The Ratio of Lumber to Gold Prices is Crashing

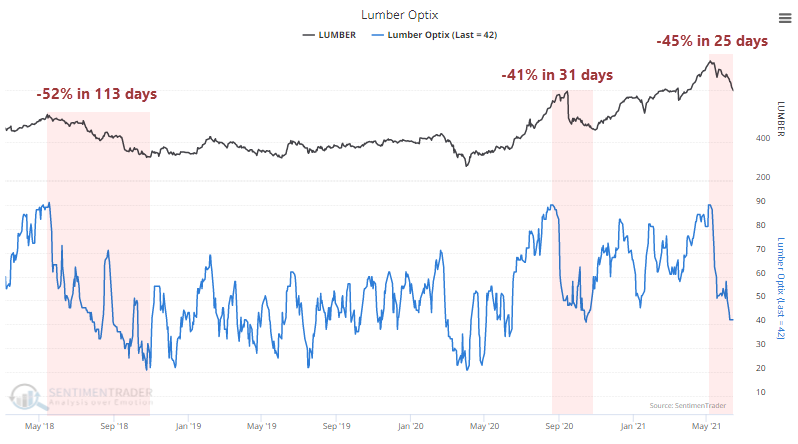

The ratio of lumber to gold is crashing, and it's raising concerns among some investors.

Lumber is considered a proxy for economic growth since it's an input to many construction projects. Gold is considered a "safe haven" asset that investors flock to in times of duress. Both assertions are questionable, but when the ratio of lumber to gold is rising, the theory is that investors are focused more on growth than safety, and it's a risk-on environment.

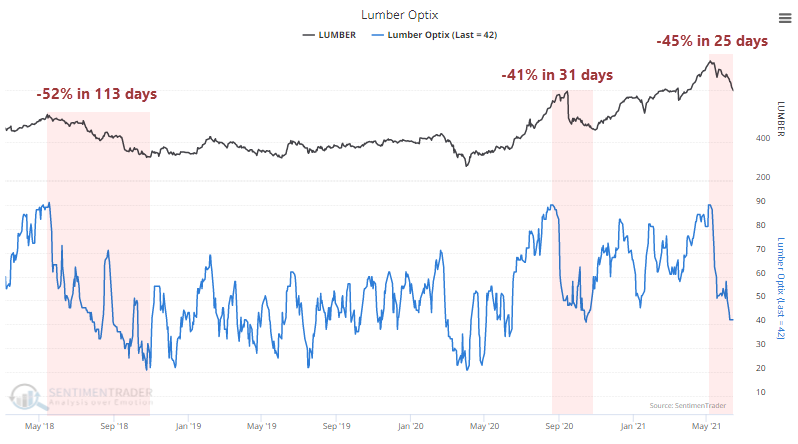

Ever since the Optimism Index on lumber hit 90%, lumber has been in a free-fall, surpassing the last couple of post-euphoria crashes in speed, if not magnitude.

The last time the ratio crash, it preceded trouble in the S&P.

