The Headwind From Option Expiration

Seasonal tendencies in markets get quite a bit of attention and mostly it's due to interesting, but spurious, patterns found by combing through years of data trying to find any type of edge.

Calendar-based influences made a lot more sense in prior decades, and sometimes when there are structural changes in markets. Nowaday, if there is any seasonal bias in stocks it is most likely due to the greater fool theory - other people are trading based on these patterns so I might as well too.

We've never been a big fan of relying on these patterns, using them as tertiary inputs as best. One of them that has persisted, though, is the tendency to see some weakness following monthly option expirations, particularly those around quarter-end.

There are some explanations for this tendency, usually related to the demands of portfolio managers and market makers to adjust their exposure levels to take into account the expiration or rolling over of options positions. Regardless of the reason, the negative bias following these days has been consistent.

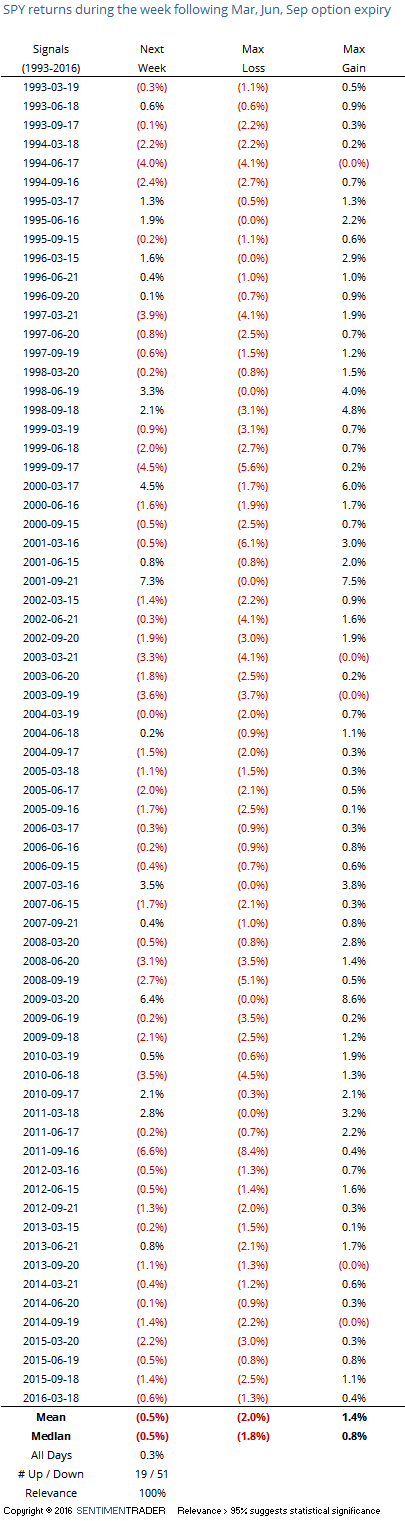

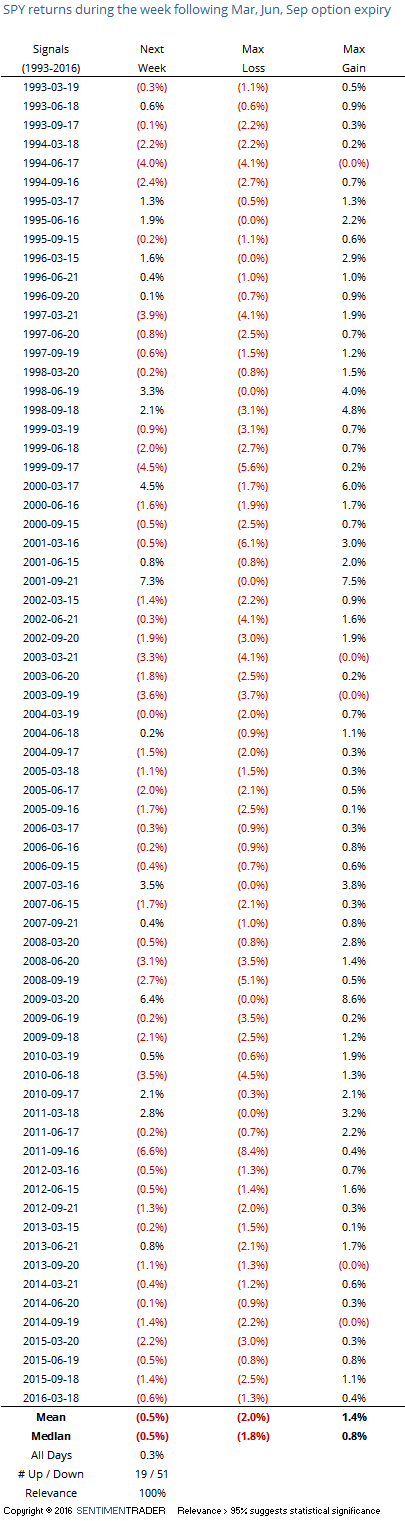

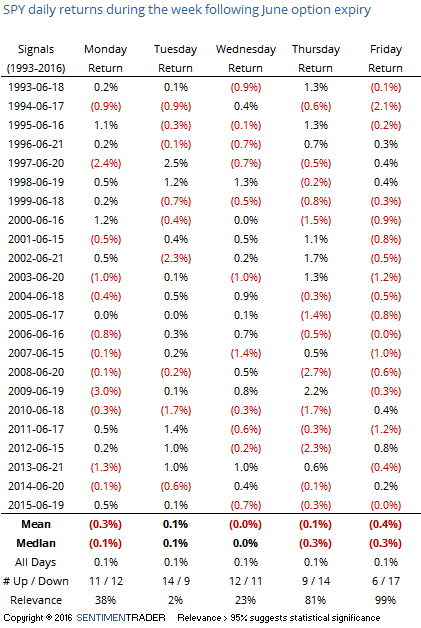

