosts the risk/reward profile of trading signals, preventing exposure to the risks of attempting to catch a falling knife.

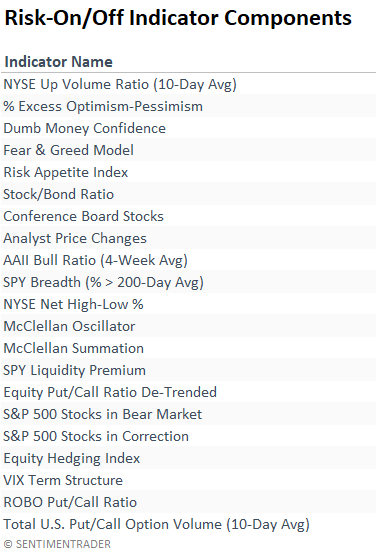

With our proprietary Risk-On/Off Indicator, a composite encompassing 21 diverse sentiment and breadth-based measures, coupled with our upgraded backtest engine, we can harness the power of both concepts to identify advantageous trading signals.

A trading system that uses the Sentimentrader Risk On/Off Indicator to identify a shift in the composite from the bottom of its recent range toward the upper end triggered a new risk-on signal for stocks. The previous signal in March 2023 led to an 8.4% gain in the S&P 500 over the subsequent three months.

A diverse set of sentiment and breadth-based measures

New backtest engine

With the new and improved backtest engine, subscribers can apply a range rank for a user-specified number of lookback sessions to any our 3000+ indicators. As a reminder, the range rank measures the current value relative to all other values over a lookback period. 100 is the highest, and 0 is the lowest.

The chart below, sourced from the backtest engine page on the website, showcases both the Risk On/Off Indicator and an 84-day range rank associated with the composite.

Utilizing the multi-condition feature in the entry criteria section of the backtest engine enables us to identify instances precisely when the range rank shifts from being below to above user-defined thresholds. Regarding my risk on/off range rank trading signal, the system measures when the rank falls below 5% and reverses above 68.5%.

