The last time tech stocks ran like this was 1996

NOTE: Troy published a more in-depth summary of some of the factors we're watching - check it out here.

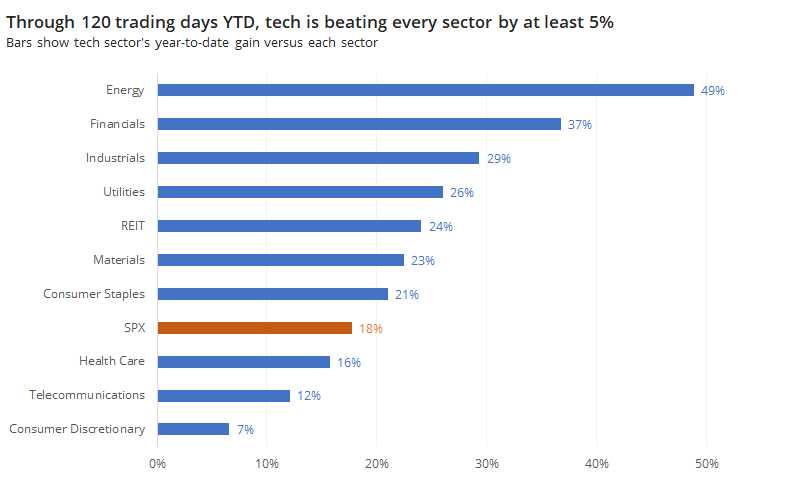

We just finished 120 trading sessions of 2020, and one pattern is clear. It's no surprise - tech rules the kingdom.

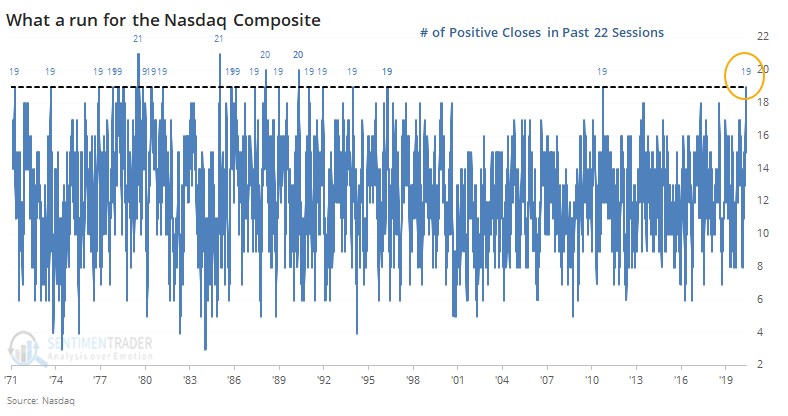

The Nasdaq Composite rallied 19 out of 22 days heading into Wednesday. That's a tie for the best streak in almost 25 years.

It also notched an all-time high for good measure. It hasn't enjoyed this kind of a run since the 1990s.

Year-to-date, the technology sector is beating every major sector by more than 5%. Its lead over energy is a whopping 49%, while the sector closest on its heels is consumer discretionary, and even that is lagging by 7%.

Going back to 1928, there haven't been too many years when tech has been such a winner, especially relative to sectors like industrials and financials.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Full tables showing what happens after Nasdaq streaks like this

- A view of tech's year-to-date gains versus the average (and best and worst) sectors through 120 trading days

- What happens when technology stocks lead industrials, financials, and energy stocks by this much midway through a year