The worst performance for stocks has been the week following March, June, and September expirations. Since its inception in 1993, SPY has rallied the week after one of these expirations only 17 times out of 70 attempts. Its maximum loss at its worst point during the week was more than twice as large as its maximum gain at its best point, on average.

Looking at June specifically, SPY rallied 7 out of 23 times, averaging a loss of 0.3% for the week. In the past 11 years, it managed a gain only once.

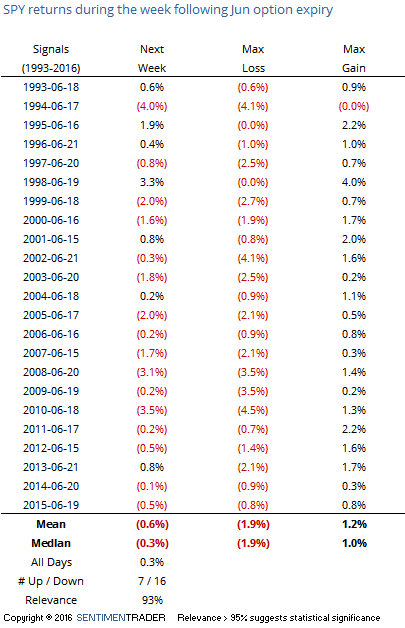

Monday tended to be a down day, followed by a mid-week bounce, then more selling heading into the end of the week.

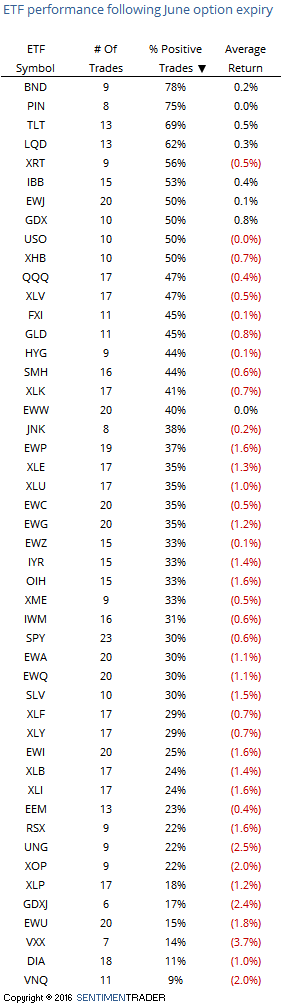

Looking through the list of most popular ETFs, it's not a big surprise that "safety" funds like bonds are the best performers. BND was up 78% of the time the week following June expiry and TLT 69% of the time.

We would put a low weight on this data and not make any trading decisions based on it alone, though it does make it seem more questionable that some of the short-term positives that have popped up, like the tendency to see a rally following 5 straight down days, will succeed.