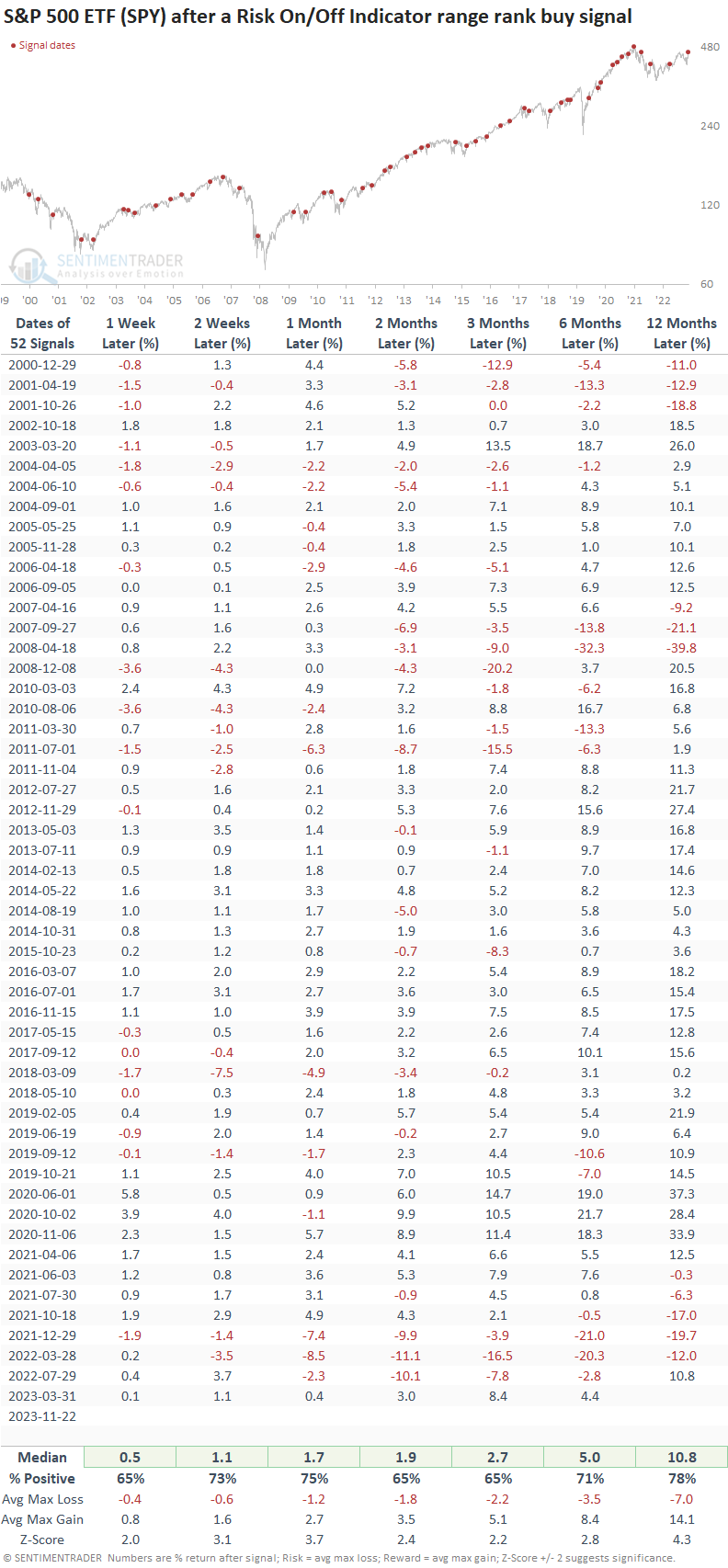

Similar range rank shifts preceded excellent returns for the S&P 500

Whenever the Sentimentrader Risk On/Off Indicator range rank cycled from below 5% to above 68.5%, S&P 500 returns, win rates, and z-scores are excellent across all time frames.

While the model exhibited proficiency in navigating countertrend rallies amid the 2000-02 and 2007-08 drawdowns, the 2022 bear market diverged from expectations by registering consecutive losses greater than -10 % over the subsequent two months.

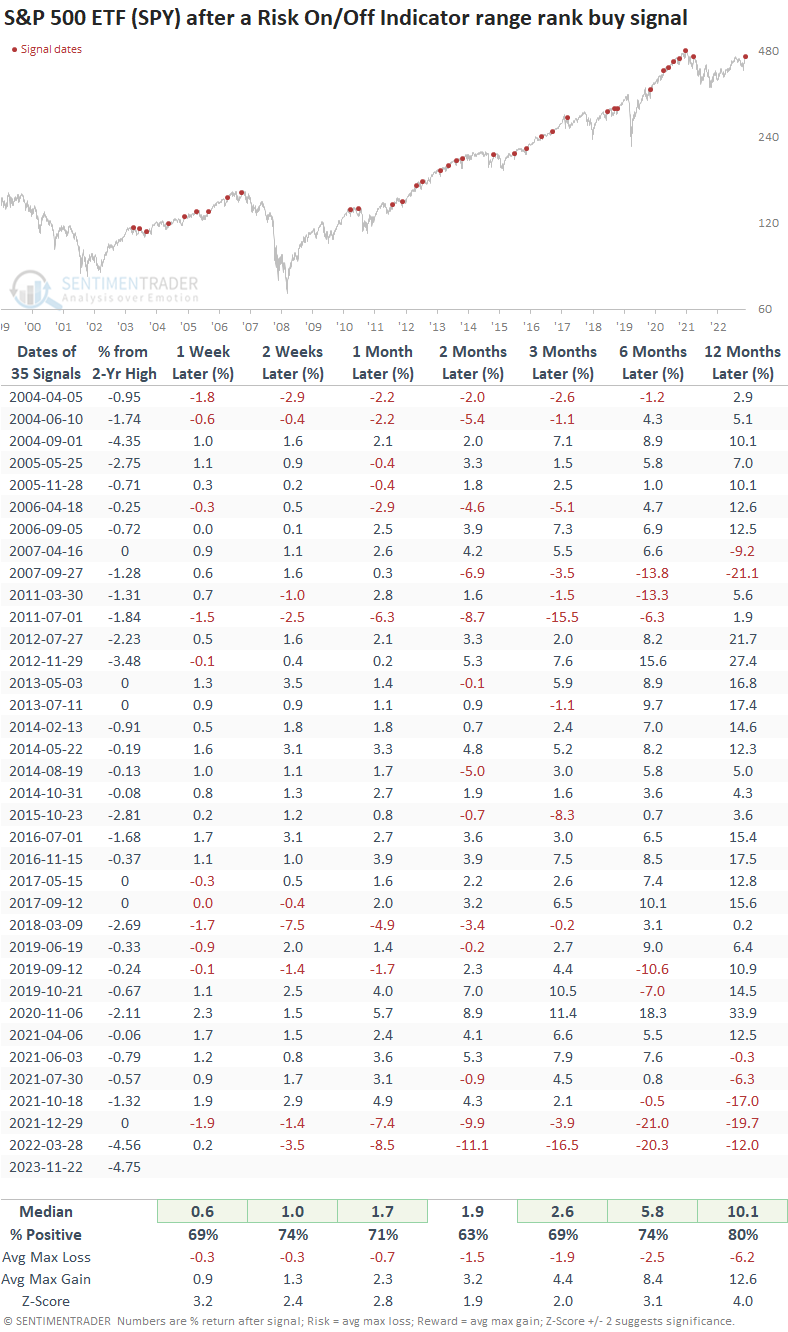

Signals near a multi-year high

Suppose I include a condition that requires the S&P 500 to close within 5% of a two-year high at the time of an alert for context similar to now. In that case, returns, win rates, and z-scores were still outstanding.

What the research tells us...

Over the past month, the research team has shared multiple updates highlighting positive developments for the stock market. The recent reversal in the Sentimentrader Risk-On/Off Indicator adds further credence to the bullish backdrop. While the outlook remains constructive, the last few sessions could imply that it might be prudent to moderate our expectations in the near term following a substantial surge from the October low.