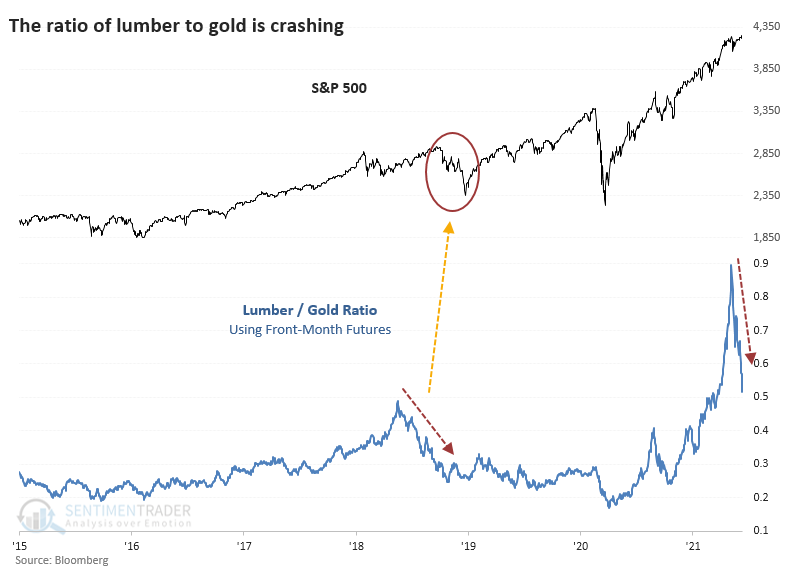

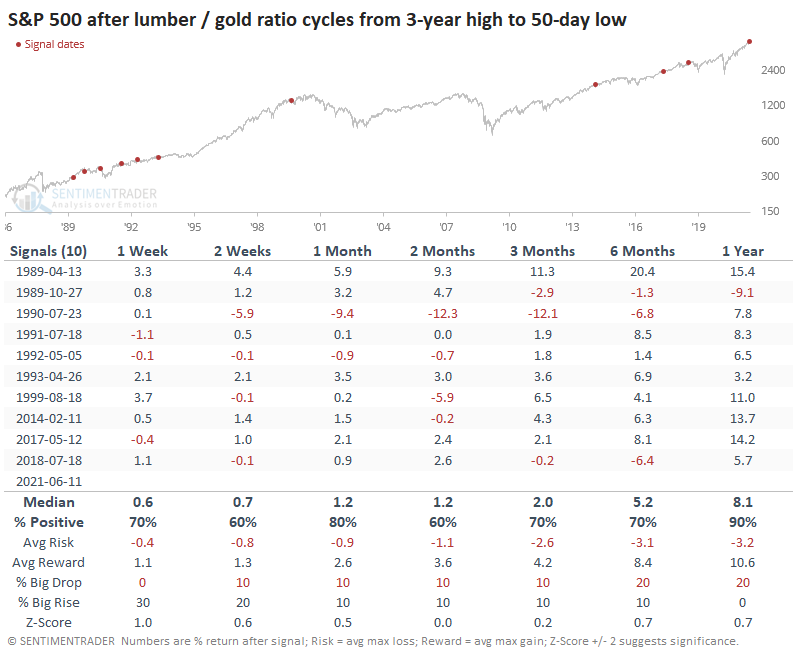

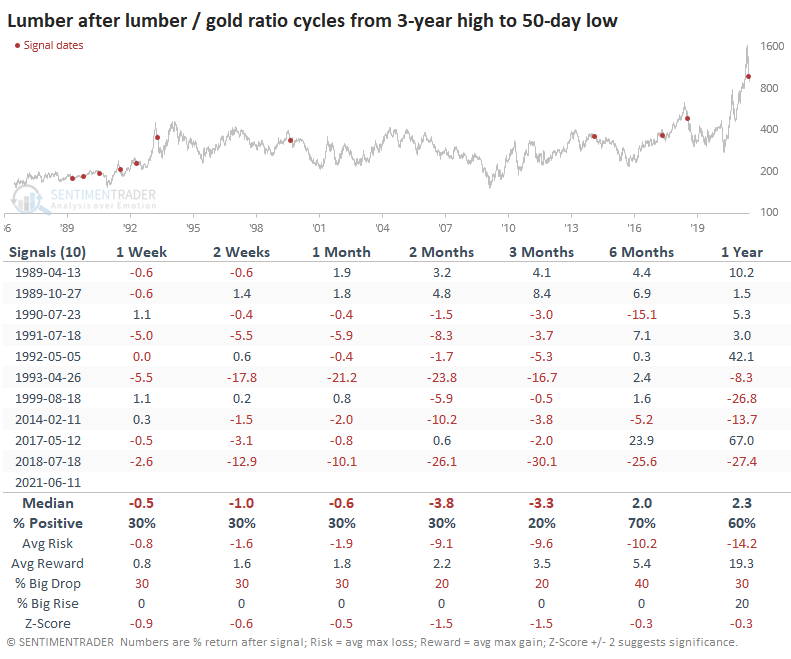

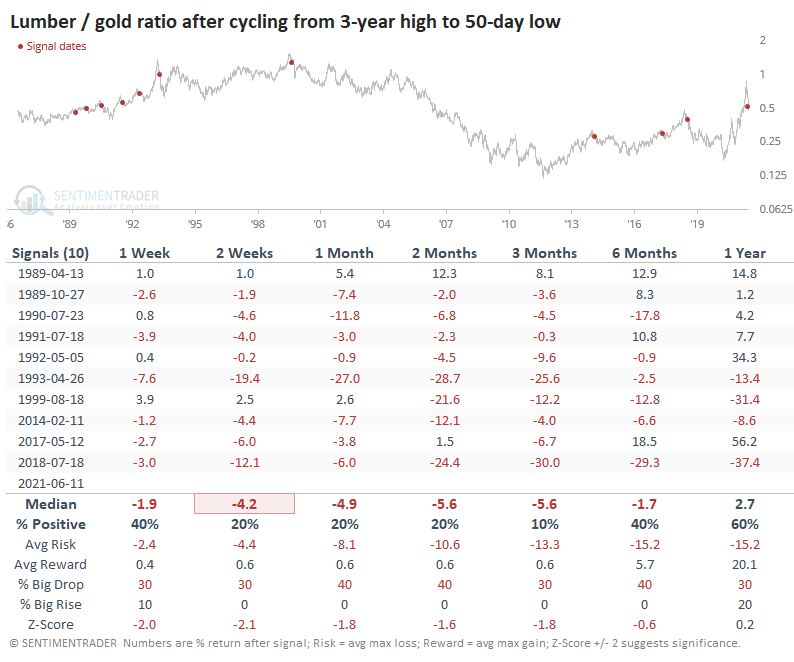

The trouble with charts is their subjectivity. So, let's go back to the inception of the futures market for both contracts and look at every time when the lumber / gold ratio cycled from a 3-year high to a 50-day low. On average, it took 29 days for the ratio to cycle like this, which is quick. The current one took 24 days, so about in line with average.

It was not a good reason to sell stocks. The S&P 500 did crack a couple of times, including the one noted above. It preceded the 1990 recession scare and kinda-sorta the popping of the 2000 bubble, but it's a big stretch to include that one in a list of warning signs.

