The Most Stably Staples Time of the Year

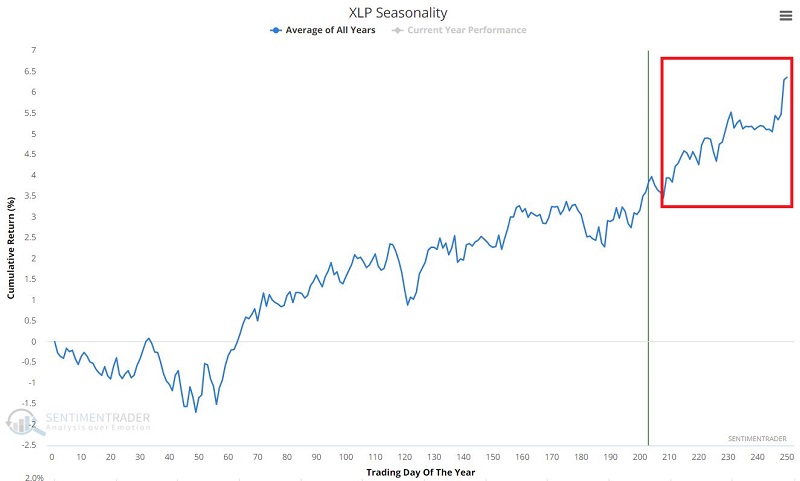

The chart below displays the Annual Seasonal Trend for ticker XLP (Consumer Staples Select Sector SPDR Fund). As you can see in the chart above, we will soon enter a consistently seasonally favorable time of year for the consumer staples sector. How consistent, you ask? Let's take a closer look.

As you can see in the chart above, we will soon enter a consistently seasonally favorable time of year for the consumer staples sector. How consistent, you ask? Let's take a closer look.

THE DATA

For our backtest data, we will use the S&P 500 Consumer Sector Index data starting in 1945.

THE TEST

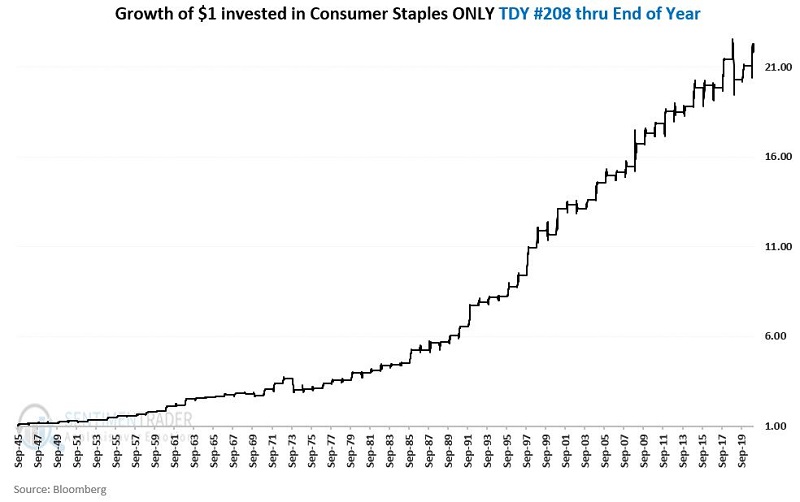

The chart below displays:

- The cumulative total return growth of $1

- Invested in the Index S&P 500 Consumer Sector Index

- From the close of Trading Day of the Year #208

- Through the close of the last Trading Day of the Year

- Every year starting in 1945 through 2020

THE RESULTS

THE RESULTS

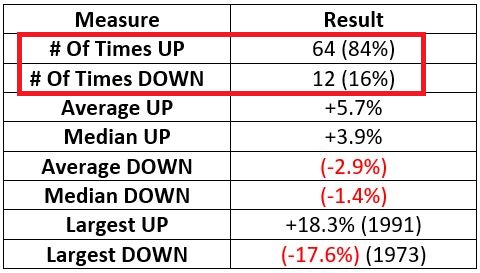

The table below displays the results of this test.

SUMMARY

Is the consumer staples sector certain to be higher by the end of the year? Of course not. There are no "sure things" in the financial markets, and 2021 could easily be one of those "off years" for staples.

At the same time:

- An 84% Win Rate

- Combined with an Average Win/Average Loss ratio of almost 2-to-1

- Over a 76-year span

- Is about as consistent of an "edge" as an investor could hope for

We'll see what 2021 has in store.