The most important index in the world has never done this before

An event that Elon Musk fans have been waiting for all year finally happened, with the announcement that Tesla would be added to the most important equity benchmark in the world. There are trillions invested based on the S&P 500 index, and inclusion brings a certain cachet.

What it doesn't usually bring is profit.

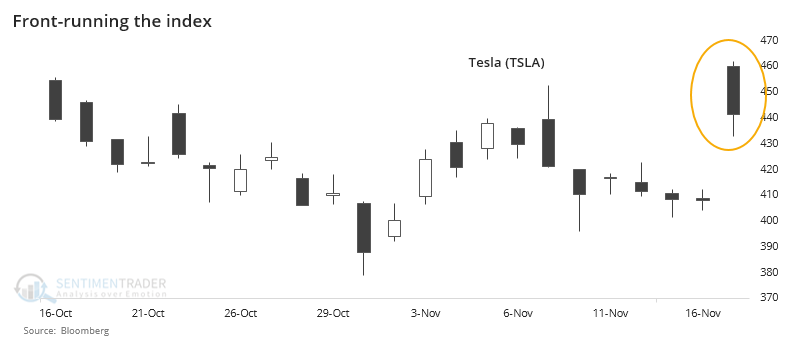

Even though being added to the index seemed widely expected, the news was enough to trigger a pop at Tuesday's open which faded during the rest of the day.

Going back to 1979, we looked for every time the Standard & Poor's committee added a new stock to the index of (approximately) 500 stocks in the S&P 500. We filtered it to only look at the stocks that had the largest market capitalizations at the time of the announcement. Tesla will be - by far - the largest stock the index tries to swallow at the moment of inclusion.

Where it gets interesting is that returns turn south once the stock is actually added to the index, which on average has been around 7 trading days after the announcement date. By this time, investors have front-run the index in anticipation of all the passive buying that should flood into the stock.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Returns in the S&P 500 after the largest market-cap stocks were added to the index

- Forward returns for each of the large stocks as of the date of they were announced as a new member of the S&P

- Also, returns after the stock was actually added to the index

| Stat Box Prior to Tesla, the largest market-cap stock added to the S&P 500 was Facebook, with a market cap of $139 billion at the time of inclusion. On average, the largest stocks sported a market cap of just over $53 billion. In contrast, Tesla's current market value is $439 billion. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

1. The TINA justification for buying stocks has become less compelling as earnings among S&P 500 companies has soured while bond yields have risen. The spread between what you earn on stocks vs bonds has plunged as a result. Investors, of course, are banking on the idea that FY21 earnings will more than make up for the recent dip. [Lisa Abramowicz, Bloomberg]

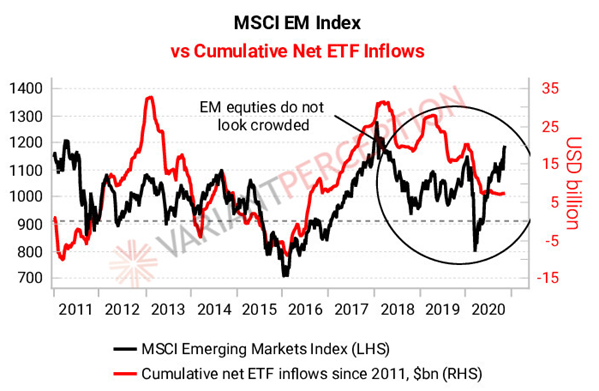

2. Investors in ETFs still haven't taken too much exposure to emerging markets. Cumulative flows in those funds remains as depressed as it was 4 years ago, even with the recent uptick in many of those countries. [Variant Perception]

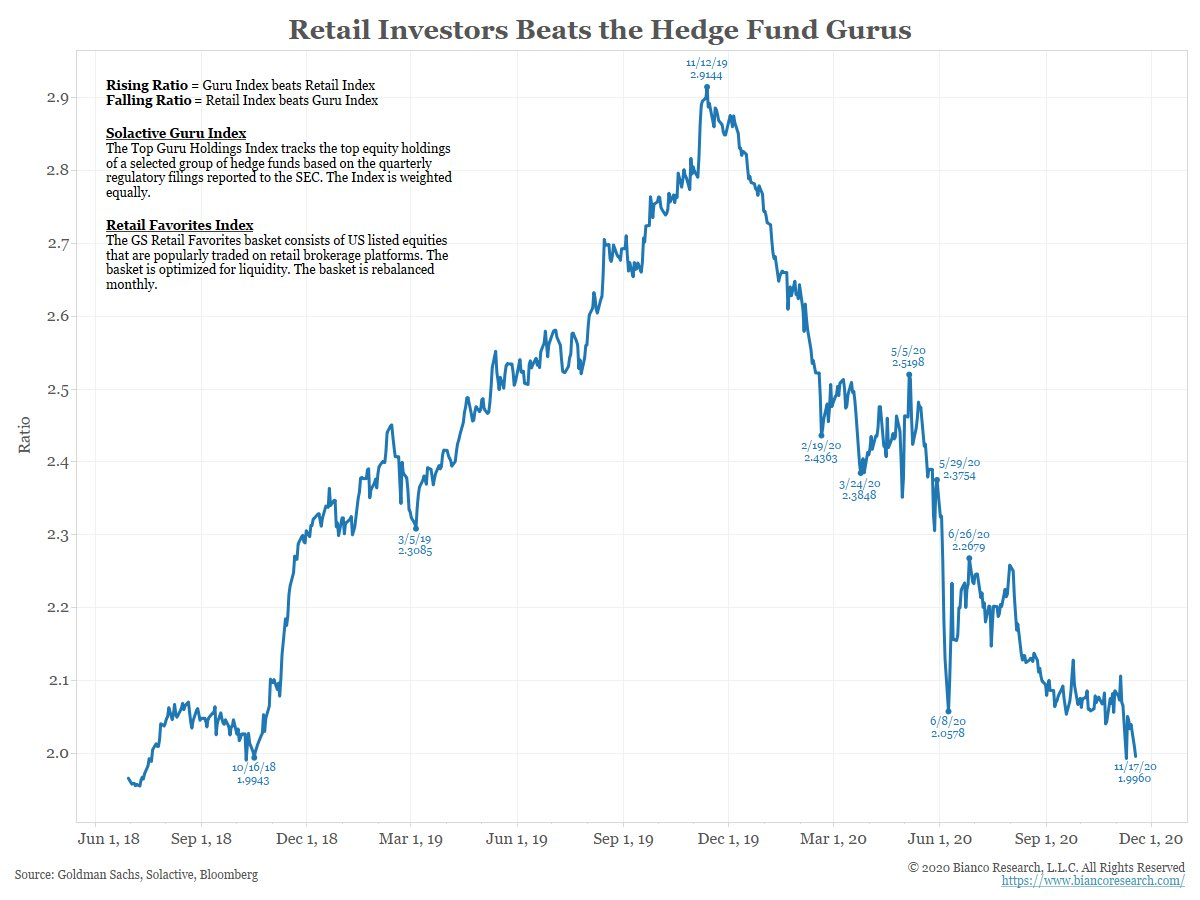

3. Thanks in part to the rise, and increasing activity, of retail traders, stocks popular with those folks have handily outperformed stocks favored by the pros. [Arbor Research via Liz Ann Sonders]