NOT A GOOD SIGN FOR LUMBER

It was, however, a pretty good reason to sell lumber. The contract continued to plunge most of the time, with the first signal in 1989 being the only sustained exception.

Over the next several months, lumber really struggled. This coincides with a weak seasonal window as lumber prices typically bottom in the late fall.

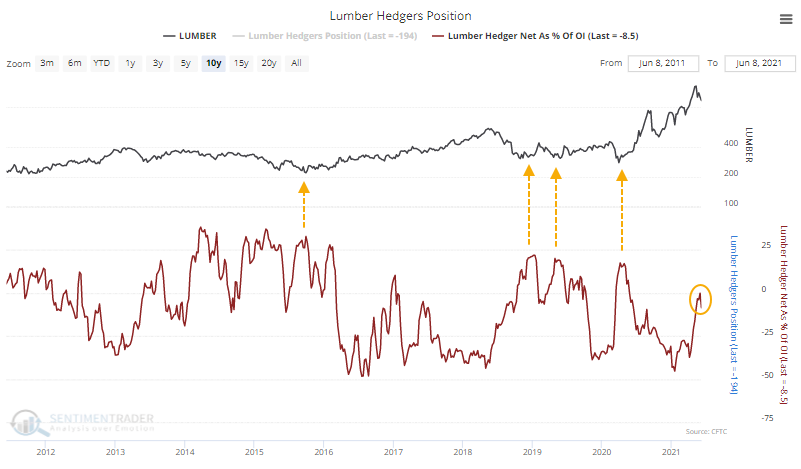

There isn't much support from "smart money" traders yet, either. In recent years, lumber had bottomed when commercial hedgers held about 25% or more of open interest net long. Currently, they're still net short.

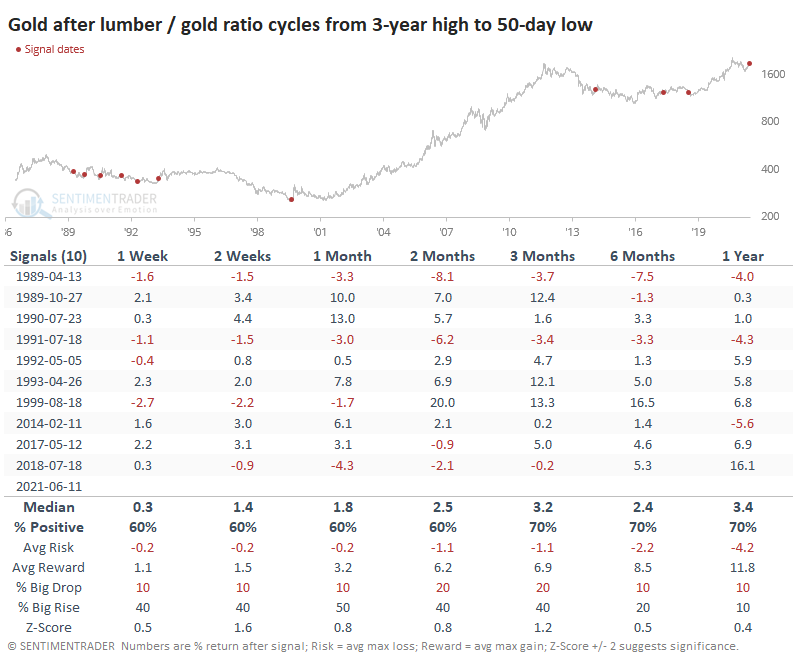

Gold prices tended to hold up much better than lumber after cycles in the ratio.

