The OECD composite leading indicators trigger a buy signal

Key points:

- A diffusion index for the OECD composite leading indicators triggered a buy signal

- Similar reversals in the OECD CLI preceded excellent returns for the S&P 500

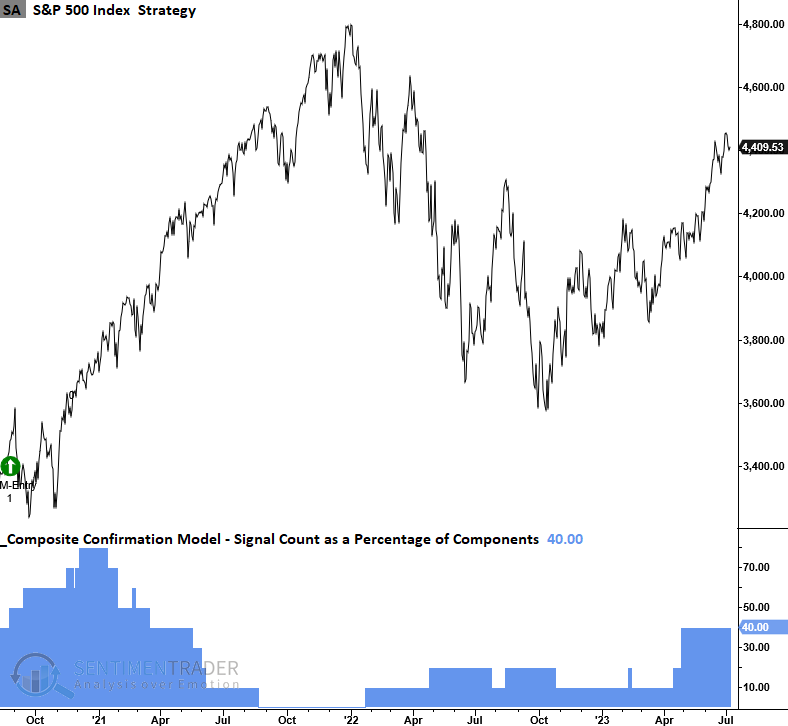

- The TCTM Composite Confirmation Model signal count increased to 40% with the new CLI alert

