The Industrial Metal Zinc is Surging

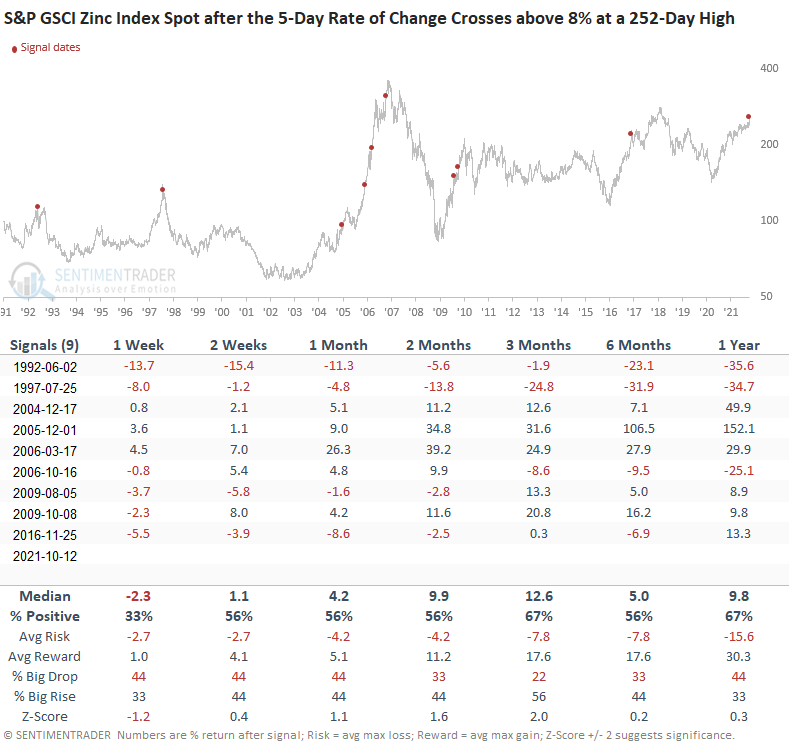

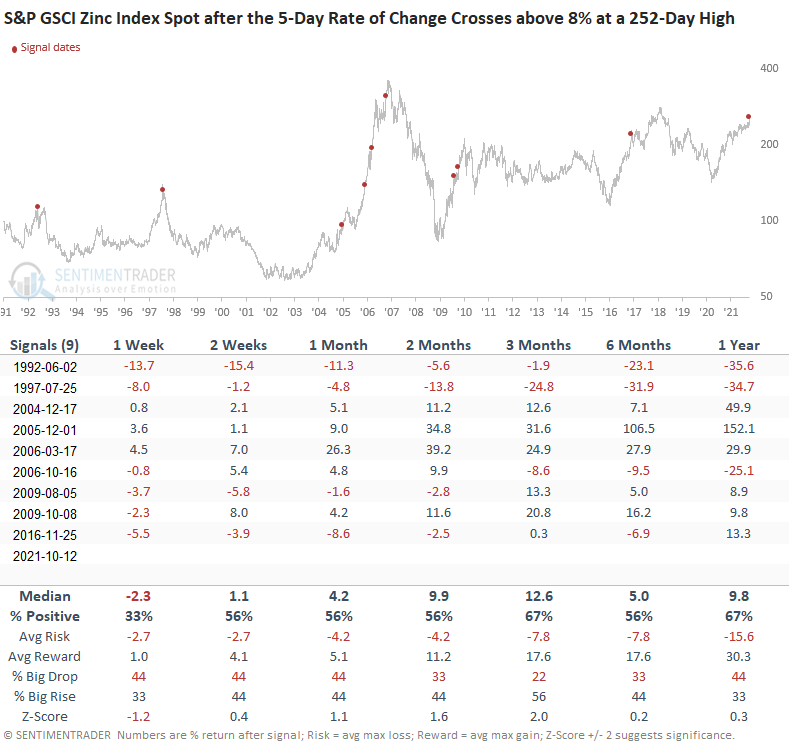

Zinc, an industrial metal used to galvanize other metals to prevent rusting, closed at a new 252-day on 10/12/21. And, the 5-day rate of change crossed above 8%. I would note that the metal is up an additional 4.75% as I write this note.

