The first sign of an oversold condition

Key points:

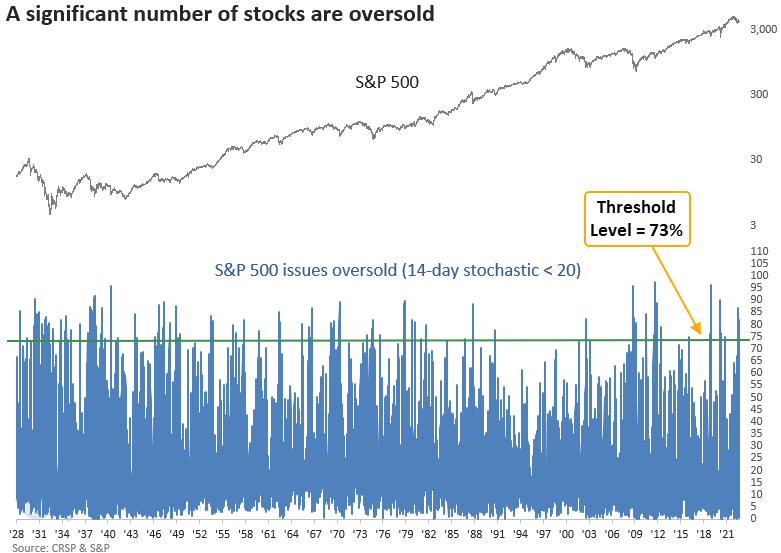

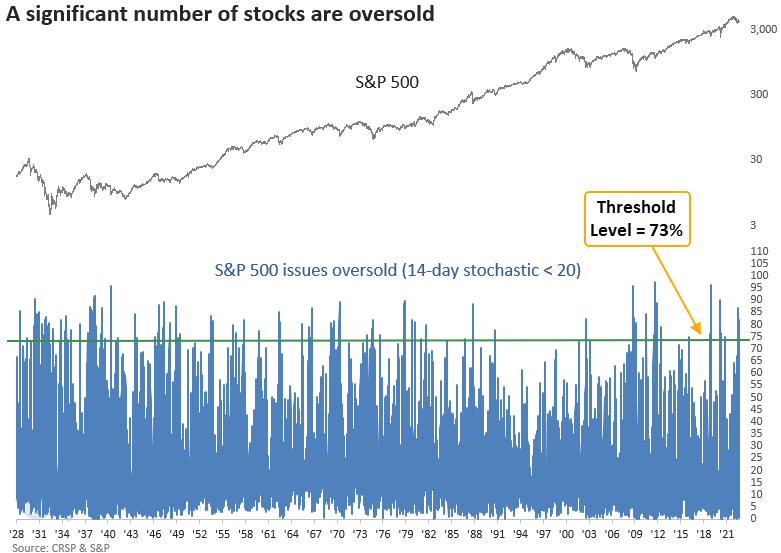

- S&P 500 issues with a 14-day stochastic oscillator of < 20 exceeded 73%

- The weak breadth triggered a signal from a member in the composite washout model

- After similar breadth-based conditions, stocks showed a positive upward bias

Market breadth is starting to show signs of an oversold condition

The Stochastic Oscillator (Stochastic for short), created by George Lane, is a popular technical indicator found in most charting applications. The Stochastic identifies overbought or oversold conditions by measuring the closing price of a security to a range of prices over a lookback period.

The indicator can be applied to a group of securities to measure the breadth of participation. In a recent note, I shared how I use the percentage of issues with a Stochastic > 80 to identify bullish momentum.

With stock indexes retracing a significant portion of the recent rally, most stocks are now showing an oversold condition based on the 14-day Stochastic. Last week, the number of oversold stocks (14-day Stochastic < 20) in the S&P 500 exceeded 73%, triggering a new signal from a member in the Composite Washout Model.

Similar breadth-based conditions preceded positive returns

The Stochastic Oscillator model generated a signal 91 other times over the last 95 years. Returns had an upward bias, with the three-month time frame showing the best win rate and z-score. The previous signal from June closed out the 5th best two-month return in history.

Context is important, and currently, the S&P 500 is mired in a long-term downtrend. Its 200-day average has declined for at least 90 consecutive days.

If we add that condition to the study, it identified 26 other instances. Once again, returns show an upward bias, with the best win rate and z-score coming a month later. The two and three-month windows suggest a potential retracement after the initial bounce.

Results look excellent a year later post the 1929-32 bear market.

Composite Washout Model Signal Count

After triggering a Composite Washout Model signal in June, the S&P 500 rallied slightly over 12% before the index peaked in mid-August. Since the peak, stock indexes have retreated at an alarming rate and now show the first sign of an oversold condition as measured by a Composite Washout Model member.

The model remains well below the threshold level for generating another signal.

What the research tells us...

Stock indexes have been in a relentless short-term downtrend since the August peak, with 9 out of 13 sessions showing a decline for the S&P 500. The slump in stocks triggered a new signal from a voting member in the composite washout model. While the signal results look constructive, we don't see an overwhelming bullish bias that suggests one should rush in with a sense of urgency to buy stocks. A better strategy might be to wait for additional evidence of an oversold condition, which could produce a more compelling outlook.