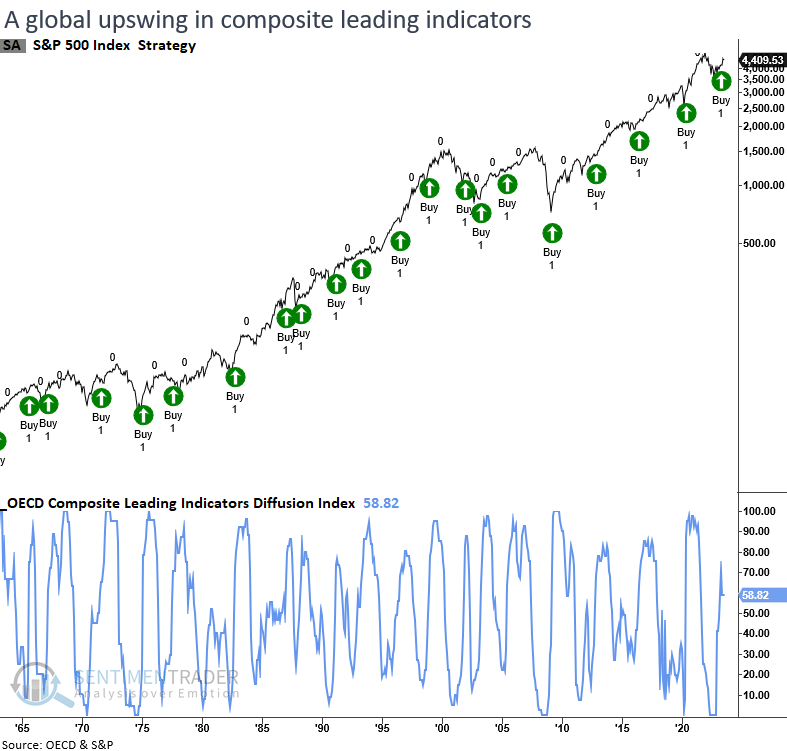

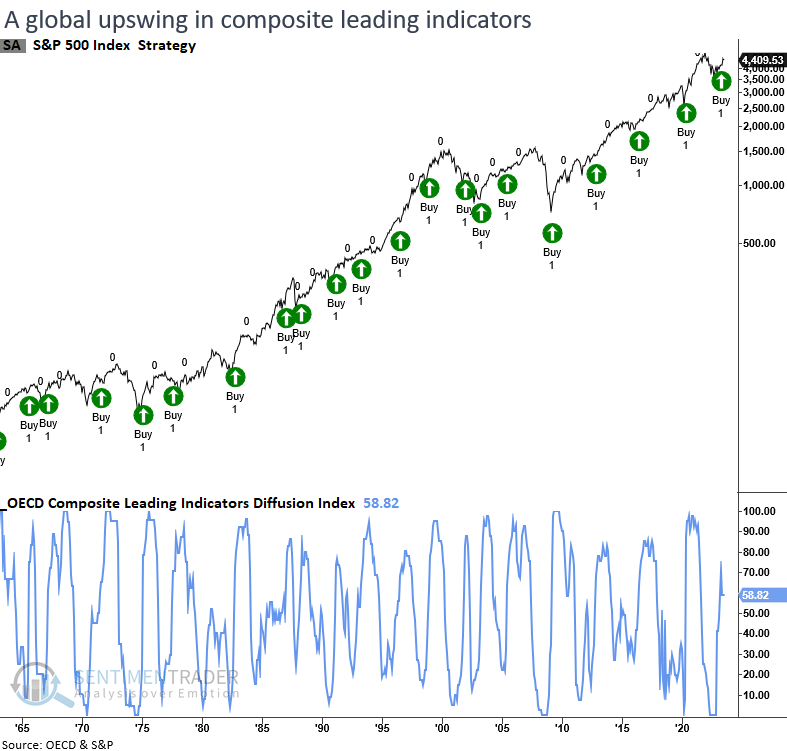

A resurgence in the OECD composite leading indicators

The Organization for Economic Cooperation and Development (OECD) compiles a composite of leading indicators for countries worldwide. By aggregating these individual country indicators into a diffusion index, it becomes possible to detect a revival in economic trends, which typically creates favorable conditions for the stock market.

The OECD CLI Diffusion Index, which tracks the proportion of CLIs rising month-over-month, declined to 0% in 2022 but has now reversed higher, triggering a buy signal when it exceeded 60%.

The TCTM Composite Confirmation Model signal count increased to 40% with the new composite leading indicators buy signal.

A couple of items to note about the OECD data series: First, revisions occur each month, so I wait a few months to see whether an initial alert holds through the revisions. Second, the OECD stopped calculating data for several countries in January 2023. The series now contains G20 countries.

