The Nasdaq's short road back to even is golden

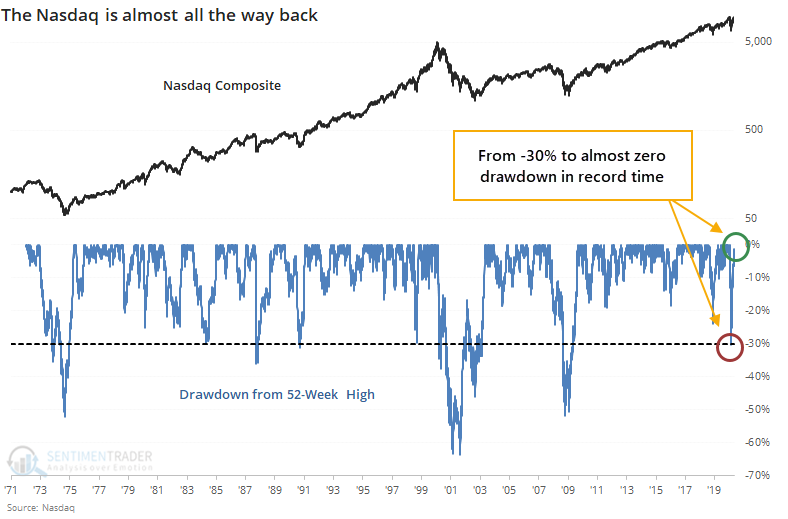

The Nasdaq Composite has almost fully made back all of its losses. After falling more than 30% from its 52-week high, the tech-heavy index has almost retaken that high, pulling within 1.5% by Wednesday. This is, by far, the fastest turnaround in its history.

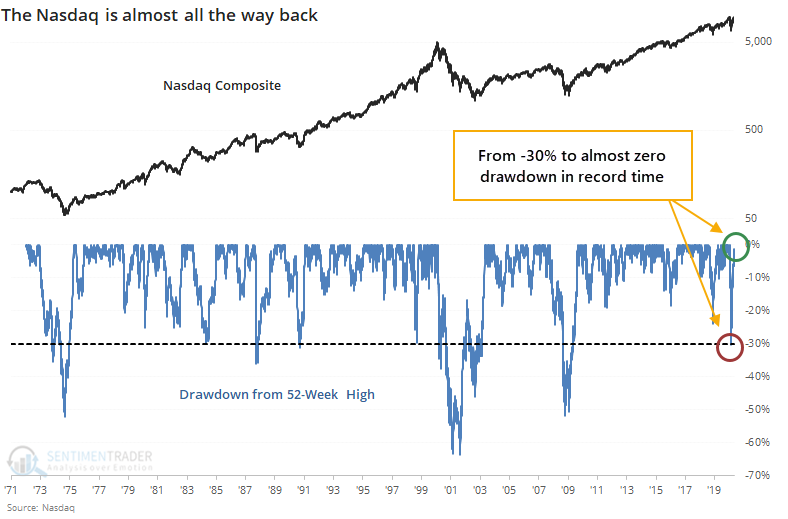

By the time the index cycled from more than 30% below a 52-week high to within 1.5% of it, as it did on Wednesday, it never failed. It closed at a fresh 52-week high within three weeks every time.

