The post-Thanksgiving year-end portfolio

Key Points

- The stock market has shown a strong tendency to advance between the end of Thanksgiving week year-end

- Real estate, financials, and health care have outperformed the S&P 500 Index during this period

- Short-term traders may be able to take advantage using ETFs

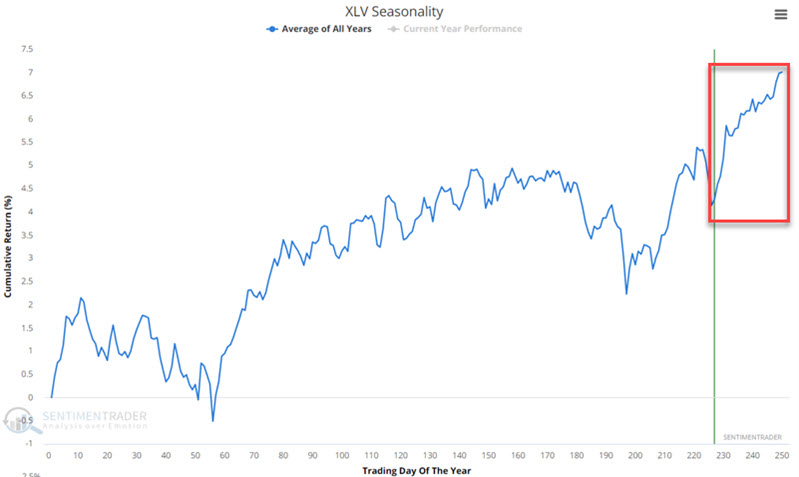

Acknowledging sector seasonality

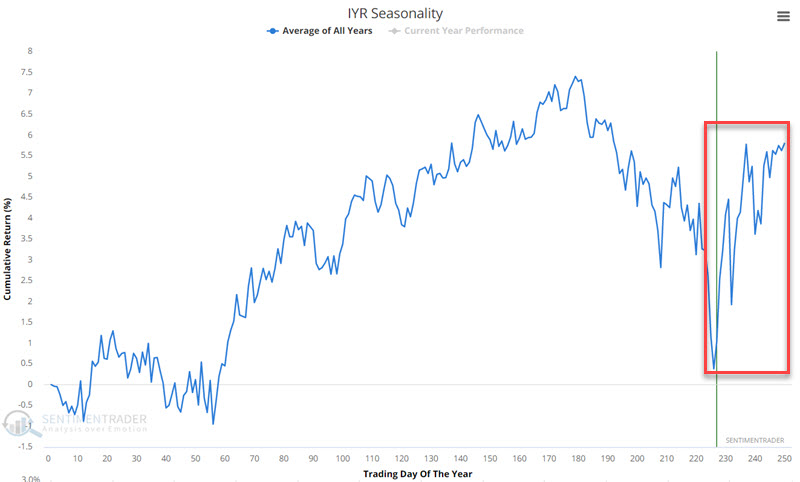

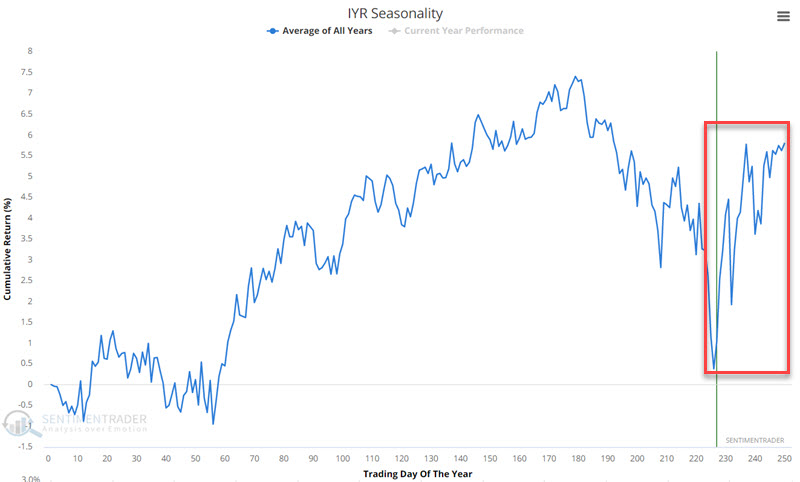

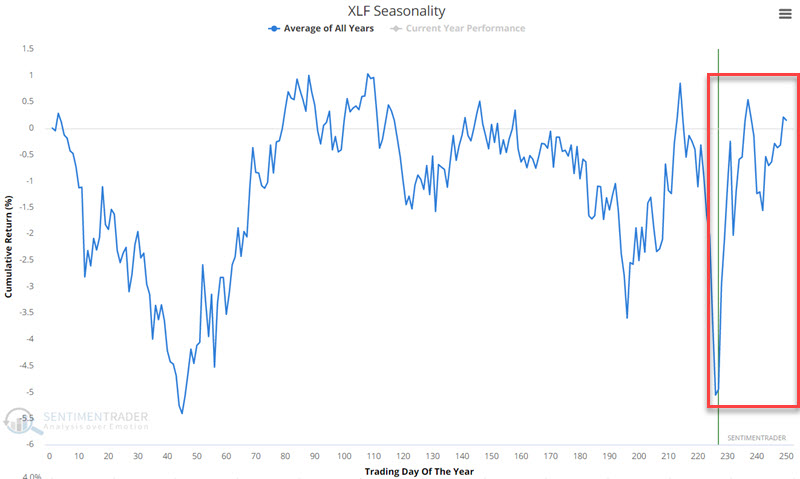

Certain sectors tend to perform well late in the calendar year. The charts below display the annual seasonal trends for IYR (Real Estate), XLF (Financials), and XLV (Health Care).

All three tend to show strength late in the calendar year. As always, these are tendencies over time, and not certainties.

