The last 100 days have been just like...

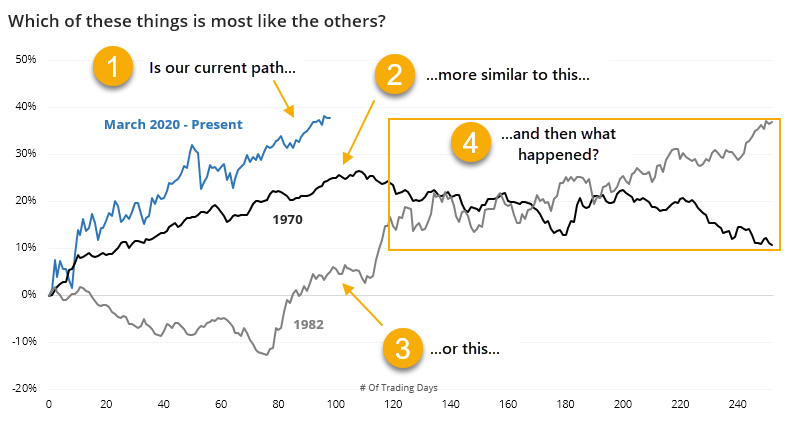

Price comparisons are becoming popular again as we've reached the 100-day mark of the rally. More and more analogs are being drawn to 2009 and other major lows - rightly so, in many respects - because the rally has been so persistent, and so large.

An analog, or comparing one period of time to another, tries to answer some simple questions - are the past x number of days more similar to some historical stretches versus others? And if so, what happened after the most similar ones?

The trouble with analogs is that they can be easily abused. We can find whatever we want to find.

As a guard against that, when we show analogs, we only do so objectively, with clear rules and with all available history. Most of the time, they're useless and don't support whatever cherry-picked example is popular at the moment. Rarely, they can help support other factors, but even then they're a tertiary guide.

If we look objectively at the past 100 sessions and go back to 1928 to look for other 100-day periods with the highest correlations (all of which were above +0.95 on a scale from -1.0 to +1.0), then we see that the last 100 days weren't the most highly correlated to the rally off the 2009 low. Or 1982. The 100 days with the highest correlation ended in April 1971.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A full look at the highest-correlated 100-day periods since 1928

- And the most highly-correlated 252-day periods, some of which were quite different

- The average S&P 500 sector is within an inch of new all-time highs

- So is the S&P itself...what it means after recovering from a bear market