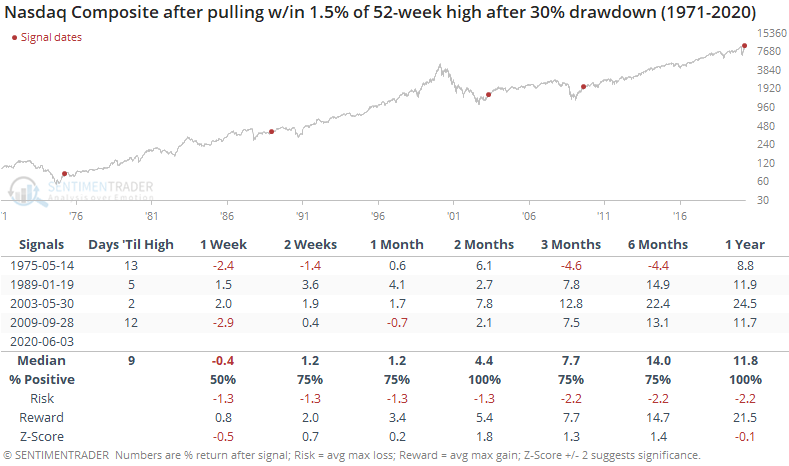

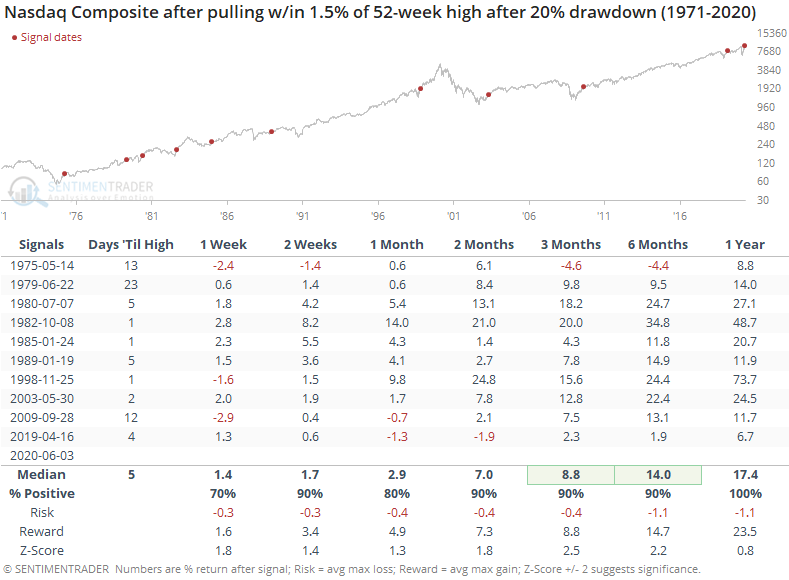

Even when looking at smaller 20% drawdowns, it also never failed, closing at a new high within 23 days every time, and showing gains a year later every time as well.

The risk/reward ratio after these recoveries was impressive across all time frames. While the Nasdaq didn't necessarily keep soaring every day, shorter-term periods of digestion tended to be minor. By the time buyers had reached this point, they were not about to give up.

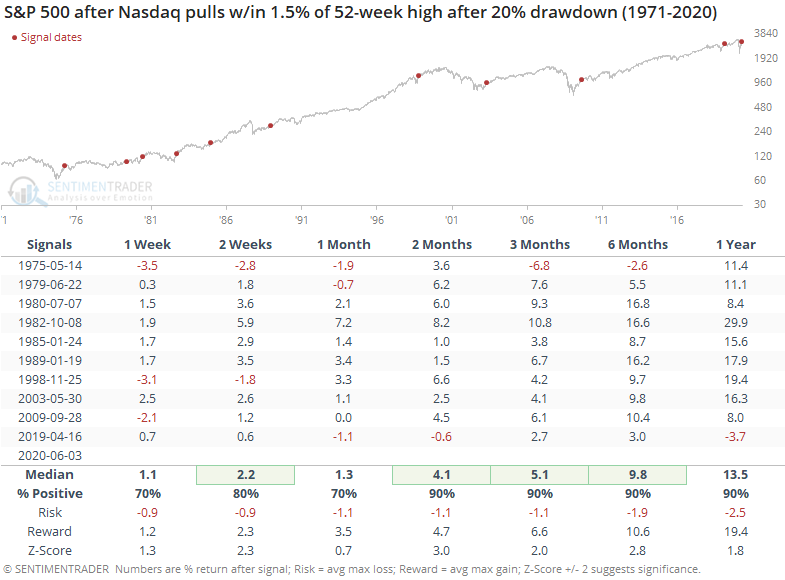

For the S&P 500, the Nasdaq's recovery was also a good sign.

