The Real Estate Sector vs. the Economy

It is fairly common knowledge that the stock market's performance is tied closely to that of the economy. On the other hand, the Real Estate sector is typically thought of as a very different asset class. And in many ways, it is. But in the end, its performance is also extremely dependent on the state of the overall economy.

THE DATA

To measure the performance of the Real Estate sector, we will use the month-end value for the S&P 500 Real Estate Sector Index.

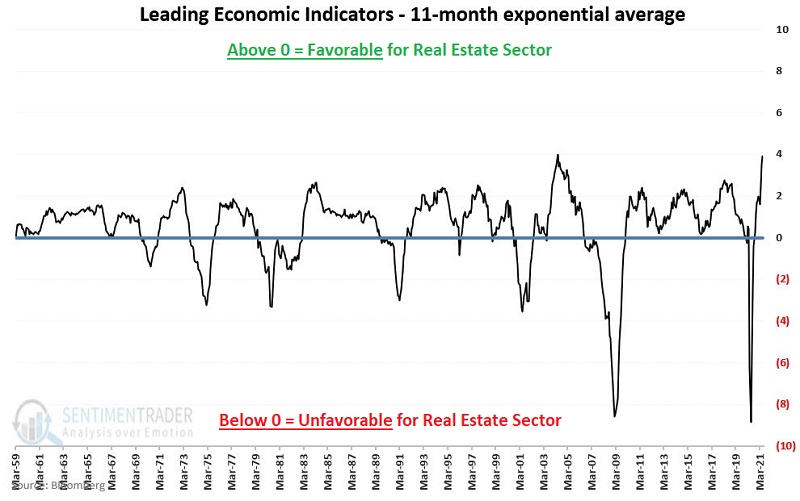

To measure the economy, at the end of each month, we compare the latest reading for The Conference Board Leading Economic Indicators Index (LEI) to its 11-month exponential moving average.

- If the latest reading is ABOVE the 11-month exponential average, then the Economy is considered Favorable

- If the latest reading is BELOW the 11-month exponential average, then the Economy is considered Unfavorable

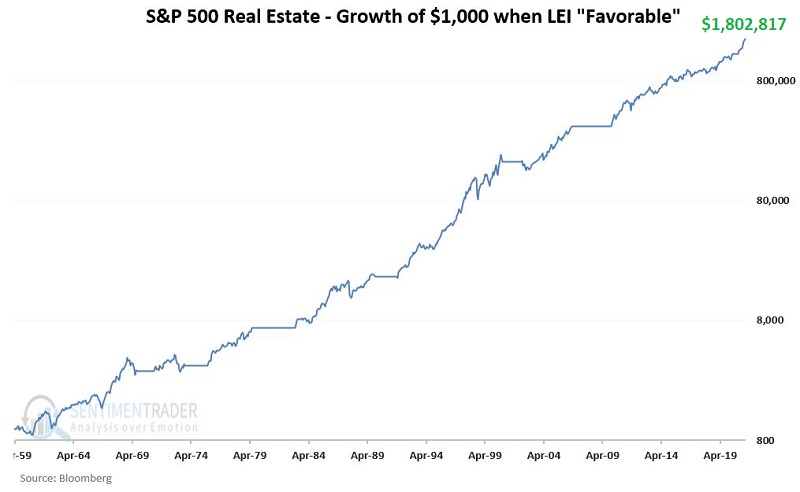

PERFORMANCE DURING FAVORABLE PERIODS

The chart below displays the cumulative growth of $1,000 invested in the S&P 500 Real Estate Sector Index ONLY during those months when the economy was deemed Favorable at the end of the preceding month.

PERFORMANCE DURING UNFAVORABLE PERIODS

The chart below displays the cumulative growth (or, more accurately, decline) of $1,000 invested in the S&P 500 Real Estate Sector Index ONLY during those months when the economy was deemed Unfavorable at the end of the preceding month.

