The media is focused on a "V" shaped recovery

These days, it seems everyone has an opinion on the shape that the economy, and by extension the stock market, is likely to form over the coming months.

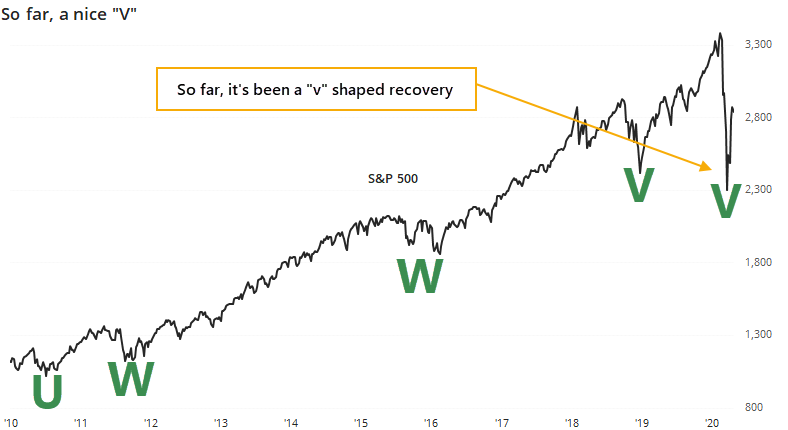

So far, it has been v-shaped in the major stock indexes, with a sharp fall followed by a sharp recovery.

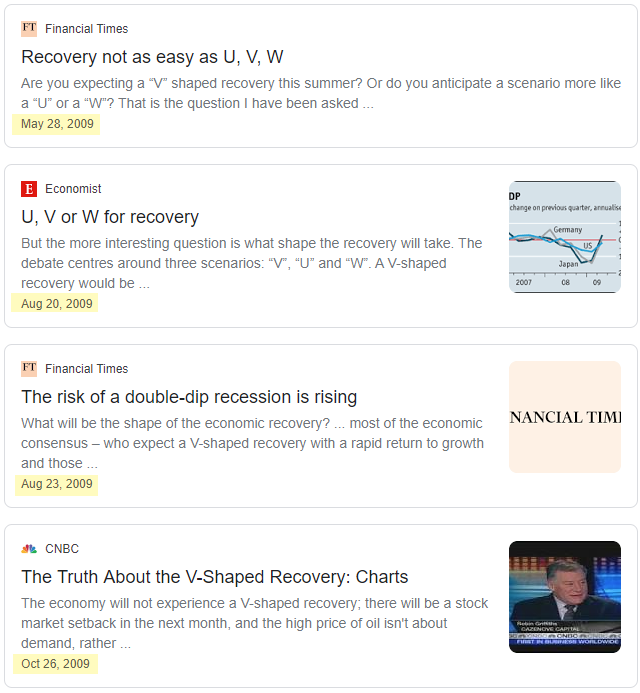

There has been a marked increase in articles mentioning other types of recoveries, but the "V" gets the most airtime. In 2009 there was a spike in articles about a v-shaped recovery as well, and most of those were similarly skeptical.

In early 2019, there were 25 times more articles about a "V" than a "U", more than we've seen lately.

Since the media is filled with talk about a v-shaped recovery, and most investors only skim the articles if they even click past the headline, there seems to be an assumption that most investors believe in that kind of recovery. They don't.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A historical look at the frequency of news articles mentioning "V" and "U" shaped recoveries

- Wall Street analysts are upgrading the price targets of more stocks than they're downgrading

- The oil/gold ratio has made a historic rebound in the past week

- Our Optimism Indexes on XLE, XOP, XHB, XLB, XRT, and INDA are showing extremes