Post-Thanksgiving week through year-end

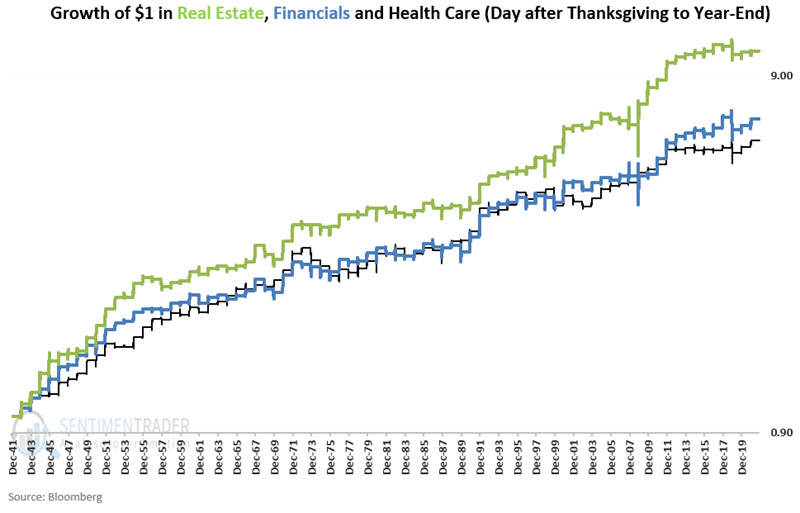

For our test, we will focus on the period beginning at the close on Friday the day after Thanksgiving through the end of the calendar year. We will compare the performance of the Real Estate, Financial, and Health Care sectors to that of the S&P 500 index from 1942 through 2020.

The chart below shows the hypothetical growth of $1 invested in those 3 sectors during this stretch of time.

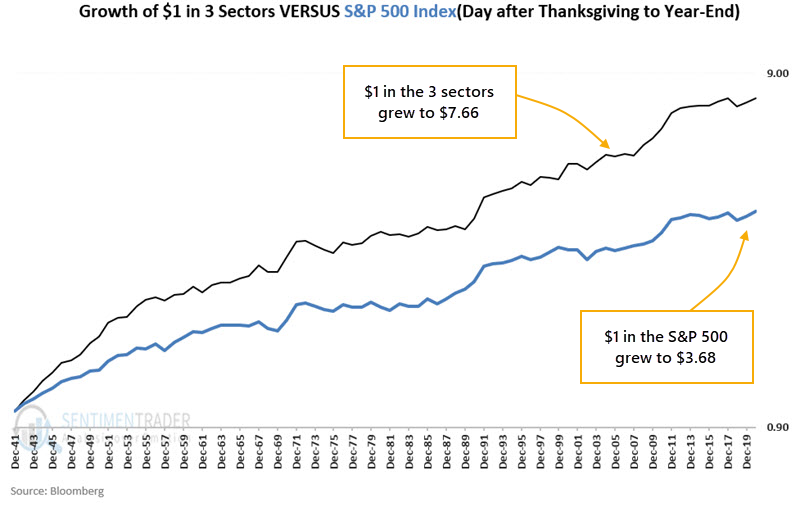

The chart below displays the growth of $1 split evenly each year among the three sectors, versus the growth of $1 invested in the S&P 500 Index each year only during the Post-Thanksgiving through Year-end period. In the 3 sectors, $1 grew to $7.66 versus only $3.68 in the S&P.

