The ice is cracking

Since markets bottomed last fall, both Dean and I have highlighted the impressive participation and thrusts underlying the rise in the indexes. A lot of stocks (and bonds) were rising, and the buying pressure was impressive. That kind of activity tends to lead to longer-term gains.

Shorter-term is a different matter, but even that has led to only inconsistent losses. The biggest issues have come when underlying momentum wanes and we see cracks under the surface.

That's what's happening now.

In multiple Daily Reports over the last couple of weeks, we've pointed out oddities on days the indexes rallied. That's a change from recent months, and by themselves, they're not a big warning sign. When it starts to spread, and we see clusters, then it's more of a worry.

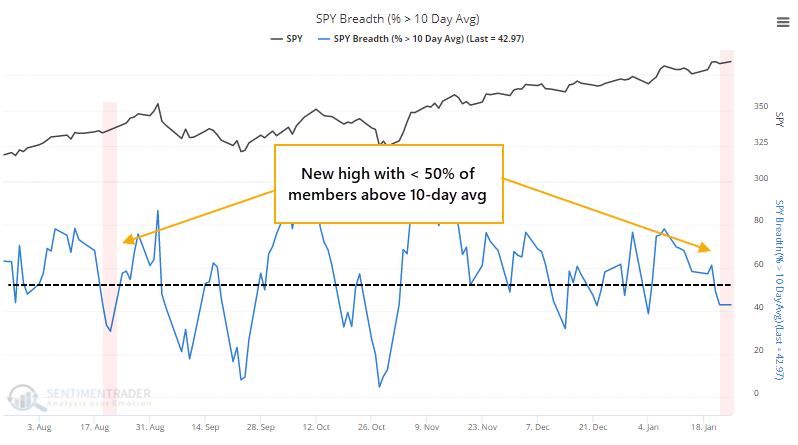

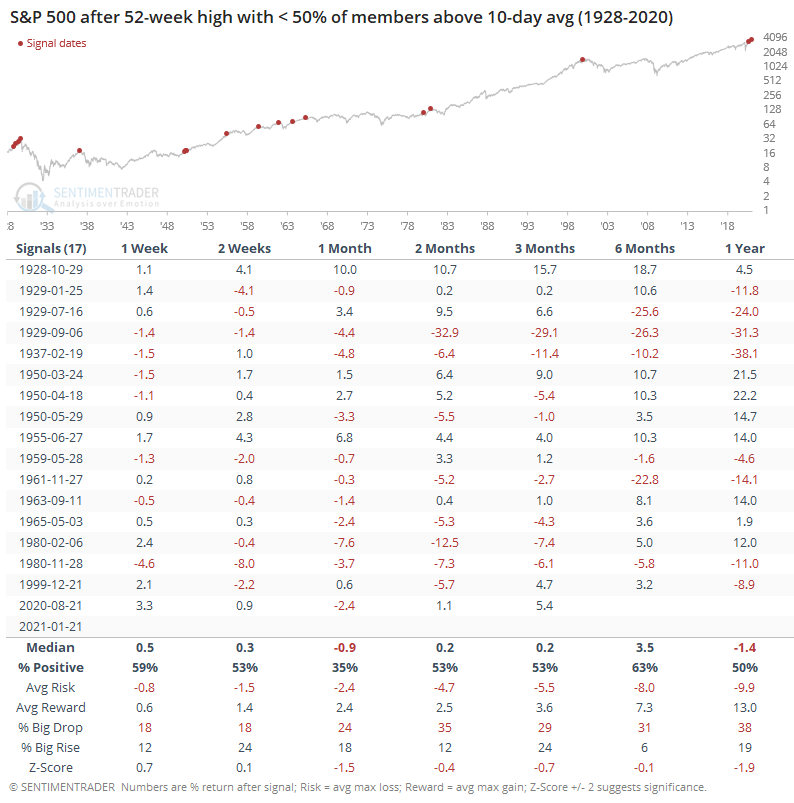

As noted yesterday, the S&P 500 closed at another record high on Monday, and yet fewer than 45% of its stocks managed to close above their 10-day moving averages. That's a lot of short-term downtrends on a day the index closed at a high.

The only time in recent years that we've pointed out similar behavior was last August. The indexes managed to run for a couple more weeks, then suffered corrections in September. If we relax that to 50%, then it's still unusual, and forward returns were not impressive.

