The Nasdaq's run, and potential end

The Nasdaq's run over the past 6 months has been well-documented. Leading up to Thursday's drop, it was building even more, with more than a third of stocks in the Nasdaq 100 in overbought territory as Troy pointed out.

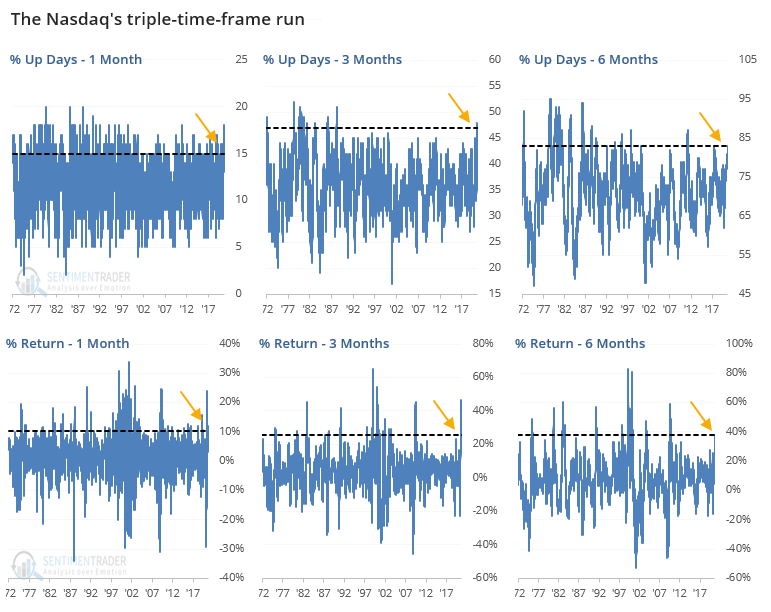

The risk of trying to compare the current one to others is cherry-picking. Analogs can sometimes be useful but have their own pitfalls. Another way we've looked at price momentum is by using a triple time frame, such as performance over 1, 3, and 6 months. We've done this with other assets like the dollar and bonds over the years, but extremes don't trigger very often, especially in stocks.

The Nasdaq has become an exception. If we look at those time frames, then leading up to yesterday the Composite was showing among the most consistent and large gains in its nearly 50-year history.

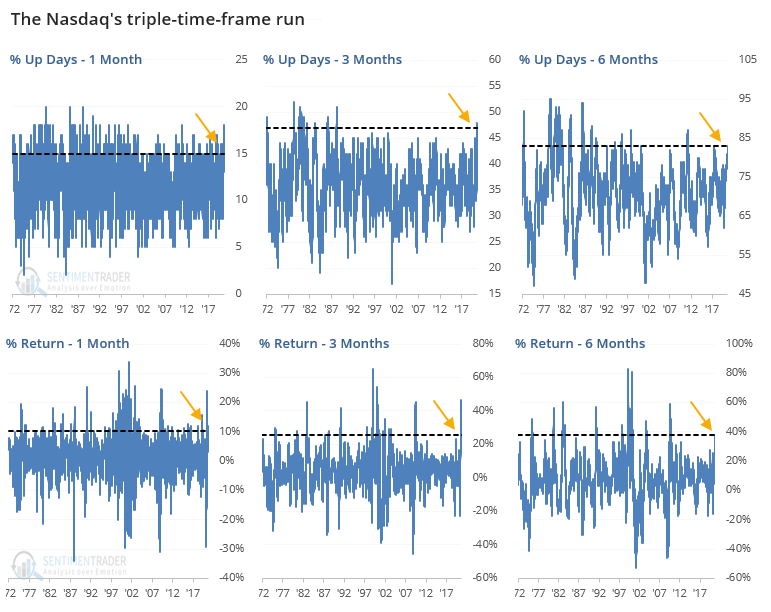

Since its 1971 inception, there have been 2 other time periods that match its current run.

- 1-month gain of >= 10% with >= 15 positive days

- 3-month gain of >= 20% with >= 45 positive days

- 6-month gain of >= 30% with >= 80 positive days

Below, we can see that neither one marked an exact peak for the Nasdaq, as it ran higher over the next month both times. Then...not.

Because of the momentum, short-sellers got run over for weeks at a time even after the rally had reached fever pitch. Waiting for some kind of weakness allowed one to avoid that but defining "some kind of weakness" leaves it open to subjective judgment. Waiting for a close below the 20-day average worked okay.

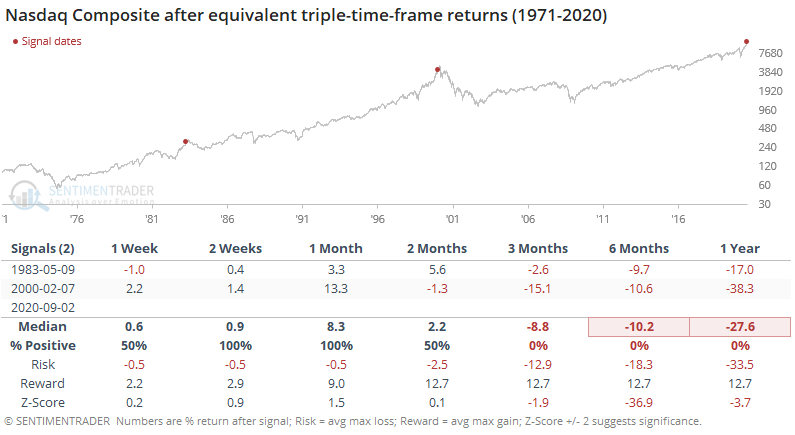

Old-school trend-followers often used a simple rule like the market reaching a new 10- or 20-day low. The former worked well. Once the Nasdaq had reached a fever pitch like this in May 1983 and February 2000, it continued to run until it broke below its prior 10-day minimum price.

Currently, that's at 11,311, not far from where it's trading Thursday afternoon. There is nothing magical about this at all, it's just an old rule of thumb, and it worked the two other times there was runaway behavior like this.

So far during the massive rally since March, tech stocks suffered big one-day declines or reversals on June 11, June 24, and July 13. Each time, it rebounded the next day and saw only limited weakness in the week ahead. With so many factors lining up lately for a return to mean-reversion, an inability for the Nasdaq to snap back right away, setting a fresh 10-day low in the process, would be a good clue that reversion has begun.