The Nasdaq goes positive

The remarkable run in stocks, primarily tech, pushed enough to turn the Nasdaq Composite positive for the year. That erases a more than 23% decline at its nadir.

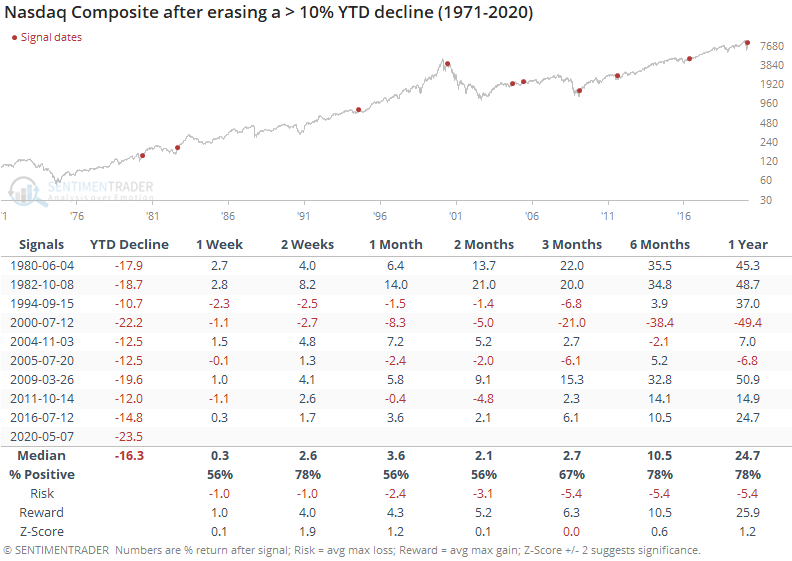

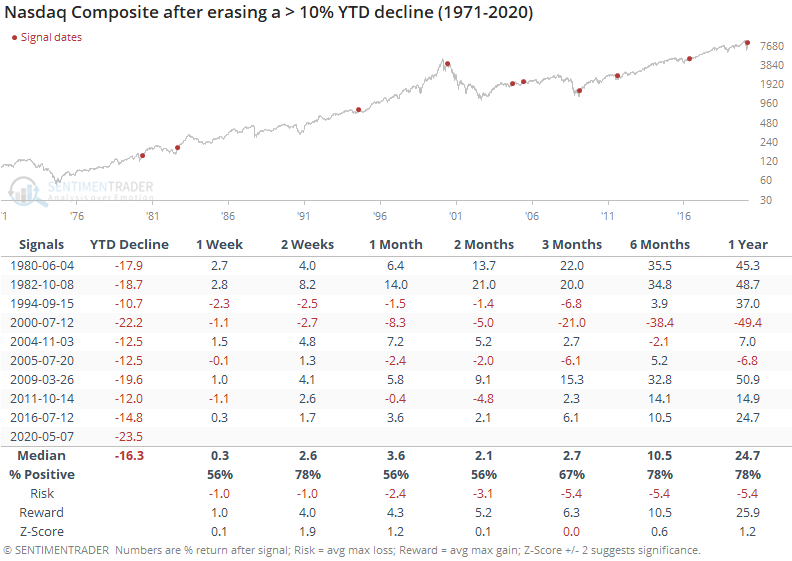

Below, we can see how the index performed following the other times it erased more than a 10% year-to-date decline. Note that these are specifically year-to-date declines, so even if the index was in the midst of a pullback, the return reset to 0 on the first day of each year.

Most fund managers are graded based on calendar returns anyway, and not drawdowns from a peak, so the table will allow us to see if turning positive YTD generated some performance anxiety and a burst of additional buying pressure.

The only time it recovered from a more than 20% decline was in 2000, which wasn't the best signal going forward. Almost immediately after turning positive for the year, it made an about-face and fell into the post-bubble plunge. The only time it recovered from a 10% YTD decline earlier in the year than now was in 2009, which was a great sign for forward returns.

Overall, it showed some mixed performances in the months ahead, with returns about in line with random and a mostly uninspiring risk/reward ratio, especially over the next 1-3 months.

