The importance of follow-through on a big gap up open

The size of overnight moves over the past month has been record-setting. As early as mid-March, we saw that traders were suffering through the widest swings ever in the S&P 500 futures, with massive swings between the close and the next day's open.

This week isn't seeing that abate at all, but at least the gaps are to the upside.

For as much as we can rely on historical precedent, how traders react to this morning's large gap up should be telling. At the moment, futures are up more than 3%, following a huge gain yesterday. The only comparisons to this are October 14, and November 24-25 of 2008. To get more samples, we'll relax the parameters some.

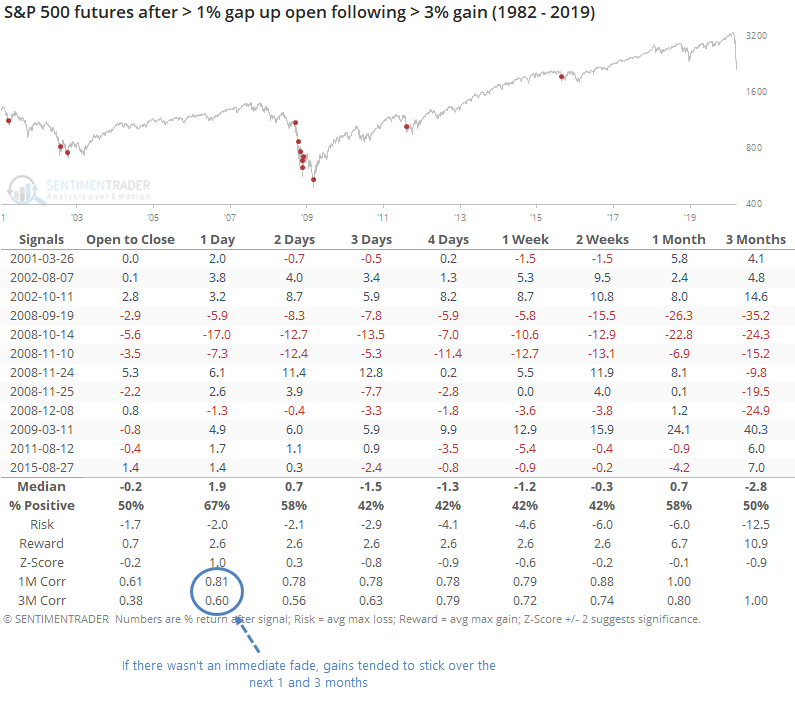

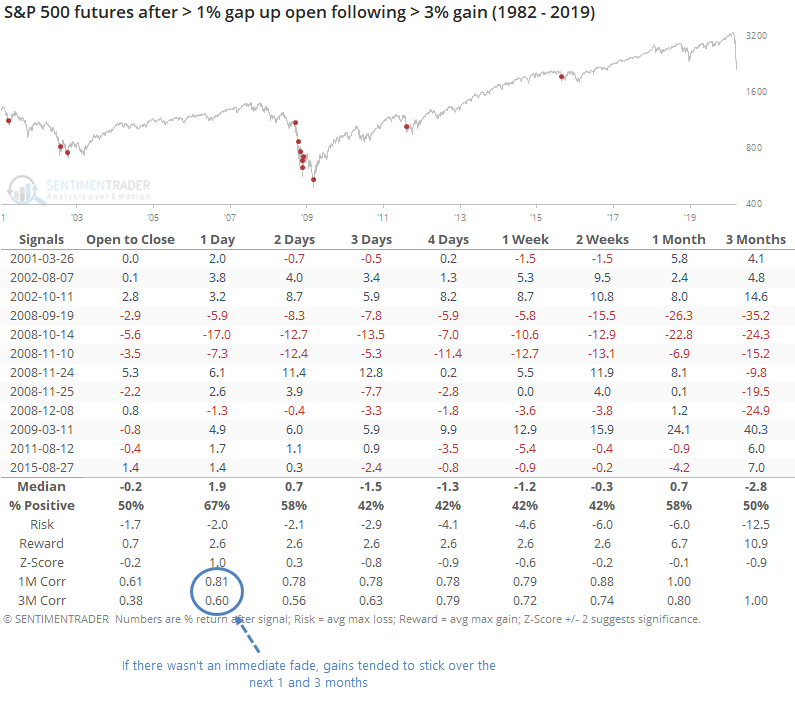

Below, we can see how the futures performed after gapping up at least 1% following a day with a gain of more than 3%.

It's not a big surprise to see below-average returns, since we'd be buying into a gap up after stocks had already rallied. But if we focus on the last two lines in the table, there is something interesting.

Those lines calculate the correlation between the return on that column's time frame and the return 1 month and 3 months later. A correlation of 1.0 would mean there is a perfect correlation.

What we can see from the table is that there is a high correlation between how the S&P did over the next day and how it did over the next 1 and 3 months. If the opening gap was faded by traders, then it was a sign that buyers weren't too eager to return, and that led to poorer returns in the month(s) ahead. But when the gap wasn't faded hard, returns were better. For bulls, follow-through would be a very good sign.