The lag in Financials doesn't have a lot of support

Key points:

- The total return in the Financial sector just fell into the bottom half of its 52-week range

- When the sector has lagged the broader market like this, it consistently continued to do so

- Internal momentum among Financials is also in a poor state

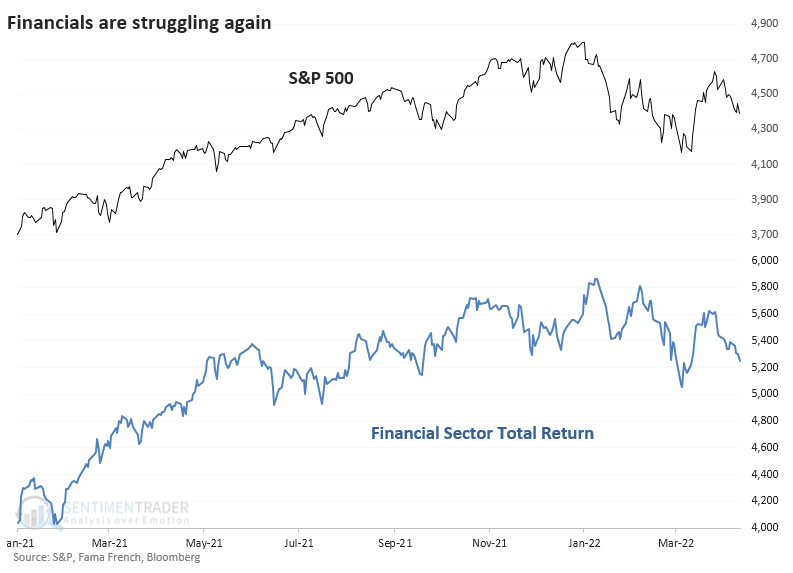

A key sector continues to lag (even with dividends)

One of the sectors that long-time market watchers never want to see struggle is Financials. It's not just PTSD from the financial crisis; analysts have used Financials as a barometer of overall market risk for decades.

That seems like it could be an issue now because they're having a hard time holding gains from the late March rally. Some of the narrower indices are plumbing multi-month or even multi-year lows. Even the total return of a broad reflection of the sector recently fell into the bottom half of its 52-week range.