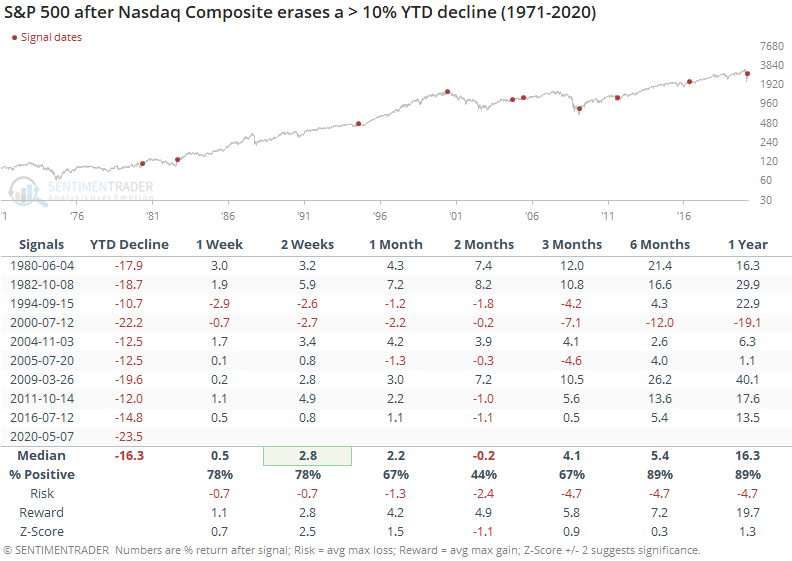

For the S&P 500, the Nasdaq's recoveries were less positive over the next two months, with more losses than gains, even if those losses were small. But over the next 6-12 months, it sported a positive return except for 2000.

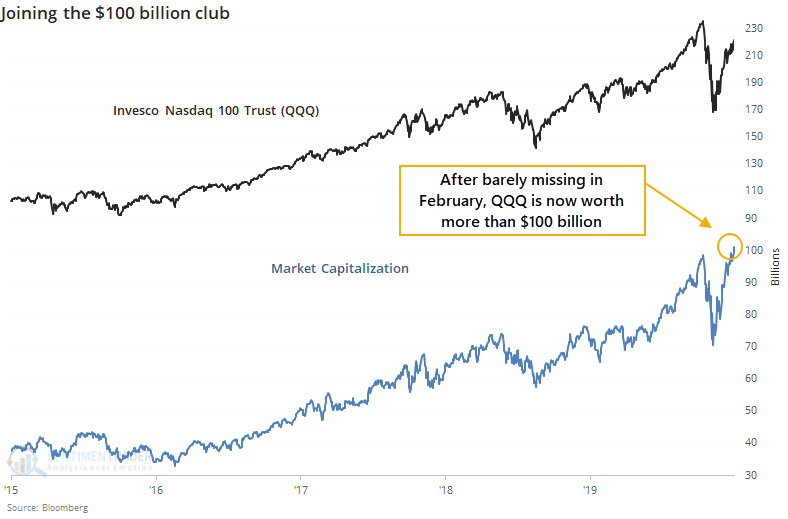

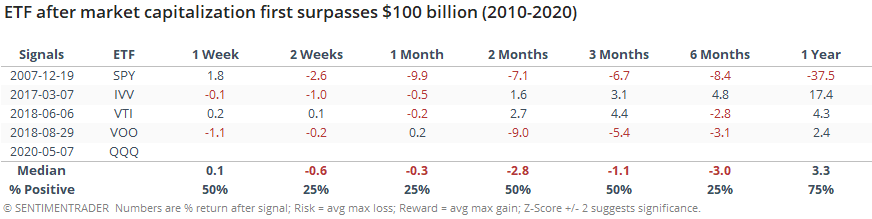

The run in tech stocks, particularly the largest ones, have pushed the go-to ETF above a $100 billion market cap.

There are only four other ETFs that are in this club, all focused on either the S&P 500 or the broader market. There isn't anything magical about the $100 billion threshold, other than perhaps as a sign of intense interest on the part of investors. It's interesting to note that from 2-4 weeks after the others first surpassed $100 billion, the funds fell back.

That's a slight worry here, along with all the other tech-love sentiment that we're seeing. The fact that tech has turned positive for the year hasn't proved to be a reliable reason to expect further gains, especially over the medium-term. While we're not seeing much that's a screaming sell signal, net positives are getting harder to come by, particularly for tech.