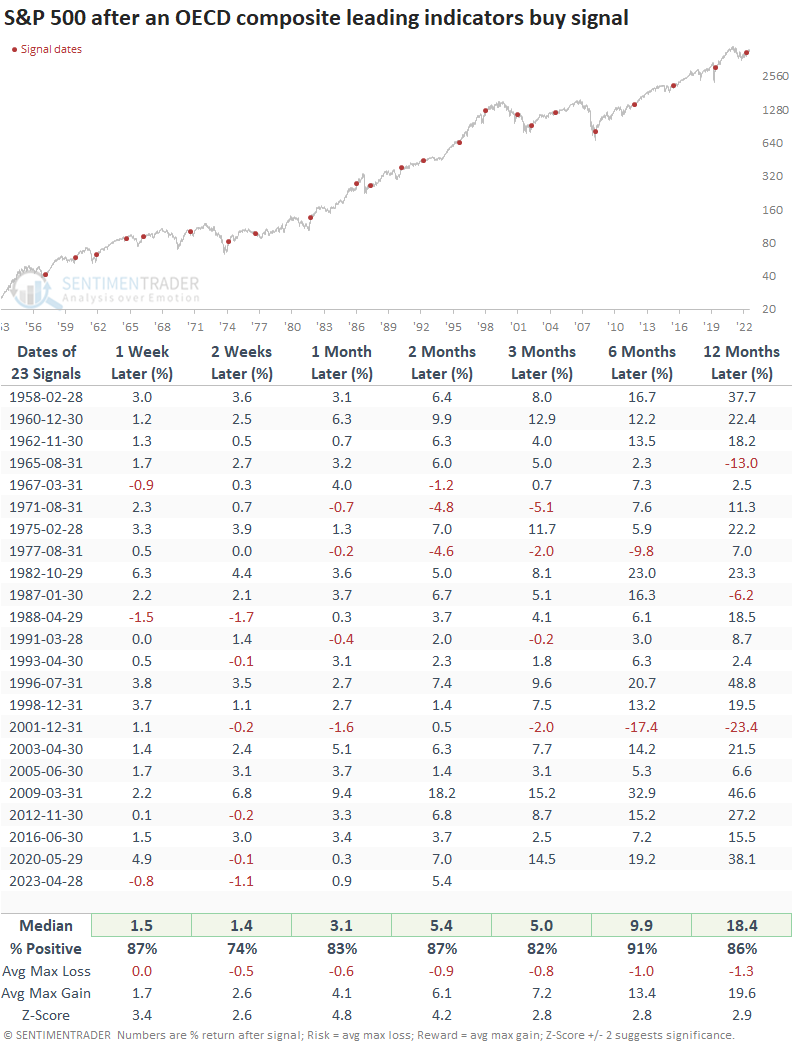

A resurgence in CLIs preceded excellent returns

Whenever the diffusion index for the OECD CLIs climbs above 60% after falling below 40%, the S&P 500 displays remarkable returns, win rates, and z-scores across all time frames. Six months later, the S&P 500 was higher in all but two precedents. The only notable whipsaw occurred in 2001 when several other economic indicators yielded optimistic signals that ultimately proved unsuccessful.

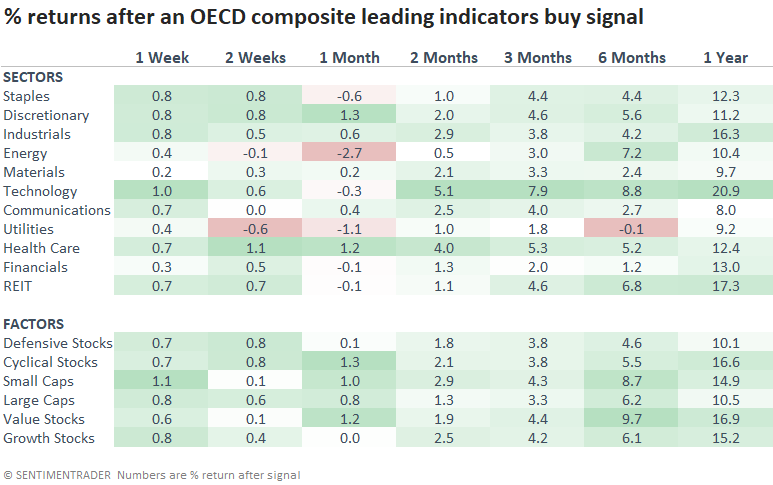

From a sector perspective, Technology is a clear-cut winner, which aligns with current relative strength trends. Favorable factors include cyclical stocks, small-caps, and value, all of which outperform their counterparts in terms of performance.

TCTM Composite Confirmation Model

Should the Composite Confirmation Model exceed the critical 50% threshold, it would provide validation for the new uptrend. As a reminder, the CCM contains big-picture price and fundamental measures, so it's not a market timing mechanism like the Composite Thrust Model.

What the research tells us...

Despite facing a barrage of negative news over the past nine months, the S&P 500 and other indexes have defied expectations and continued to rise, indicating that the market has already factored in the pessimistic developments. Whether we consider indicators such as the Sentimentrader Macro Index Model or the OECD CLIs, the recent improvement in economic trends suggests the uptrend for stocks can continue.