The Nasdaq 100 is showing some strong internal buying interest

Big tech stocks got all the credit when stocks were soaring into early September, then all the blame when they got hit last month.

Quietly (for those stocks, anyway), many of them have bounced back. For one of the few times in the past 20 years, more than 90% of stocks in the Nasdaq 100 (NDX) have closed above their 200-day moving averages.

While it seems like this should equate to overbought conditions and lower future returns, that didn't prove to be the case when this many stocks rose above their averages for the first time in at least a month. The NDX never lost much ground after previous signals.

Same goes for when its Cumulative Advance/Decline Line reaches a new high ahead of the index itself, which just happened.

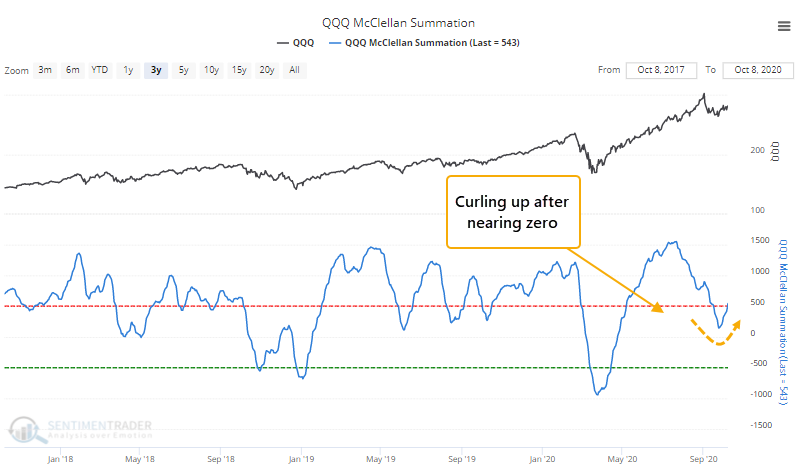

The pullback-then-recovery internally has caused the long-term McClellan Summation Index for Nasdaq 100 stocks to curl higher after approaching zero.

This is exactly what healthy markets do.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Table showing signals when most Nasdaq 100 stocks exceed their 200-day averages

- What happens when the A/D Line for the Nasdaq leads the index itself

- Optimism on utilities and semiconductors is getting hot

- The Stock/Bond Ratio just reached an extreme

- For the first time in months, fewer than half of major country indexes are in a correction