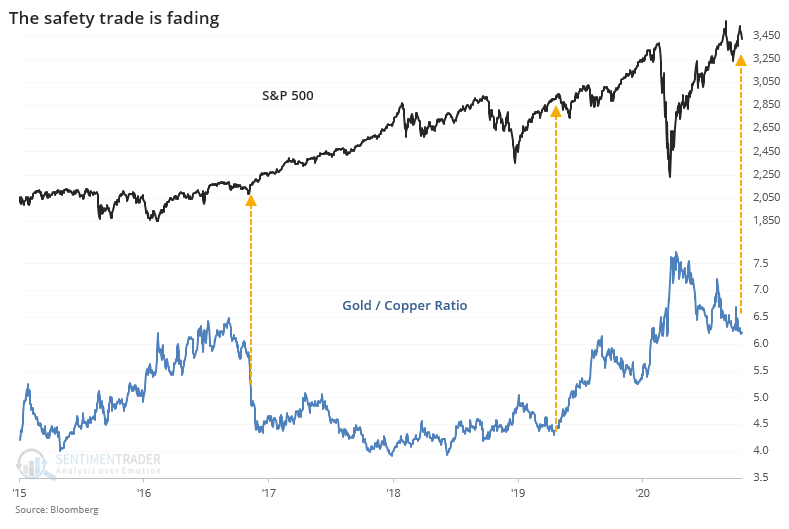

The ratio of gold to copper shows returning risk appetite

The safety trade is starting to fade.

During times of duress, traders often flee to the perceived safety of gold. During economic booms, they gravitate toward copper, which has more industrial utility. So, watching the ratio of gold to copper can provide a sense of whether traders are looking for safety or a play on economic growth. That's the theory, anyway.

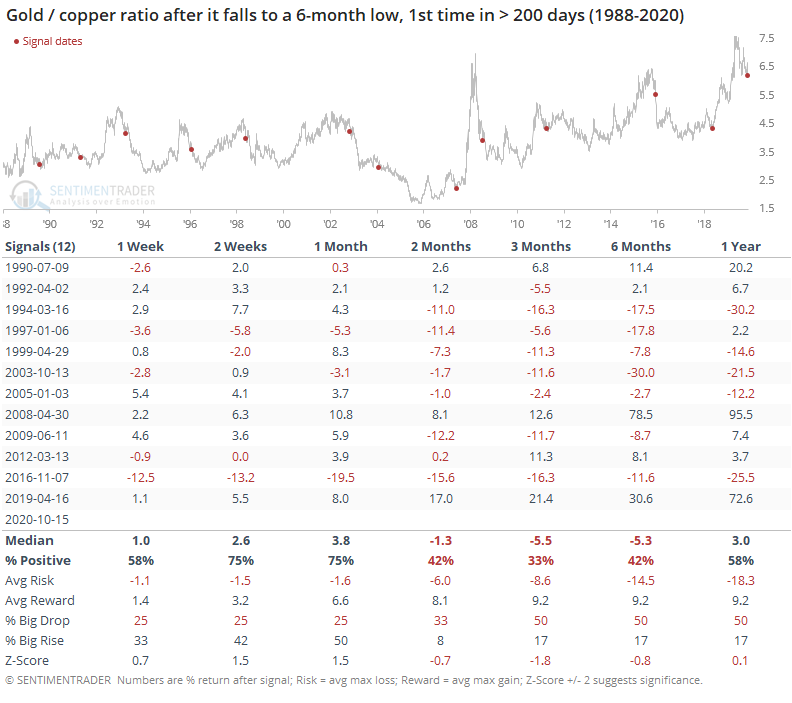

According to Bloomberg, the ratio of gold to copper has dropped to its lowest level in months, as traders shift from safety to growth. The last couple of times the ratio fell to a 6-month low for the first time in more than 200 sessions, stocks rallied hard in the months ahead.

If we believe in the theory behind this ratio, then traders have been anxious for a while. The recent drop in the ratio marked the first time in nearly a year and a half that it had been at a 6-month low, one of the longest streaks in over 30 years.

