The Last Time This Happened? March 2000.

Whatever one thinks about the outlook for inflation, it's hard to debate the idea that it's already here. Using traditional ways of measurement, virtually all of them are high and rising.

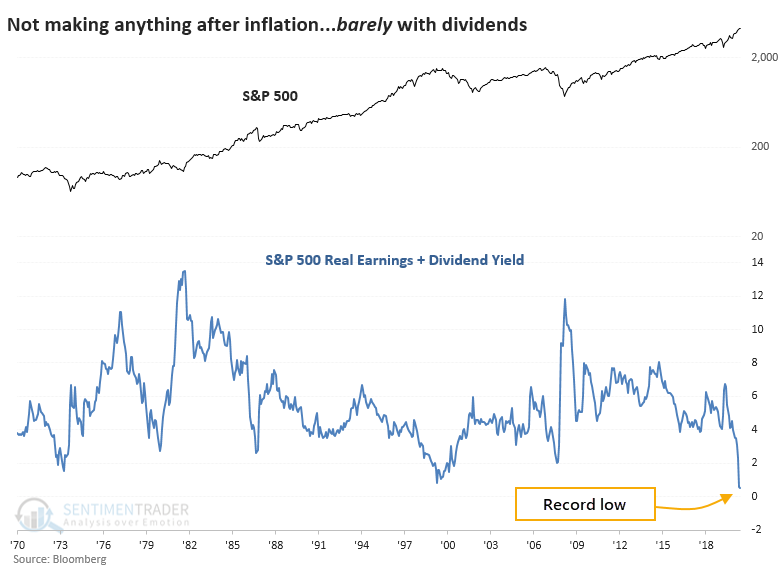

Until recently, one of the main arguments for stocks was that even though they weren't yielding much, at least they were earning more than Treasuries, even after accounting for inflation.

Now that there has been a spike in inflation gauges, the earnings yield on the S&P 500 has turned negative. This is not a condition that investors have had to tackle much over the past 70 years.

When an investor in the S&P adds up her dividend check and share of earnings, then subtracts the loss of purchasing power from inflation, she's barely coming out even. This is a record low, dating back to 1970, just eclipsing the prior low from March 2000.

If we ignore dividends, then there have been five other times when the S&P 500's inflation-adjusted earnings yield turned negative. The S&P failed to rally more than 7% at its best point within the next two years after all but one signal.

| Stat Box Our Optimism Index on the Barclays iPath S&P 500 VIX Short-Term Futures ETN (VXX) fund has plunged below 10, showing that traders are not very optimistic that volatility will rise. Our Backtest Engine shows that of the 37 days when sentiment on VXX has been this low, the VIX index was higher a week later 30 times, an 81% win rate. NOTE that the VIX Index tended to rise, not necessarily the related ETPs. |

What else we're looking at

- Detailed returns following other times the S&P's real earnings yield turned negative

- A look at whether there were any sectors or factors that did well after those signals

- Yet another breadth signal has triggered on Tawainese stocks

- Disney (DIS) stock shows a consistent tendency over the summer