The last hour has been a bear

You wouldn't know it by the last couple of days, Friday in particular, but the past few months have been dominated by late-day selling pressure. This predates issues with the blowup of Archegos Capital, though Friday's late-day buying ramp could have been directly influenced.

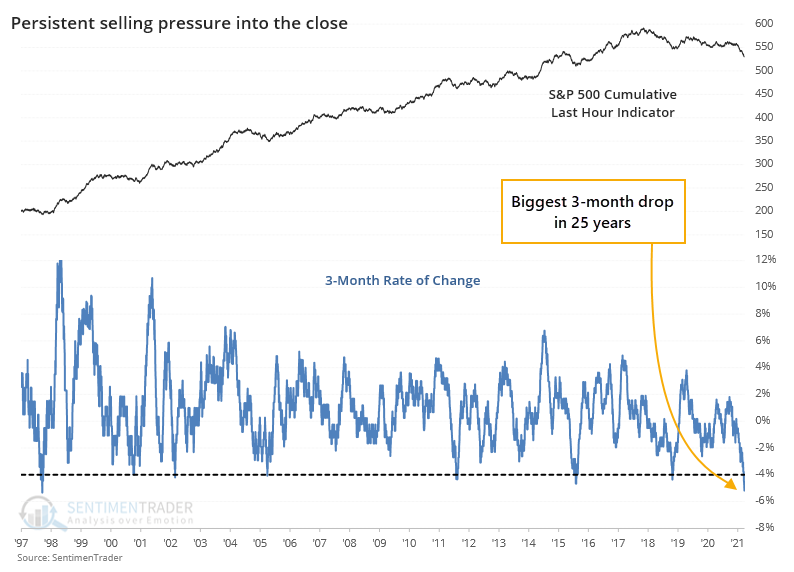

The Cumulative Last Hour indicator looks at the last hour of trading in the S&P 500 fund, SPY. If the fund rises during that hour, then the indicator adds 1 to the running total. If it drops, then it subtracts 1. Dean noted in February how this gave a signal that has preceded some weakness in the past.

Recent months have seen a continual erosion in the indicator, to the point where it's at the lowest level in 6 years. When stocks have been persistently hitting new highs while the Last Hour indicator was plumbing new lows, it has been a warning sign.

What is especially notable about the current behavior is just how persistent the selling has been during the last hour. Over the past 3 months, the indicator has dropped 5%, which doesn't sound like a lot, but it's the biggest plunge in 25 years.

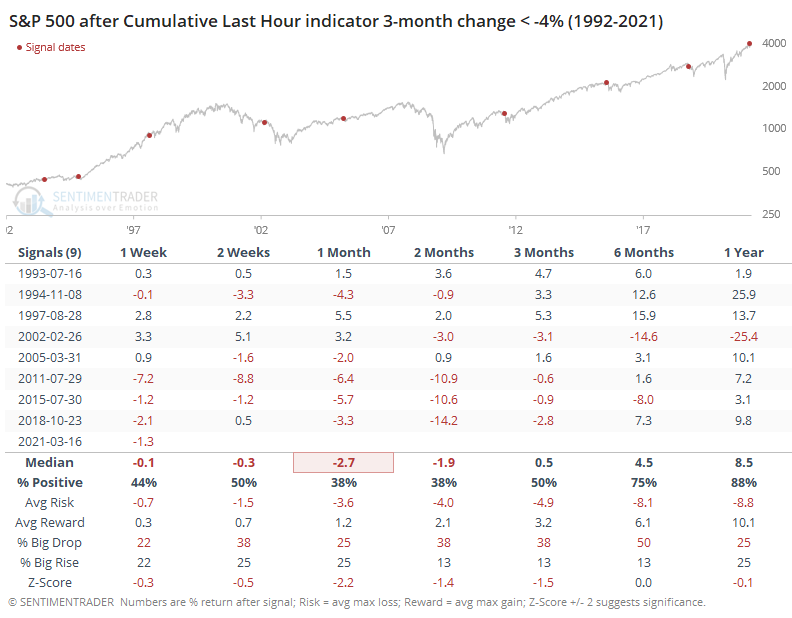

The table below shows that when the indicator dropped 4% or more over a 3-month period, stocks struggled. The only exceptions were in 1995 and 1997.

