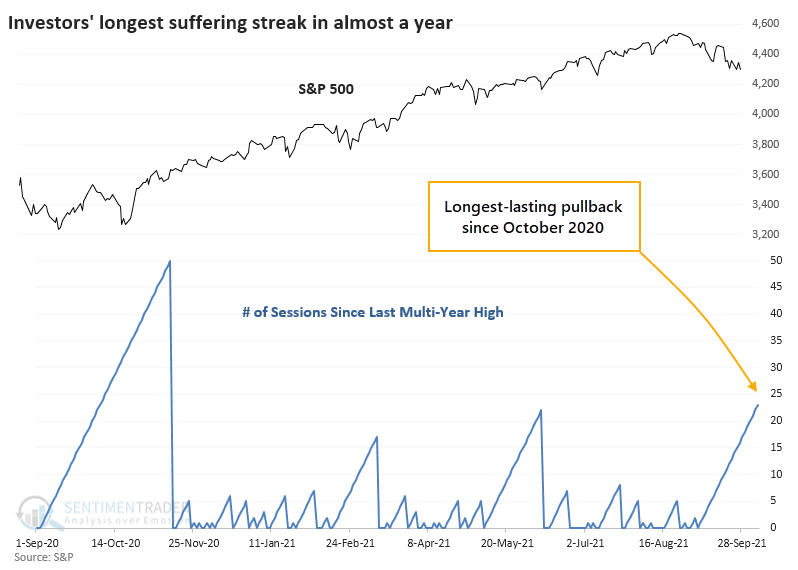

The Most Extended Pullback in 200 Days

Last August, the S&P 500 did what was unthinkable just a few months prior - it broke out to a new all-time high.

Soon after, stocks saw a bit of a blow-off peak, and the S&P didn't regain its highs until November. And it hasn't looked back since. The most protracted pullback that investors suffered was 22 days in June. Until now.

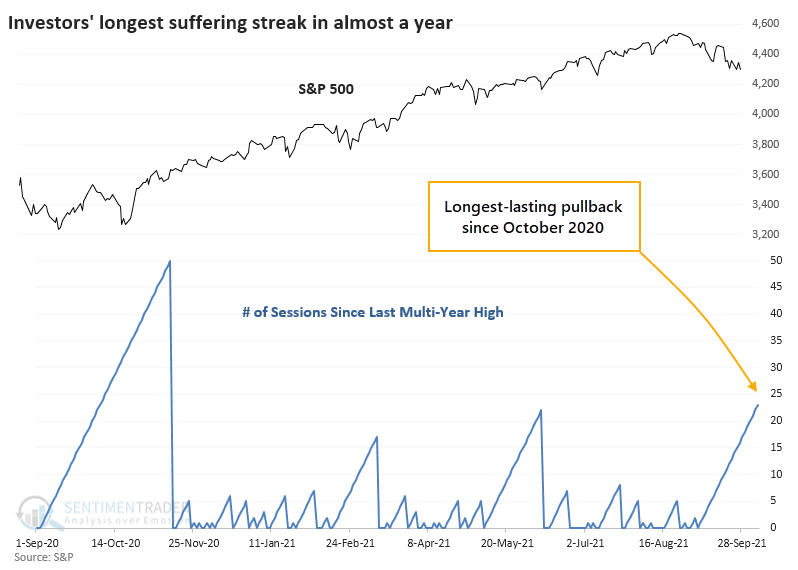

This ends a near-record run with investors not having to suffer more than 22 days without seeing a new multi-year high (not considering bear markets). The only period that exceeded our current run, and that was just barely, ended in February 1955.

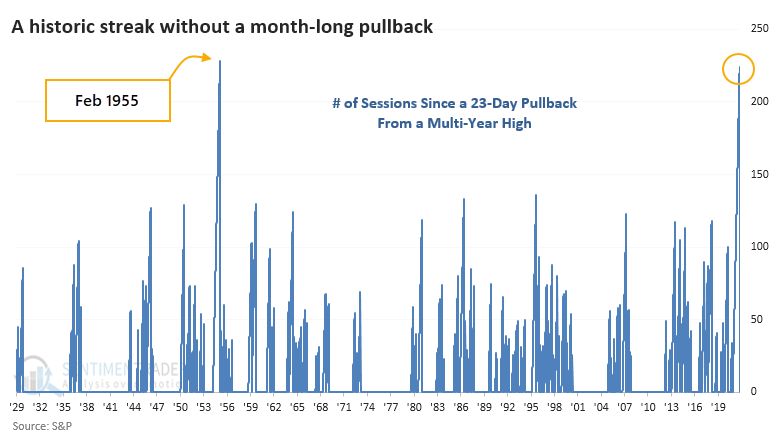

Buyers came in immediately after that streak ended, setting a new high the next day, and pushed the S&P 500 higher by a couple of percentage points over the next month. It did suffer some longer pullbacks after that but enjoyed double-digit gains within six months.