Let's conduct a study to assess the outlook for the metal, stocks, and bonds when it surges to a new high. Our study will identify historical instances when Zinc closed at a 252-day, and the 5-day rate of change is 8% or greater.

HOW THE SIGNALS PERFORMED

Results look weak in the short-term, which should not be a surprise after a sharp move higher. The 2-12 month time frames look better, especially since 2005. I would include this study in the plus column if you're in the camp that industrial metals have embarked upon a new bull market. I would also add that an infrastructure deal from the folks in Washington wouldn't hurt.

Please note the sample size is small.

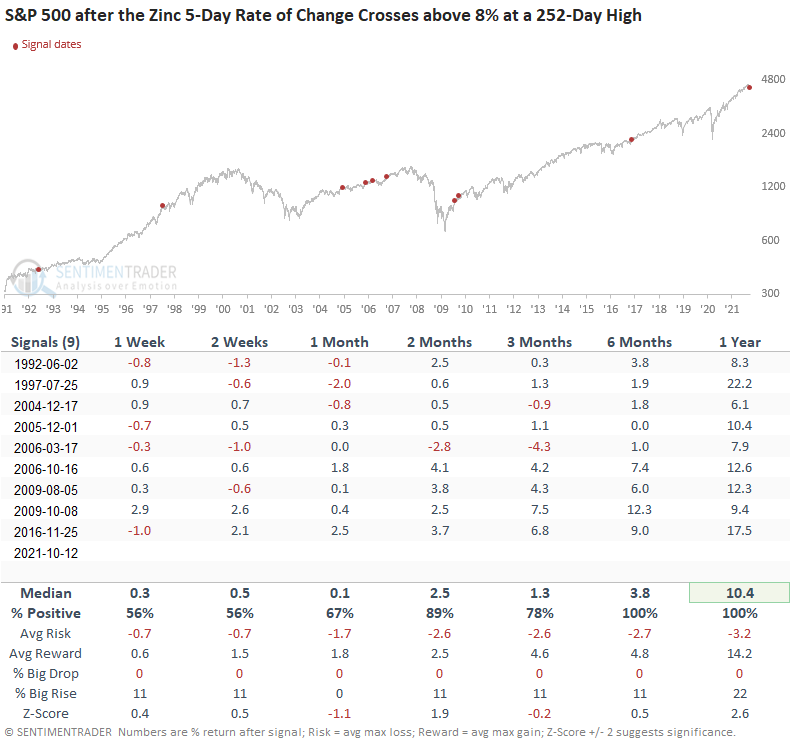

Let's apply the Zinc signals to the S&P 500 to see if this particular industrial metal provides a stock market message.

HOW THE SIGNALS PERFORMED - STOCKS

Results look okay in the short-term and excellent on an intermediate to long-term basis. It would appear that if Zinc is in gear, the stock market is healthy.

