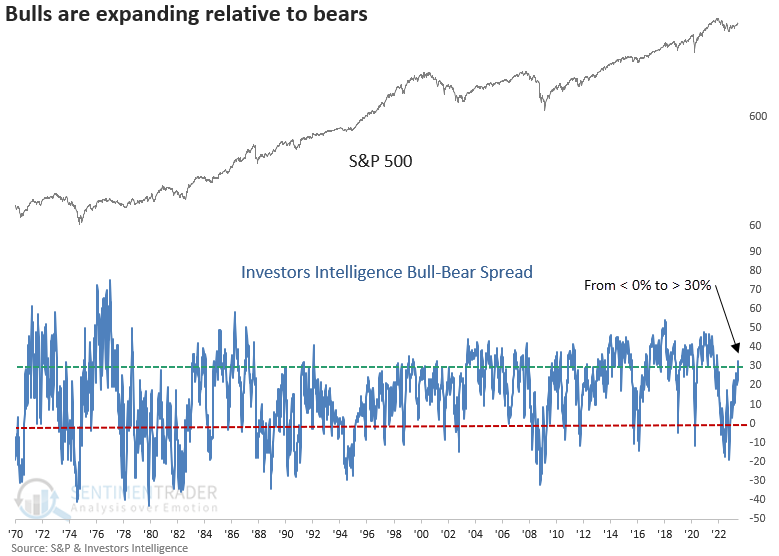

The Investors Intelligence bull-bear spread reverses higher

Key points:

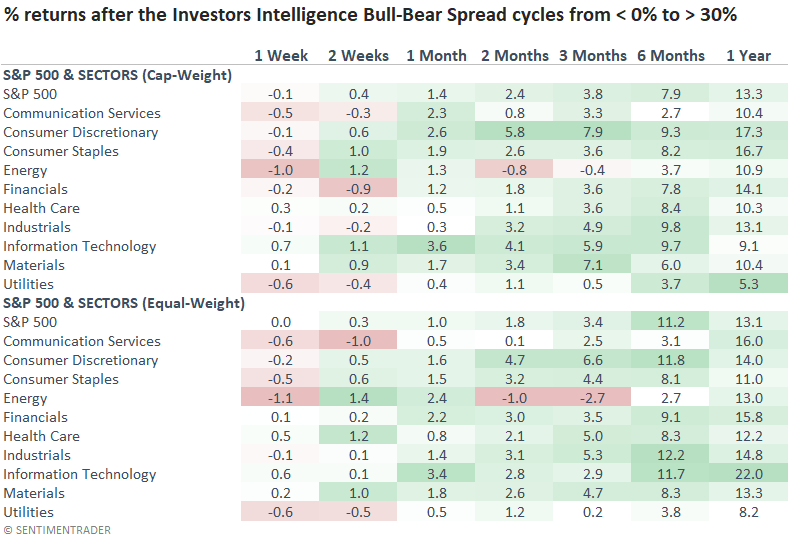

- The Investors Intelligence Bull-Bear spread cycled from less than 0% to greater than 30%

- Initially, the shift in sentiment caused a brief setback, but it eventually resulted in excellent results

- Offensive sectors tend to outperform defensive ones when sentiment reverses, like now

Newsletter writers are turning more bullish

The reversal from pessimism to optimism in sentiment indicators continues as investors embrace the bullish price action in stocks.

The oldest stock market survey, Investors Intelligence, which measures newsletter writers, showed an increase in bulls relative to bears with the latest update on Wednesday.

The spread between survey members who are either bullish or bearish has now cycled from less than 0% to greater than 30% for only the 21st time since 1971.