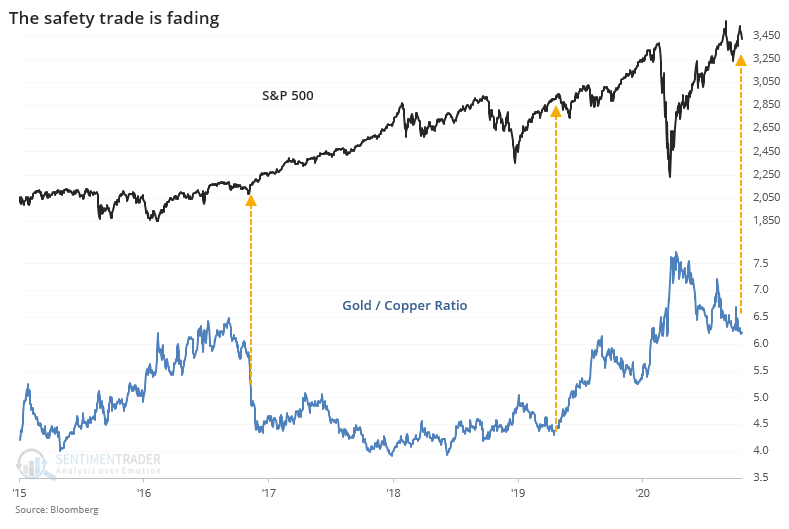

Other times the ratio ended a long streak without a 6-month low, gold prices tended to keep falling.

Over the short- to medium-term, gold struggled to show a gain. The win rate, average return, and risk/reward skew were all negative up to 2 months later. About the only solace for bulls was the 6-month window when it finally turned positive.

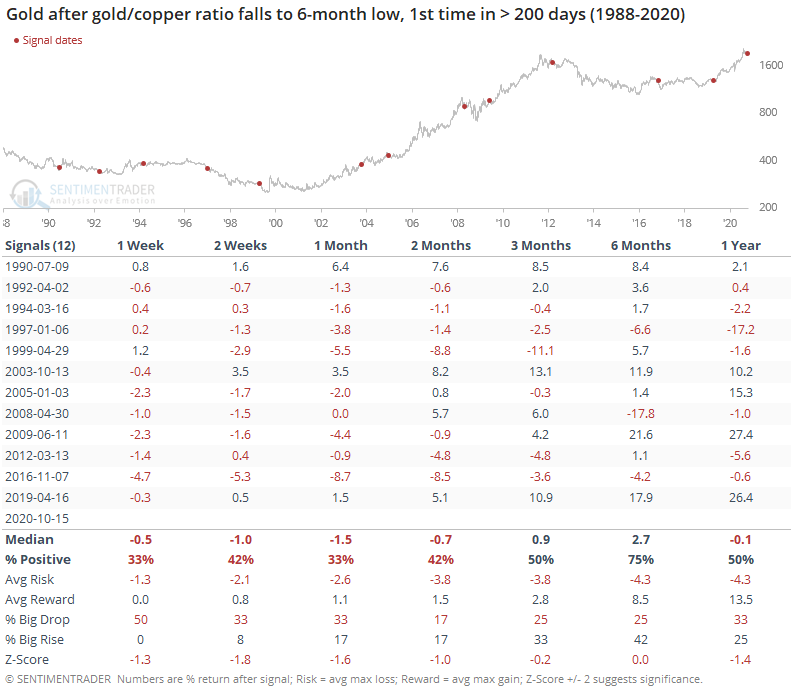

Copper also tended to struggle. Weakness here was mostly shorter-term, with an especially poor risk/reward ratio over the next month.

Even so, gold tended to drop more than copper over the medium-term, so the ratio between them continued to decline. The ratio rebounded about 3 times out of 4 during the next 2-4 weeks, but after that the longer-term trend asserted itself.

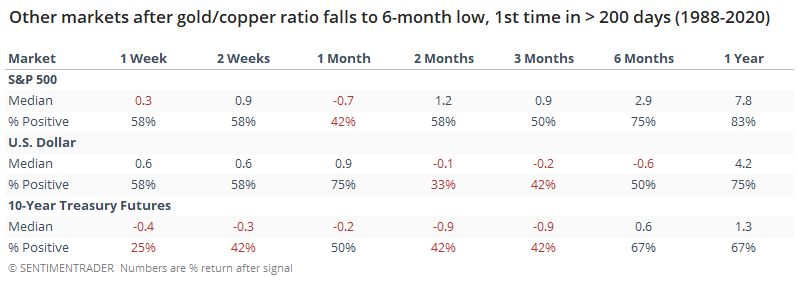

For other markets, it was a modestly good longer-term sign for stocks, not so much for the dollar or Treasuries over the medium-term.