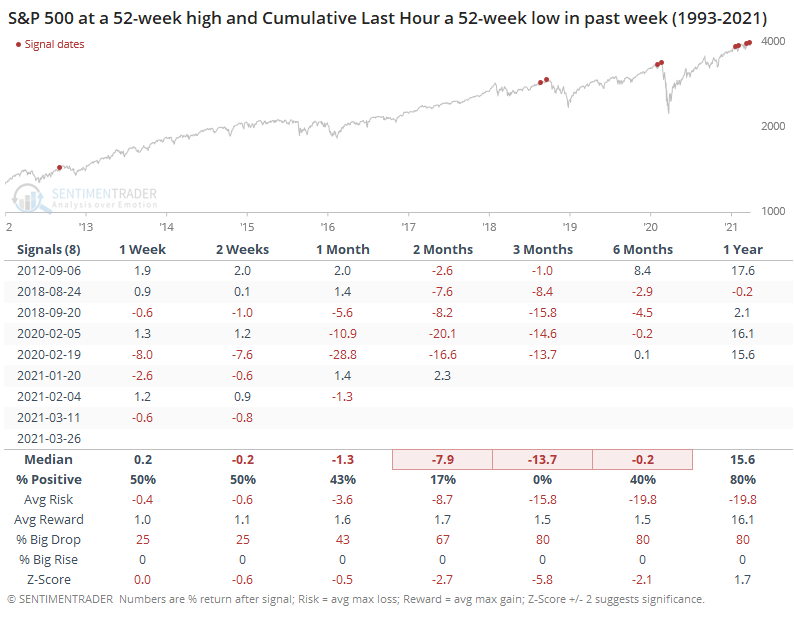

When we look specifically for divergences between the S&P and the Last Hour indicator, with them recently at opposite 52-week extremes, then there isn't much of a sample size. It never happened prior to 2012, and all of them witnessed some weakness going forward.

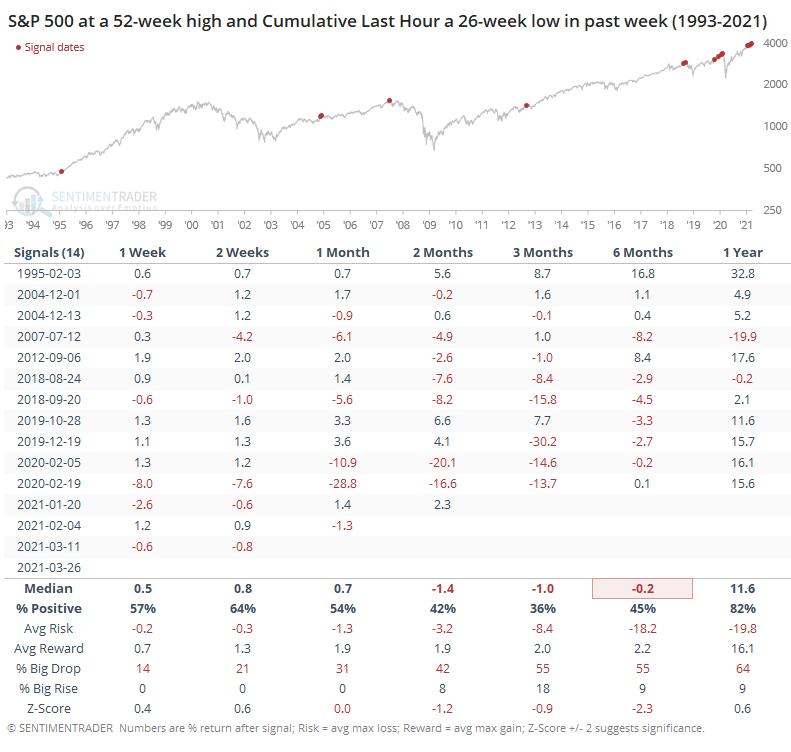

Looking at lesser extremes, when the S&P was at a new high and the Last Hour indicator was at a 6-month low, there were a few more precedents. The only one that saw uninterrupted upside was the first one, back in 1995.

The initial concept of looking at the last hour of trading originated decades ago with the theory that emotional traders make decisions at the open in a knee-jerk reaction to overnight news, while the smart money executed their transactions near the close of trading after absorbing and considering all the data and other traders' reactions.

It's an interesting theory, and probably a good one. It's become less compelling in recent years due to the passive investing trend and the massive amount of volume that funds transact in the last hour nowadays. Maybe that has rendered this indicator useless.

Until there's consistent evidence that that's the case, though, we'll continue to use it as an input, and currently, it is without a doubt signaling caution.