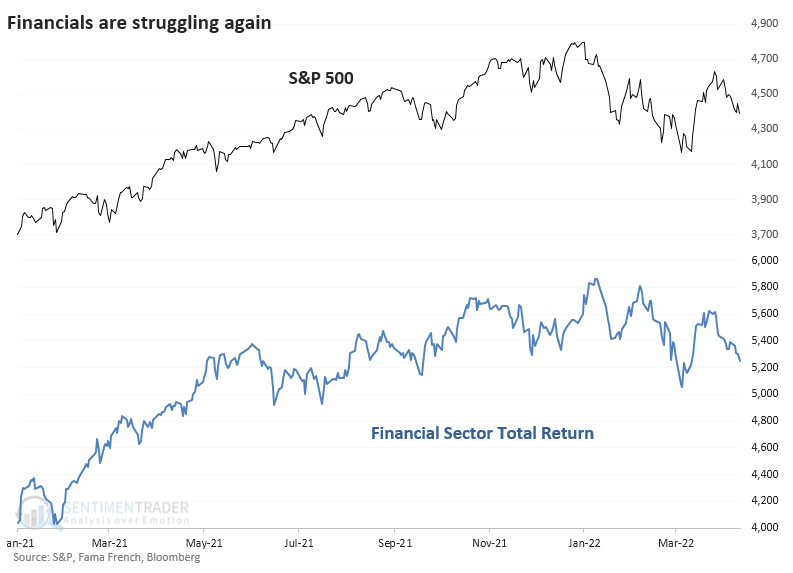

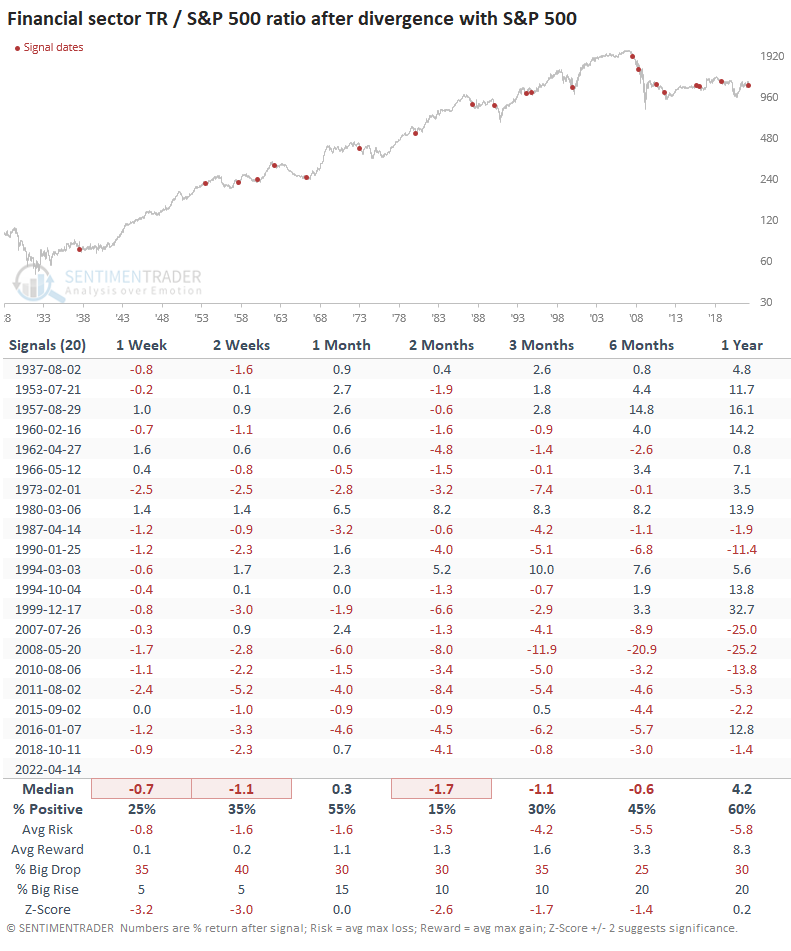

As of last week, the S&P 500 was still within 10% of its last 52-week high. But the total return of the Financial sector was not only more than 10% off its own peak, it was within 10% of its last 52-week low. The divergence isn't too stark, but it's been a bit of a downer for the broader market when they've lagged within their range.

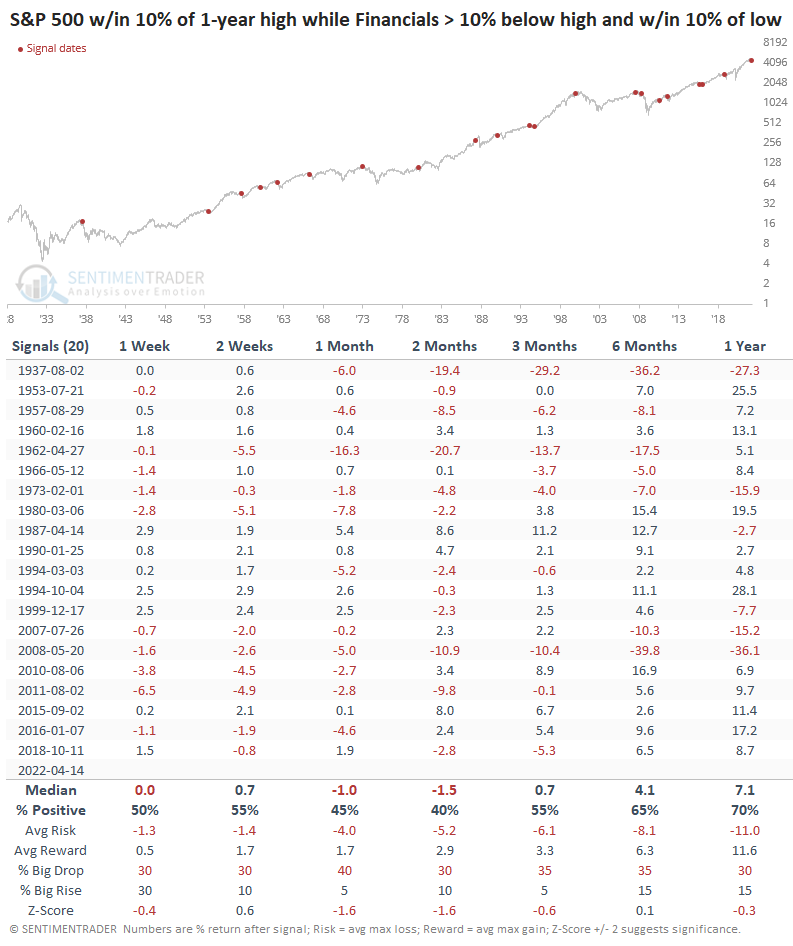

For Financials themselves, it was a worse sign. Over the next two months, the total return averaged -1.9% and was positive only 35% of the time. In an unusual flip for a long-term total return series, risk was higher than reward across all time frames up to a year later.

