The Past 200 Days Are Just Like 2019 (and 2013, and...)

It's easy to look at a chart and cherry-pick dates to say, "Hey this looks just like that!" and make a conclusion. One of the common ones lately has been comparing the last 200 days to the initial thrust off past bear market bottoms.

Fair enough, but the past 200 sessions have been remarkable for their calm. Most other kick-offs have suffered at least some volatility along the way.

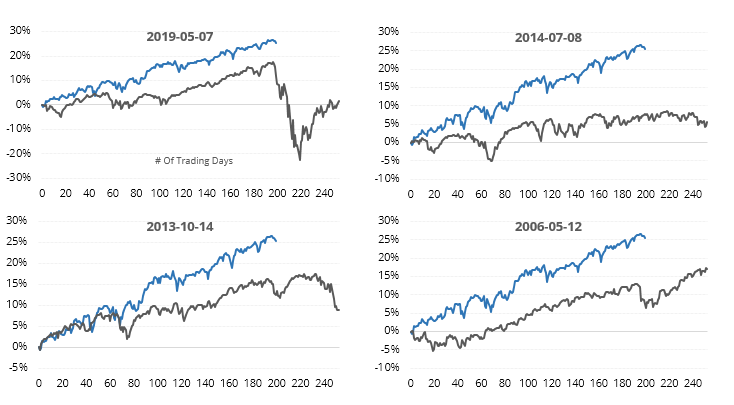

If we use the objective calculations we always do for analogs, then we can look at other 200-day periods in the S&P 500's history to see which ones have the highest correlation to the recent past. It turns out there were 18 other stretches with a very high correlation, when the S&P was also trading at a multi-year high at the time.

The chart below shows the last 200 days in the index (blue) along with the 4 most recent occurrences.

Looking at all of the precedents, shorter-term returns were not great. Across most time frames, the S&P's returns were below random, and the overall risk/reward was very poor.

One difference with our current market is just how strong the momentum and (mostly) breadth have been. The S&P just ended a historic streak with more than 75% of its members above their long-term trends, which showed that any shorter-term dips had a strong tendency to rebound in the months ahead.

What else we're looking at

- Looking at an aggregate of the most highly-correlated 200-day periods in the S&P 500 history

- Forward returns after those analogs ran their course

- A monthly stock market anomaly that hides in plain sight

- Looking at current seasonal effects in platinum and the U.S. dollar

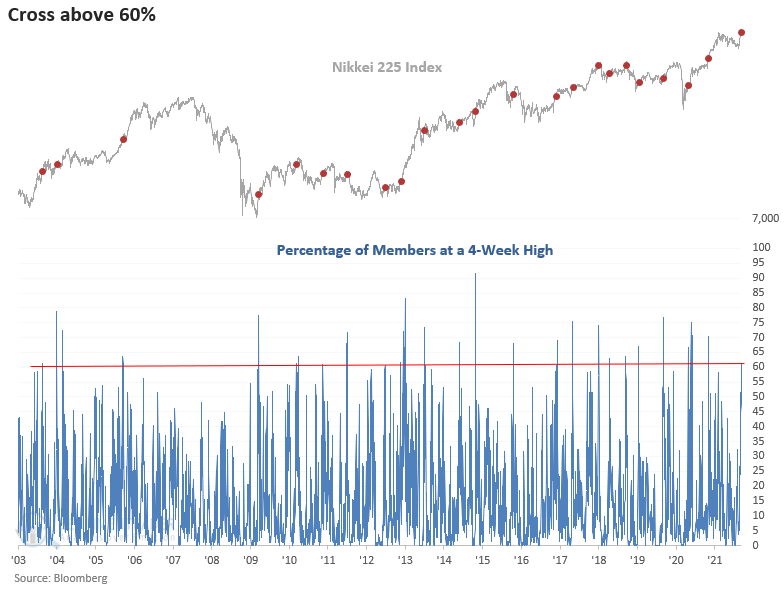

- A detailed look at a breath surge in Japanese shares and what it means for U.S. investors

| Stat box Traders fled the IWM Russell 2000 small-cap fund on Wednesday, as it suffered a more than $1 billion outflow. According to our Backtest Engine, other > $ 1 billion outflows in the past decade preceded a rally in IWM after 33 of 43 signals. |

Etcetera

More signs of a surge. More than 60% of stocks in the Nikkei 225 index of Japanese shares jumped to a one-month high. Dean highlighted how that kind of thrust has tended to continue in the weeks ahead.

