The highflying Nasdaq 100 stocks have become the "safe" ones

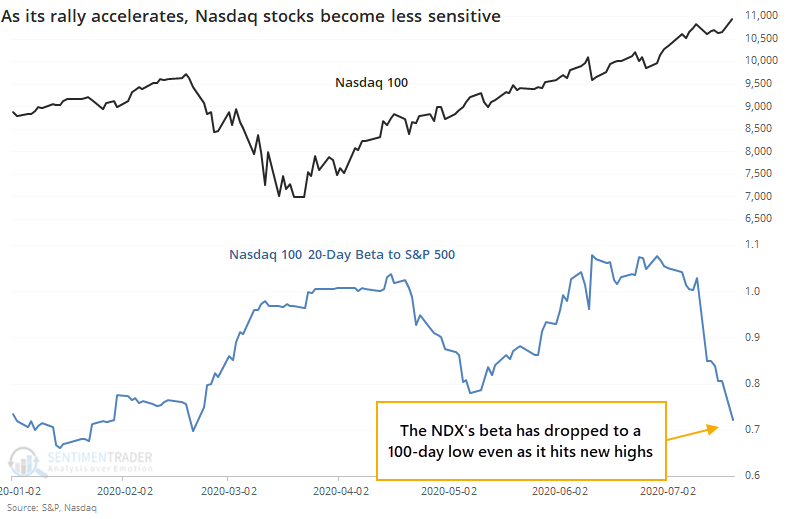

On the Nasdaq's march to new highs, a curious thing has happened - they've become the "safe" stocks.

As the Wall Street Journal noted, starting during the pandemic, many stocks that would be considered highflying flipped their usual patterns. As indexes like the S&P 500 rose and fell, these stocks rose or fell less than the S&P or even moved in the opposite direction.

Over the past 20 sessions, its beta has plunged to 0.74 relative to the S&P 500, its lowest in more than 100 days.

This has been a modest negative for the Nasdaq 100 going forward, with below-average returns and a poor risk/reward ratio, especially up to three months later.

Over the next 1-3 months, the ratio consistently dropped as the S&P outperformed the NDX. There have been other signs in recent weeks that incessant outperformance of these stocks might start to falter, and this is another (minor) one.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more in-depth look at what happens in the Nasdaq 100 and S&P 500 when its beta falls even as it hits new highs

- The Cumulative Advance/Decline Line has hit a new high, but the S&P and the stocks-only A/D Line are lagging

- The Nasdaq's new high / new low ratio is the highest it's been in years

- The gold / silver ratio has plunged like it has only 4 other times in history