The Nasdaq has run and run and run

The Nasdaq's run over the past 6 months has been well-documented. Leading up to Thursday's drop, it was building even more, with more than a third of stocks in the Nasdaq 100 in overbought territory as Troy pointed out.

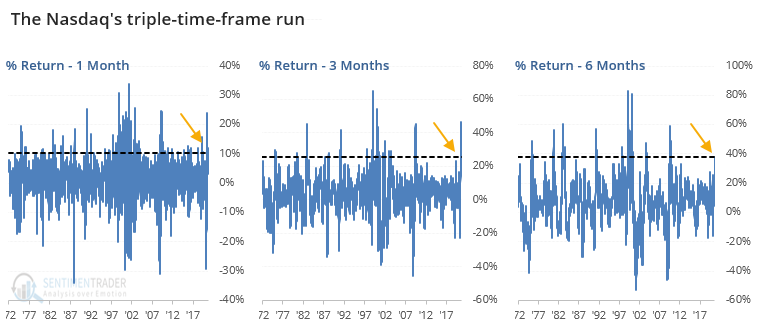

The risk of trying to compare the current one to others is cherry-picking. Analogs can sometimes be useful but have their own pitfalls. Another way we've looked at price momentum is by using a triple time frame, such as performance over 1, 3, and 6 months. We've done this with other assets like the dollar and bonds over the years, but extremes don't trigger very often, especially in stocks.

The Nasdaq has become an exception. If we look at those time frames, then leading up to yesterday the Composite was showing among the most consistent run of positive sessions and large gains in its nearly 50-year history.

Since its 1971 inception, there have been 2 other time periods that match its current run. The Nasdaq managed to continue higher over the next month both times, but an old-school trend-following exit did a good job of getting an investor out before the index suffered its worst losses.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A closer look at the Nasdaq's run, and its two historical precedents, along with the exit

- Over the past two months, our Risk Level has failed, with 2 time periods showing a similar failure to lead to weakness

- The "dumb" money has been right over past 2 months to a degree that has been matched only a handful of times since we started compiling it in 1998

- What happens after very sharp selloffs from a high in the S&P 500

- The Nasdaq's streak above its 20-day average is in jeopardy

- For the first time in months, more than half of Nasdaq stocks are below their 50-day averages