Over the next 6-12 months, the S&P 500 showed consistent gains, with a good average return, but nothing much beyond random. Shorter-term returns were even a bit below random, so assuming that this risk-on signal meant gains ahead for stocks wasn't very useful. It was modestly successful at preceding declines in T-notes over the next 2-3 months, meaning interest rates rose.

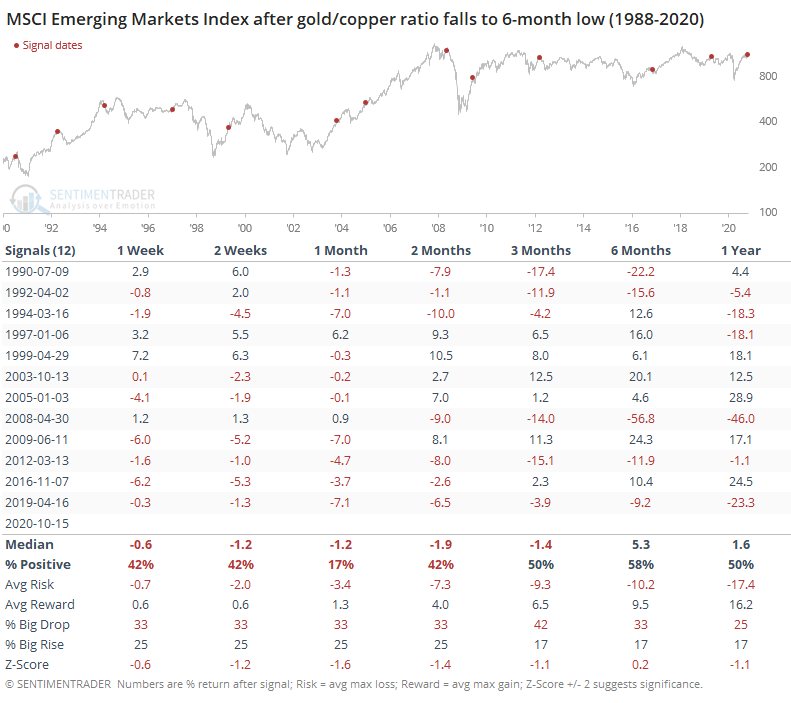

A breakout in copper is supposed to be a particularly good sign for emerging markets, but when the gold / copper ratio fell to a 6-month low, emerging markets had a strong tendency to show a loss over the next month, gradually working toward breakeven over the next several months.

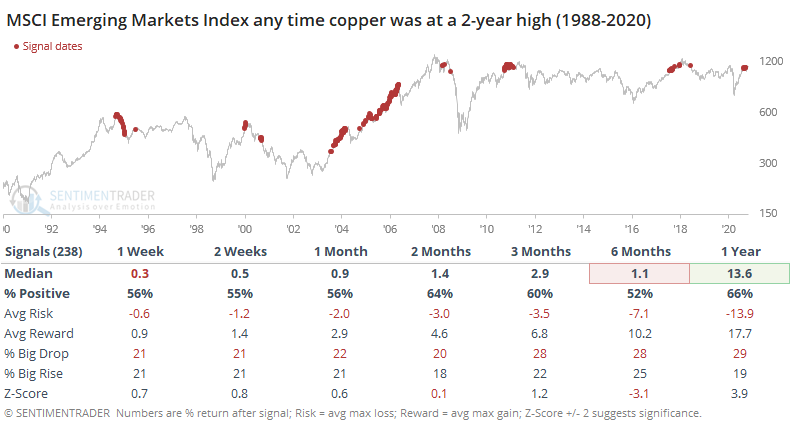

If we forget gold for a moment and just look at any day when copper hit a 2-year high, it was still not a consistent reason to buy emerging markets.

It should be a good sign that risk aversion is receding, but based on this ratio's measurement of it, not consistent enough to put a lot of weight behind.