THE RESULTS

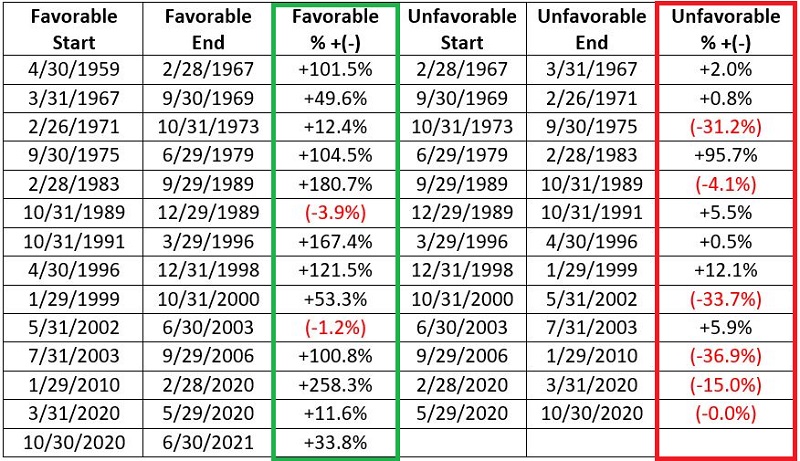

The table below displays the performance of the S&P 500 Real Estate sector index separately during Favorable and Unfavorable Periods.

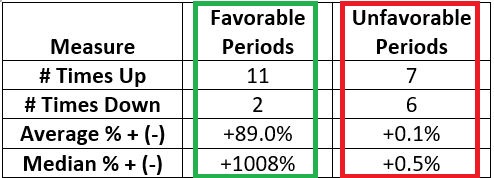

The table below presents a summary of the comparative results.

CURRENT STATUS

As of 6/30/2021, the LEI was above its 11-month exponential average. Thus this simple form of analysis presently deems the environment for the Real Estate sector as Favorable.

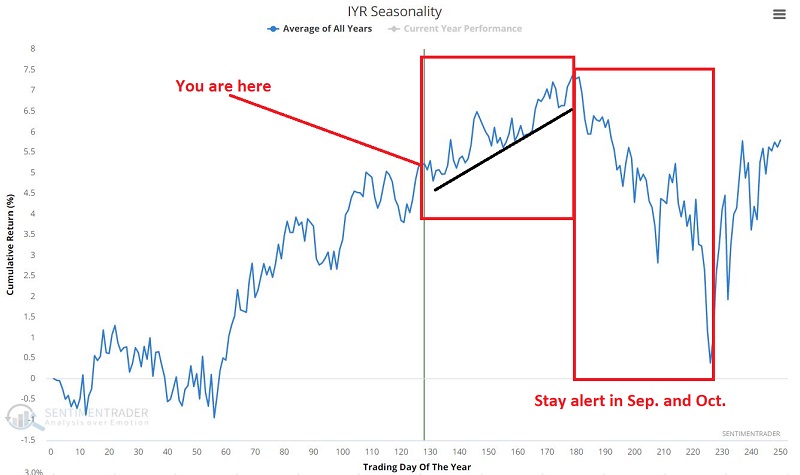

The chart below shows that the Annual Seasonal Trend for ticker IYR (iShares U.S. Real Estate ETF ) is still also favorable for a while longer (although it is worth noting that September and October tend to be more challenging for real estate stocks).

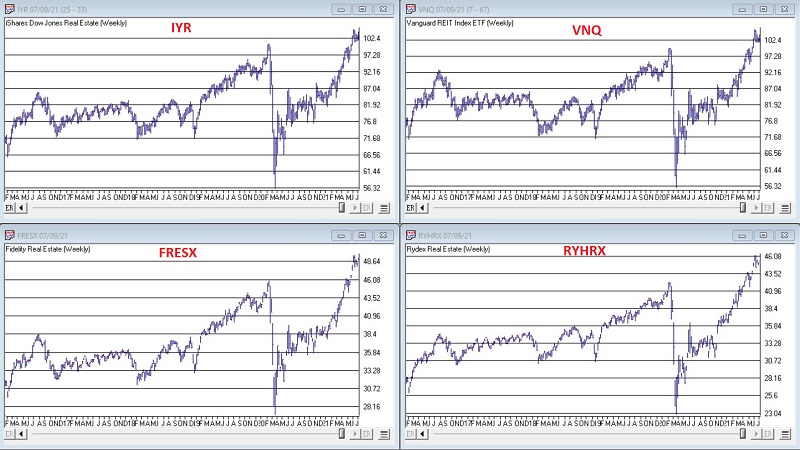

For traders interested in the Real Estate sector, the screenshot below displays weekly charts (courtesy of AIQ TradingExpert) for 2 ETFs and 2 mutual funds:

- IYR - iShares U.S. Real Estate ETF

- VNQ - Vanguard Real Estate Index Fund ETF Shares

- FRESX - Fidelity Real Estate Investment Portfolio

- RYHRX - Rydex Real Estate Fund Class H