This dynamic means that the ratio of lumber to gold had a strong tendency to keep declining.

HOMEBUILDERS DROP, DEFENSIVE STOCKS POP

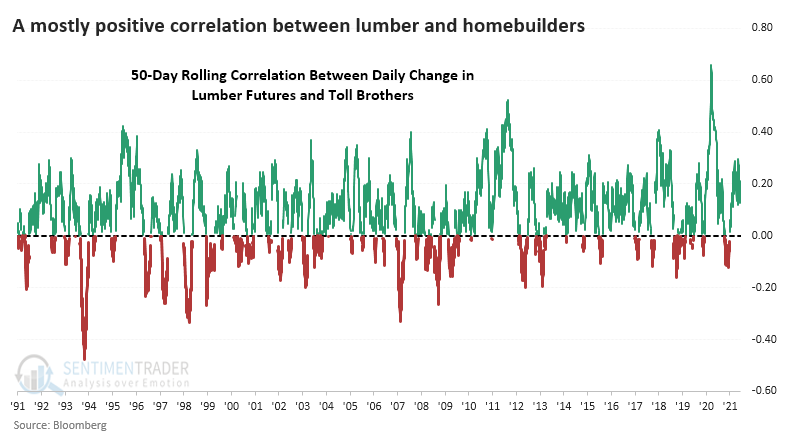

While it's not perfect, lumber prices do have an impact on homebuilding stocks. The chart below shows the rolling 50-day correlation between daily price changes in lumber and the homebuilder Toll Brothers. This is mostly well above zero, especially over the past decade.

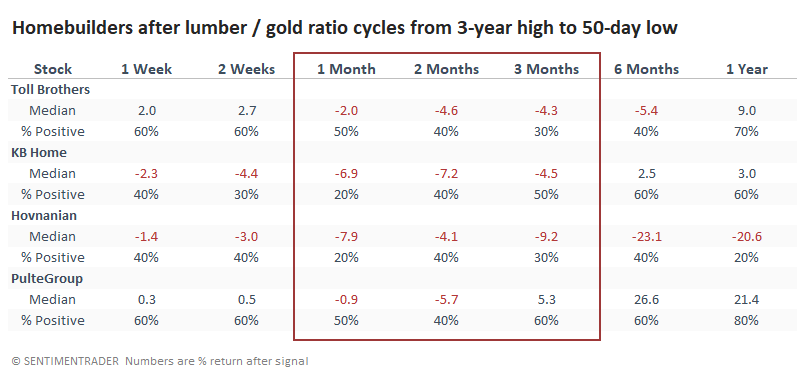

That means if lumber tended to continue to fall after these cycles in the lumber / gold ratio, then homebuilders should have too. And they did. Medium-term returns for several of the builders with the longest histories as public companies were not impressive.

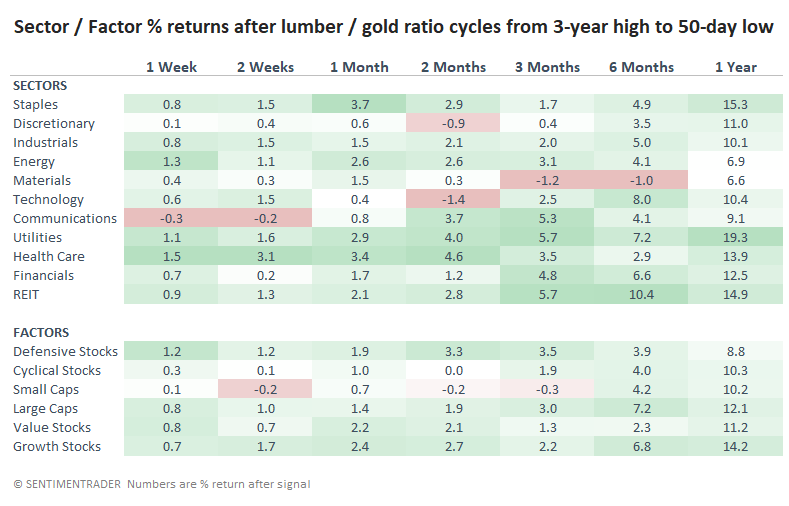

As for major sectors and factors, there was not a huge difference in future returns. Materials, Tech, and Discretionary stocks showed poor medium-term returns. Utilities and Health Care were among the strongest, so it's not a shocker that Defensive stocks were the best-performing factor.

There isn't much support here to consider a crash in the price of lumber relative to gold as a reason to be concerned about the stock market, at least on an aggregate level. A more defensible position is that higher-beta, higher-risk sectors may be more vulnerable, and homebuilding stocks have suffered the most.