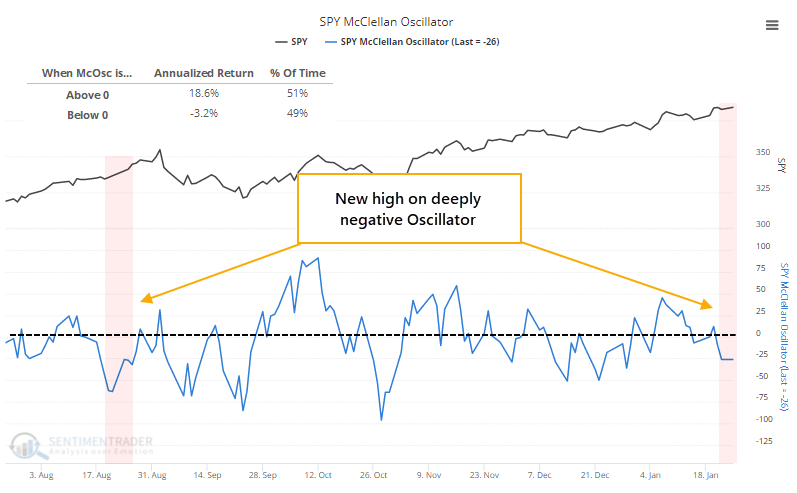

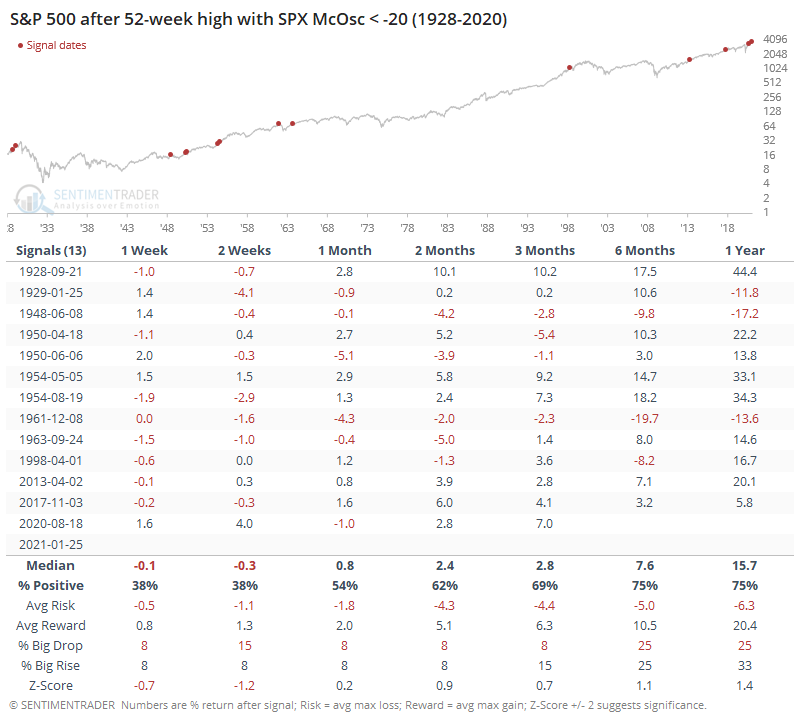

The reason why relatively few stocks are above their 10-day averages is that relatively few have been rising on days the S&P showed a gain. That difference between advancing and declining stocks has been negative enough that the McClellan Oscillator for the S&P 500 is well below zero.

We can see from the chart that the S&P's annualized return since 1928 when its Oscillator was below zero is an abysmal -3.2%.

Once again, it's unusual to see it below zero, and especially well below zero, when the index itself closes at a 52-week high. The only time in recent years that it triggered was last August.

Markets are currently being held in captivity by another wave of speculation among options traders. The only time in 20 years that speculation neared the current level was in the latter half of last August. It's probably not a coincidence that that was also when we started to see initial signs of deterioration in stocks underlying the major indexes like we are now.

Growing up in the frigid Upper Midwest, we quickly learn to identify "bad" ice versus "good" ice. Mistaking one for the other leads to a very unpleasant outcome. Until the last week or so, markets have been skating on good ice. Recent sessions have started to pop off that cracking sound that makes the hairs stand up on the back of the neck of anyone walking across a frozen lake. Sometimes it's just new ice forming. Most of the time, it's the precursor to a fall.