The S&P didn't show as pristine a record as the Nasdaq, but it's forward returns were still excellent. If buyers had enough interest in the higher-risk stocks trading on the Nasdaq, then it was a generally good sign all around.

Like the breadth thrusts and recoveries, signs like this are hard to ignore, especially over medium- to long-term time frames.

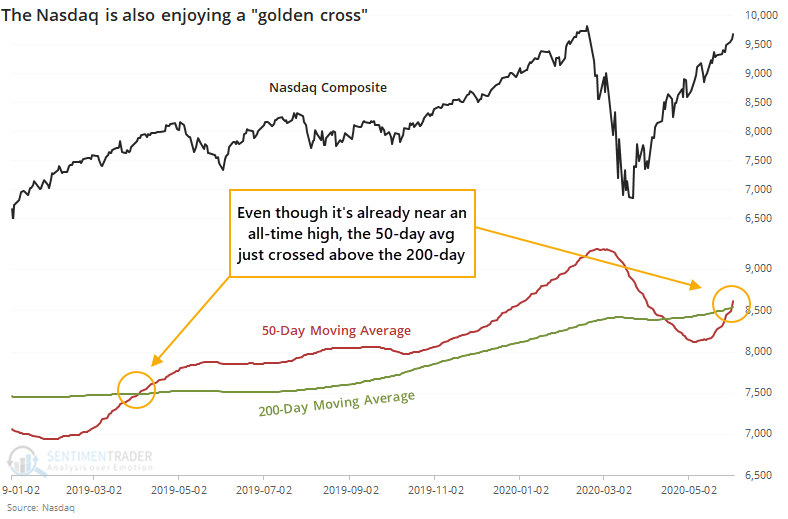

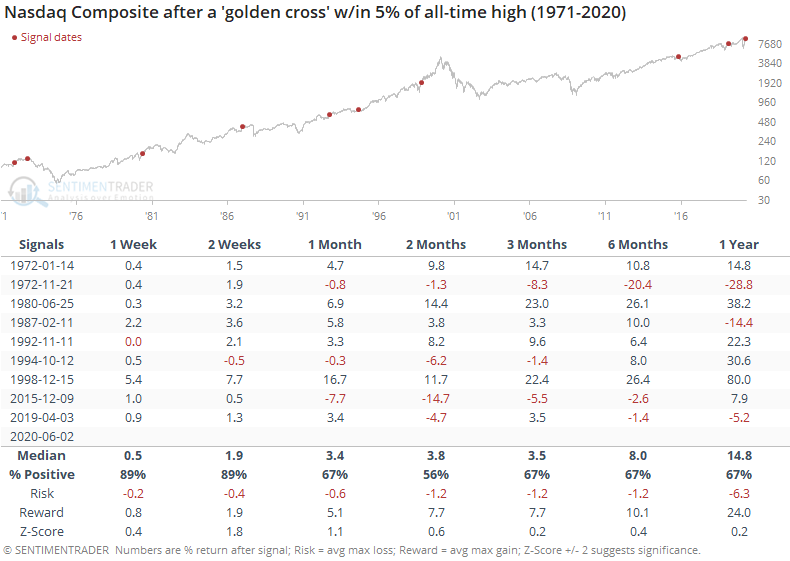

The Nasdaq has also enjoyed a "golden cross", a mostly ineffective signal that gets a lot of attention regardless. The curious thing about the current cross, when the 50-day moving average rises above the 200-day average, is that it triggered when the Nasdaq was already so close to an all-time high.

That didn't seem to dampen its forward returns much. It was not a great buy signal, but it was not a consistent reason to sell, either.

Returns were more consistently positive when the cross happened with the Nasdaq more than 5% below its all-time high, so it would have been more of a buy signal if prices hadn't already run so much.