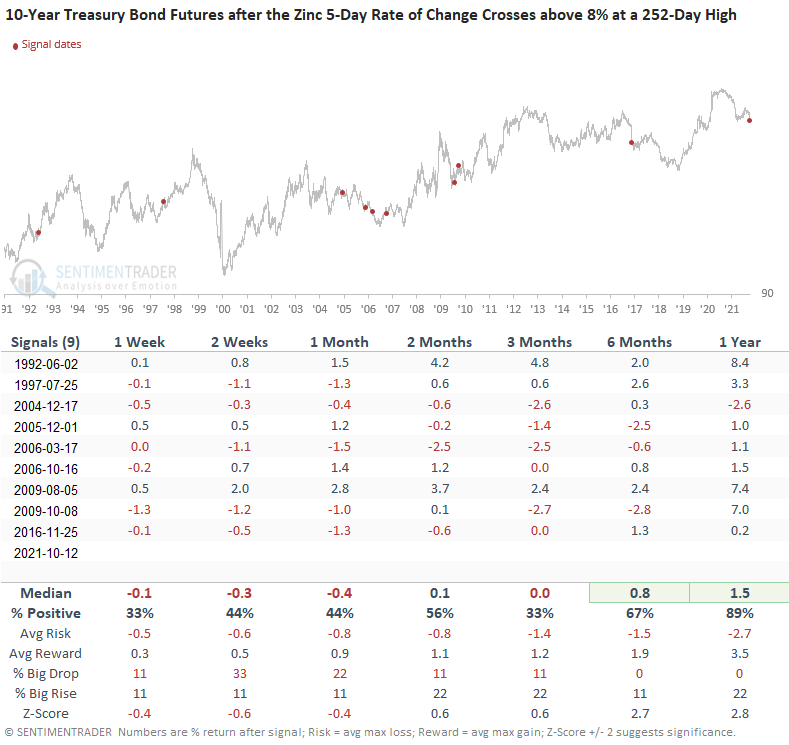

Let's apply the Zinc signals to the 10-Year Treasury Bond futures contract to see if this particular industrial metal provides an economic message.

HOW THE SIGNALS PERFORMED - BONDS

Bond prices look weak on a short to intermediate-term basis. It would appear that when Zinc is in gear, the economy is healthy, and bond yields increase. I suspect the 6-12 month results somewhat reflect the long-term downtrend in yields.

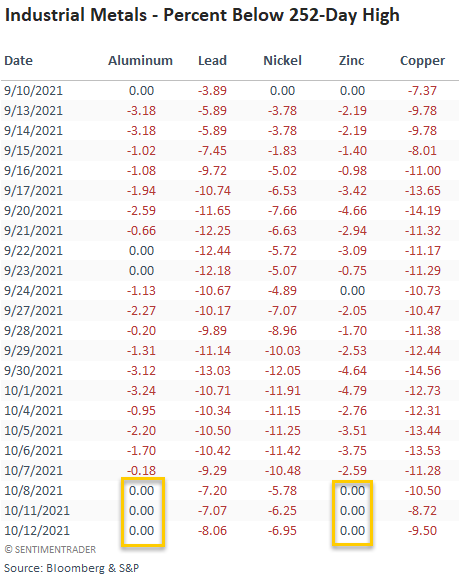

The following table measures the percentage below the rolling 252-day high for industrial metals. Aluminum and Zinc have been registering new highs of late as the other metals consolidate.

Do the other metals play catchup? Copper certainly looks like it wants to, as the metal is surging over 4% today. Stay tuned.

A value of 0.00 equals a 252-day high.

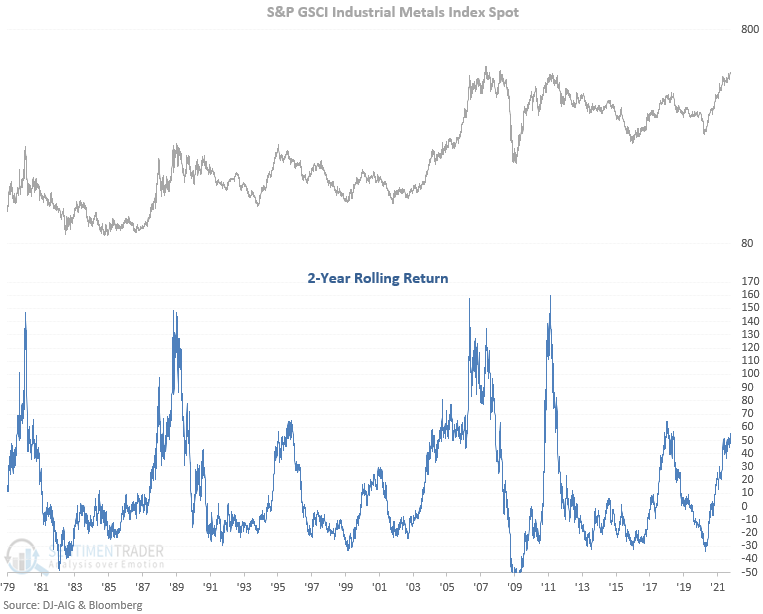

HISTORICAL CHART

The 2-year rolling return for industrial metals suggests the group could go higher from here based on other periods after an economic contraction.