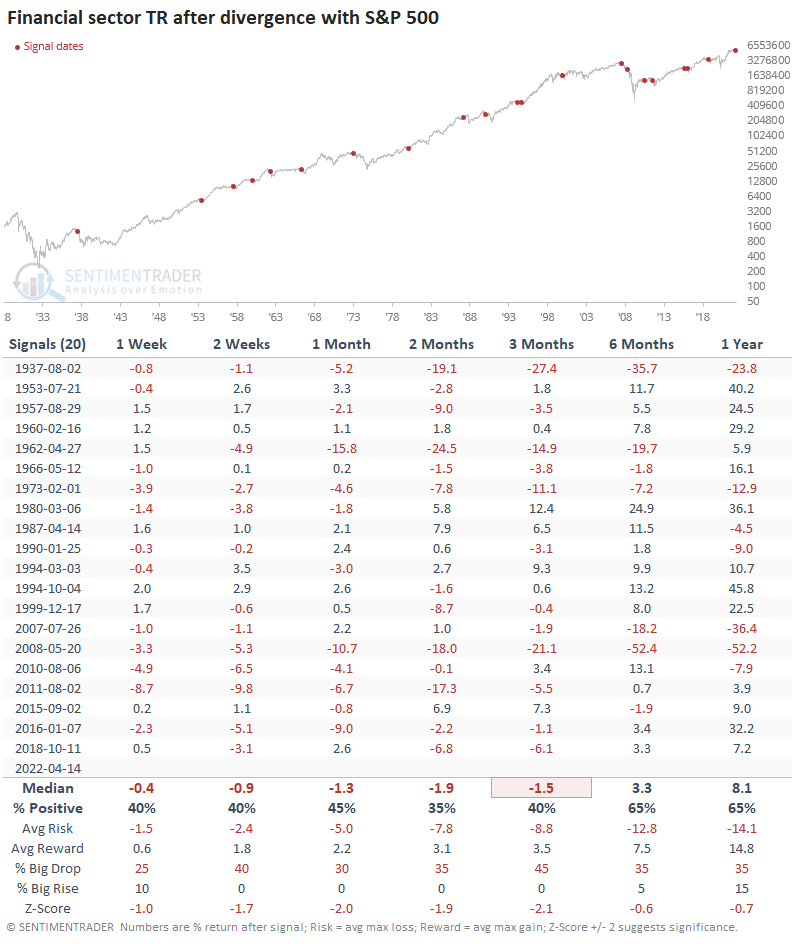

The trouble for the sector comes into even more stark relief when we look at the ratio of Financials to the S&P 500. There was almost no sign of mean-reversion here as the sector underperformed the broad market across almost every signal during the next two months.

Internals are struggling in the sector

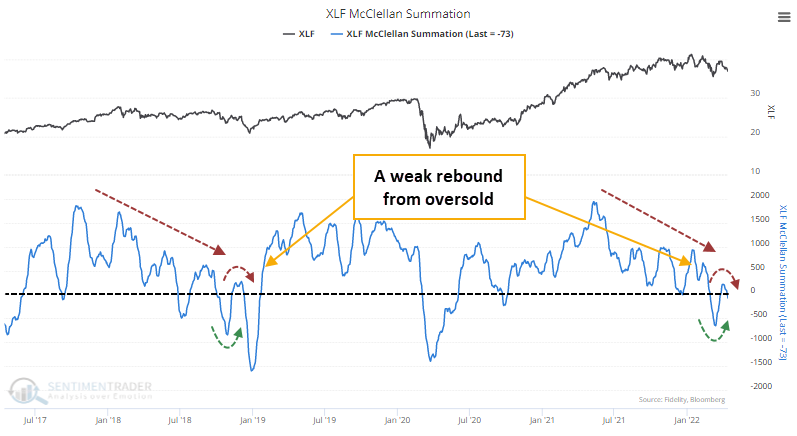

Even though breadth within the Financial sector has been poor as the sector struggles, there aren't any exhaustive extremes. The only one showing even a minor degree of perhaps too-heavy selling was the McClellan Oscillator, and that has already recovered.

Because the Oscillator was negative for a while, the McClellan Summation Index for Financials is in its worst possible configuration - below zero and declining. This looks very similar to late 2018, when internal momentum had been weakening for months, rebounded from oversold, but couldn't hold above the zero line for more than a few days.

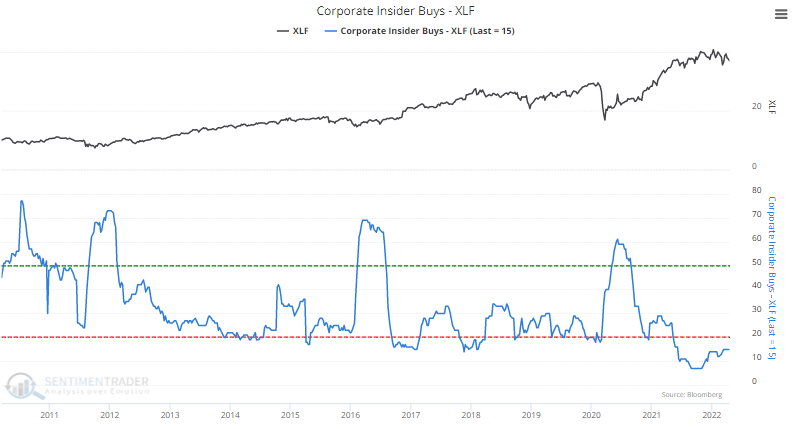

It's also worrying that corporate insiders don't seem to find much value in their own shares. A little less than a year ago, the number of insiders buying shares during the prior six months plunged to the lowest since at least 2010, and it hasn't recovered much.

What the research tells us...

Financial stocks have done okay the last couple of days, and they're trying to form a bottom. But they are still chopping around relative to the broader market. Based on their recent slide within their range, the more likely outcome appears that they will continue to struggle. The sector deals with massive economic crosscurrents that could easily swamp any technical development. Still, based on their relative weakness, they have a lot of work to do to attract investors.