The improbability of a 3-peat

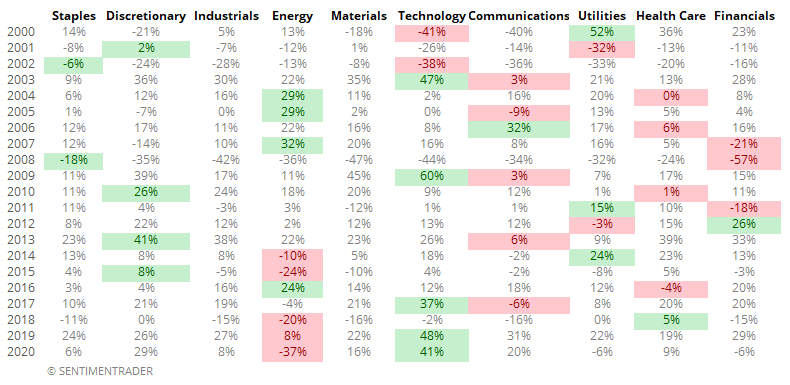

In September, we saw that energy was not only the most-hated sector in 2020, it was the most-hated of any sector of all time.

The flip side is that when there's a sector that does very poorly, there's usually a different one that does very well. This year, of course, that's the technology sector. It was the best sector last year, too.

Below, we can see each sector's yearly returns since 2000. The top sector for that year is highlighted in green; the worst in red. The numbers aren't that important, with the biggest takeaway being just how random the colors seem to be. There isn't a lot of continuity - the best sector one year usually isn't the best the next year. It's a little more common for the worst sector to repeat, but even that is fairly rare.

In the table, we can see that energy has been the worst sector for 3 years in a row, while tech has been the best on back-to-back years, and with massive gains.

When we go back to 1926 and look for similar years when a sector so dominated its peers, we see just how rare it is, with only 3 sectors managing to accomplish such a feat.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Full details on which sectors have performed best on consecutive years

- What happened to those sectors when the gains were moderate, large, or massive

- Next-year returns when a sector gains 40% on consecutive years

- Despite indexes being at/near new highs, daily breadth is very weak

- The small-cap Russell 2000 is seeing a big loss vs other indexes

- Internal momentum is curiously lagging

| Stat Box Tuesday was the 23rd time since 1962 when the S&P 500 closed within 0.25% of a 52-week high and yet fewer than 40% of issues on the NYSE managed to advance, and less than 40% of volume flowed into those securities. Over the next month, 8 of those days saw the S&P close higher a month later. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

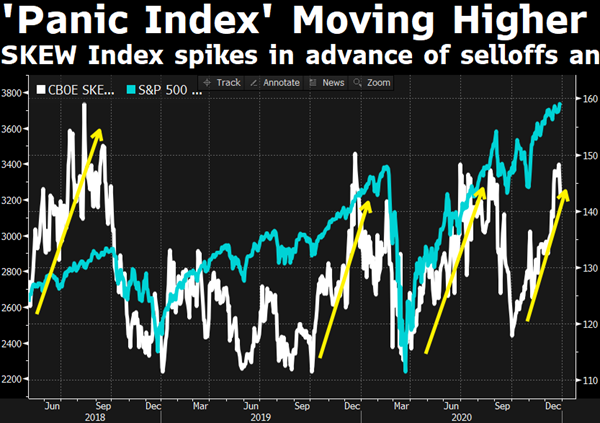

1. At least someone seems to be hedging. The SKEW Index shows traders are paying up for put options, increasing the probability of a large move in the next 30 days. [Bloomberg TV]

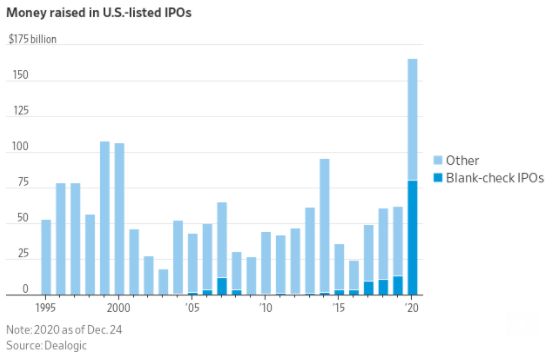

2. Just because this will never get old - the rise in IPOs in 2020 is shattering almost all records. Proceeds raised by bankers to a willing public are up more than 50% from the prior peak. [Wall Street Journal]

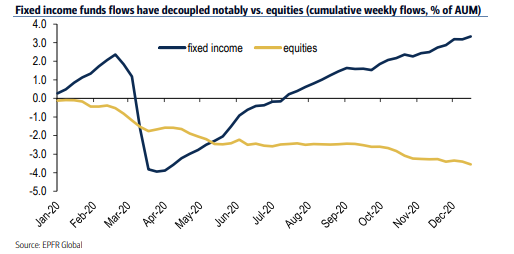

3. Curiously, funds continue to see outflows (in stocks) as investors gravitate more and more toward individual equities. [EPFR]