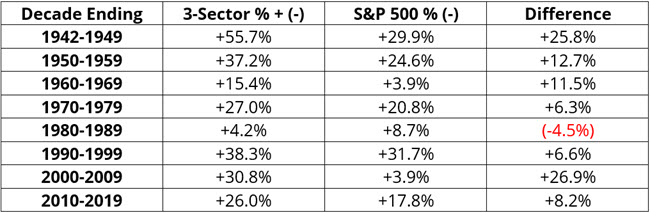

A history of consistent and wide outperformance

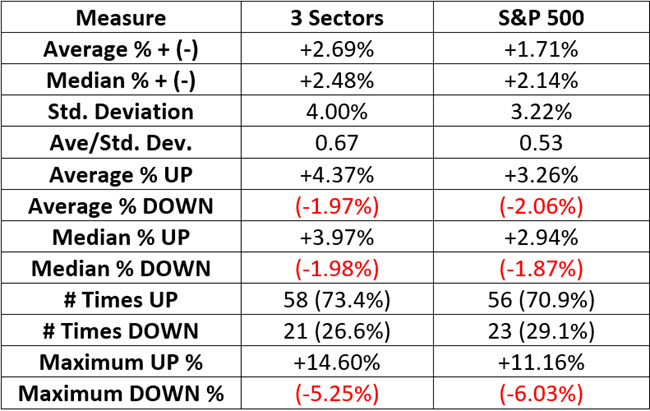

The table below displays the comparative figures. Over time the three-sector portfolio has outperformed the S&P 500 Index in all categories.

The three-sector portfolio has outperformed the S&P 500 Index in all but one calendar decade since 1942.

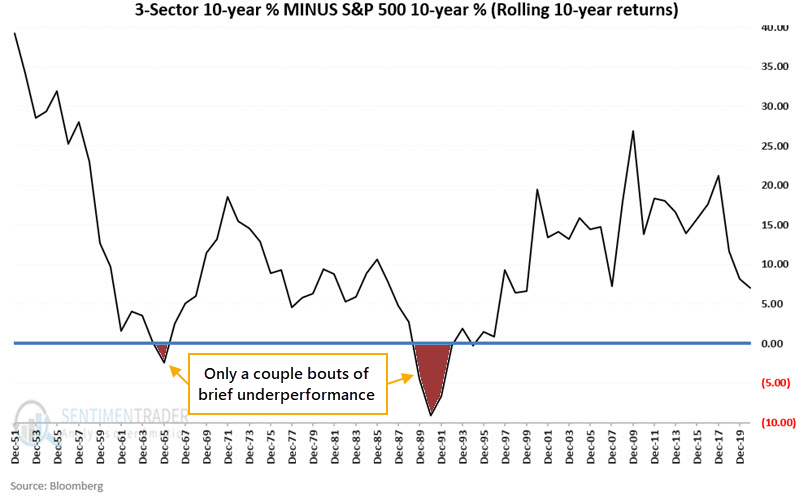

The chart below displays rolling 10-year returns for the three-sector portfolio minus 10-year rolling returns for the S&P 500 Index. A reading above 0 means the three-sector portfolio outperformed the S&P 500 Index over the prior 10 years.

The three-sector portfolio has shown a gain during 70 out of 70 rolling 10-year periods (100%), while the S&P 500 Index has shown a gain during 67 out of 70 rolling 10-year periods (95.7%). The three-sector portfolio has outperformed the S&P 500 Index 64 out of 70 rolling 10-year periods (91.4%).

Traders can attempt to emulate this strategy using these popular ETFs:

- IYR (iShares U.S. Real Estate ETF)

- XLF (Financial Select Sector SPDR Fund)

- XLV (Health Care Select Sector SPDR Fund)

What the research tells us…

The Real Estate, Financial, and Health Care sectors have tended to outperform the S&P 500 Index during the post-Thanksgiving part of the year. There is no way to predict if the three-sector portfolio will show a post-Thanksgiving gain, let alone outperform the S&P 500, but as a group that have shown a consistent tendency to do so.