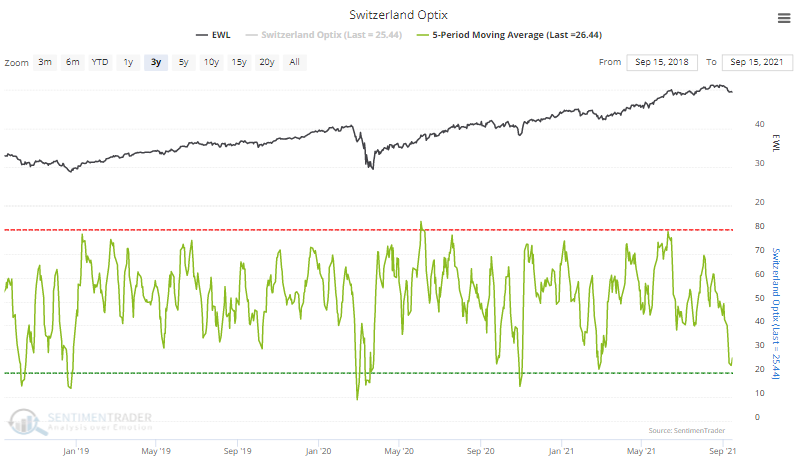

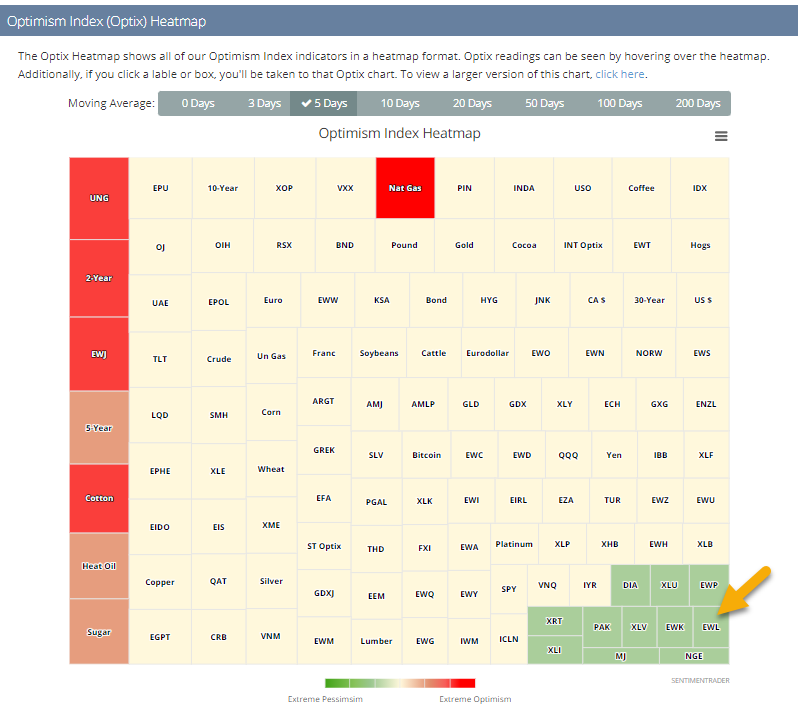

Hot (and not) markets. Our Optimism Index Heatmap shows where optimism is (and isn't) across many of the markets we cover. Over the past 5 sessions, one of the funds with the lowest optimism is EWL, focusing on Swiss stocks.

Not neutral. Taking a closer look at optimism in Switzerland via the EWL fund, the 5-day average is trying to curl up from the 7th-lowest level in the past 3 years.