Similar shifts in sentiment led to outstanding long-term results for stocks

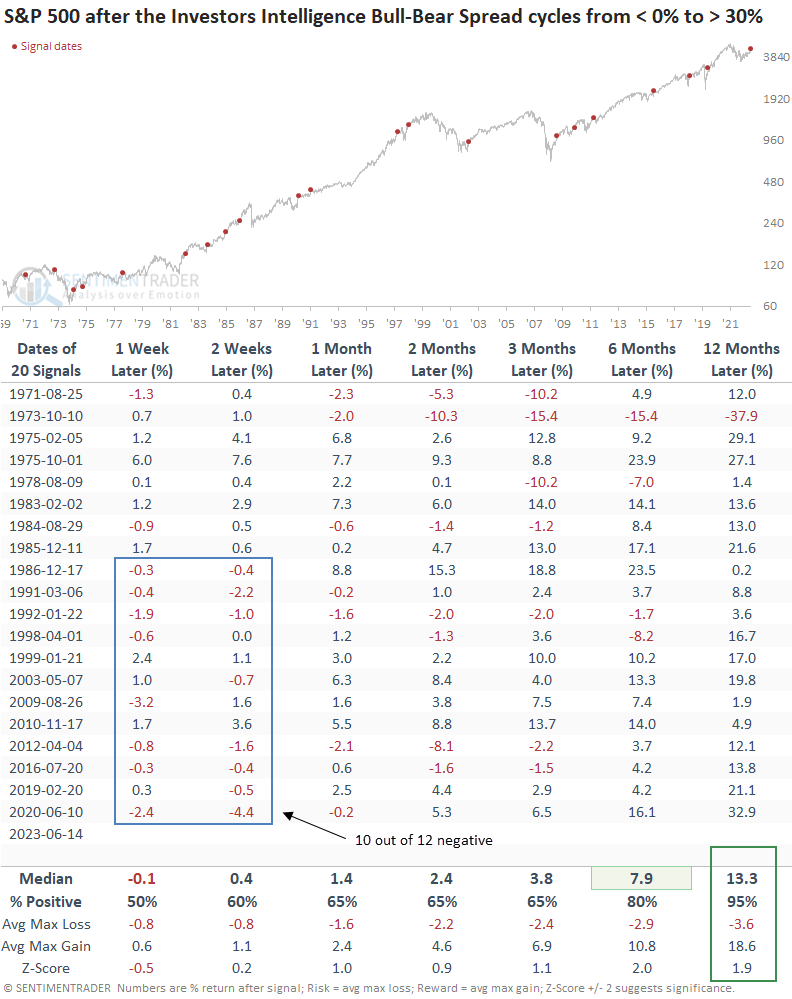

When the Investor's Intelligence bull-bear spread shifts from less than 0% to greater than 30%, the S&P 500 struggles during the first few weeks. Over the past three decades, 10 out of 12 precedents have exhibited losses at some point within that time frame. However, the index was higher a year later in all but one case.

Signal dates reflect the as-of-report date.

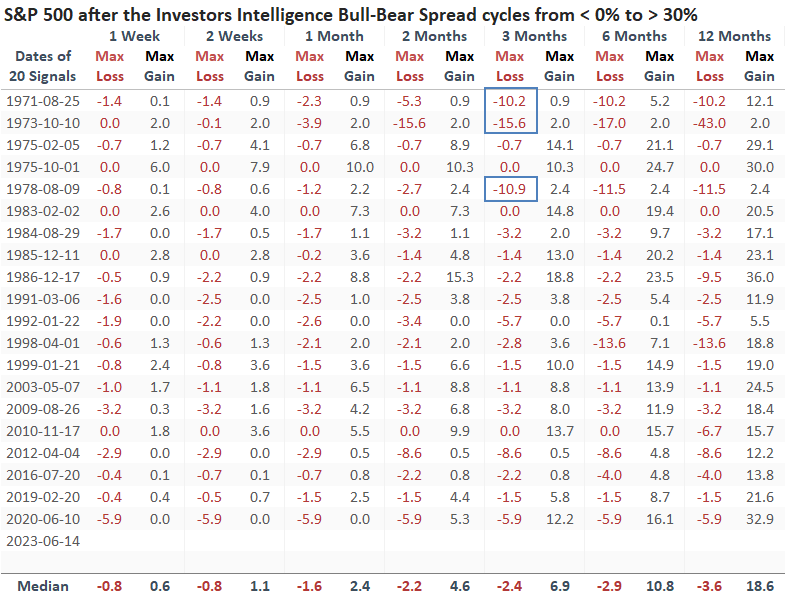

During the inflationary 1970s, there was a higher prevalence of medium-term max losses surpassing -10%. Such occurrences have been absent for over 40 years.

Given that most signals occurred as the stock market transitioned from a period of risk-off to risk-on, it's not surprising to see offensive sectors perform better.

What the research tells us...

A significant shift is underway in investor behavior as the herd moves from a pessimistic outlook to an increasingly optimistic one. Rising stock prices will do that. The Investors Intelligence bull-bear spread is the latest indicator to confirm this renewed optimism. When the spread cycles from below 0% to above 30%, the S&P 500 tends to experience a temporary pause lasting a few weeks. However, I would buy the consolidation/correction as large-cap stocks are higher a year later in all but one case.