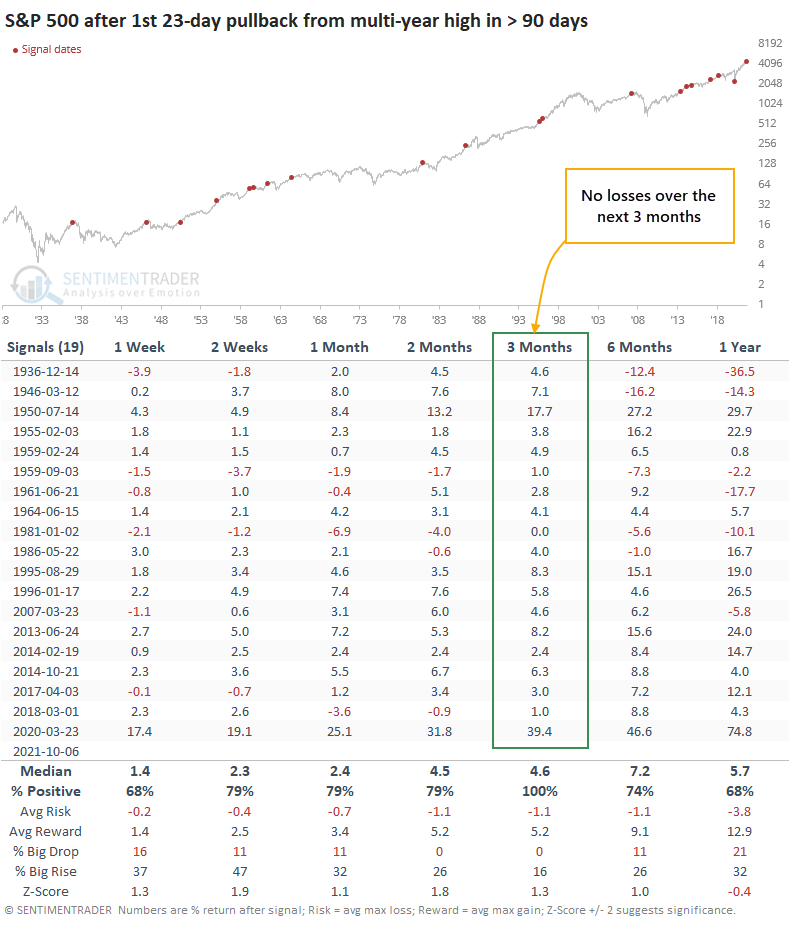

That was more the rule than the exception. After other long streaks without a 23-day pullback finally ended, the S&P rebounded during the next three months every time.

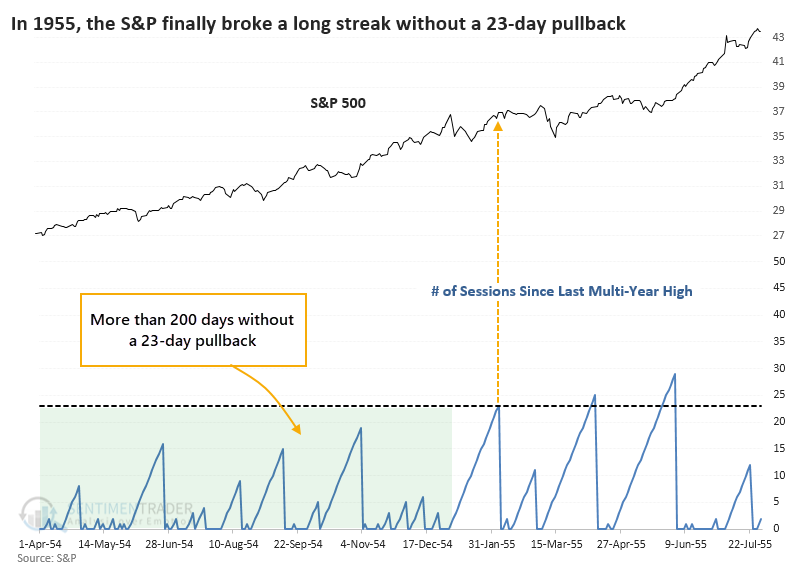

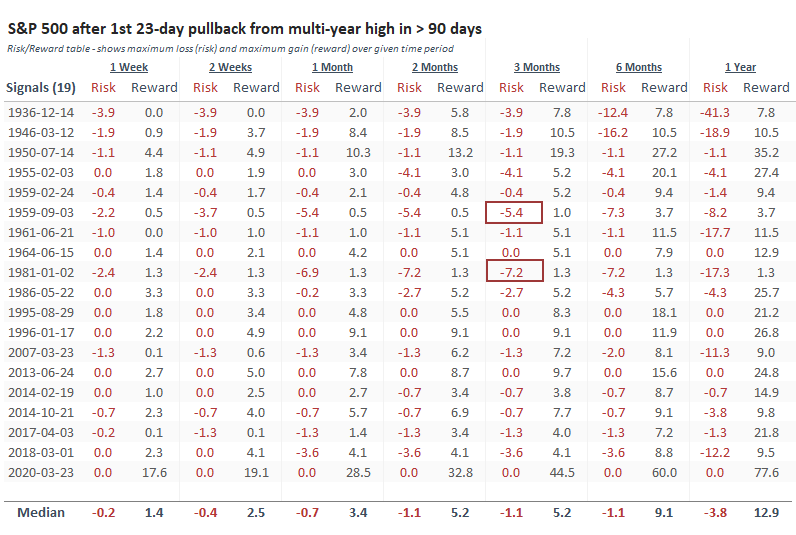

Over the following three months, risk was very low relative to reward. Only 2 out of the 19 signals saw more than a further 5% decline at any point within that time frame, while a whopping 14 of them saw more than a 5% gain at the best point.

As we saw with the ends of other streaks of price momentum, risk-on sentiment, and year-to-date gains, the first substantial pullback has had a strong tendency to attract buyers.

There's an old traders' cliche about high volatility when stocks are near a high as being a bad thing. Not sure where it came from, but it's probably one of the many heuristics that some guy thought up, and it got around because it was simple and it sounded good. But most of the time, the first bout of volatility following an extended run of new highs leads to tremendous dip-buying interest from all those who were too cautious during the initial run. They finally see a good opportunity to get in.