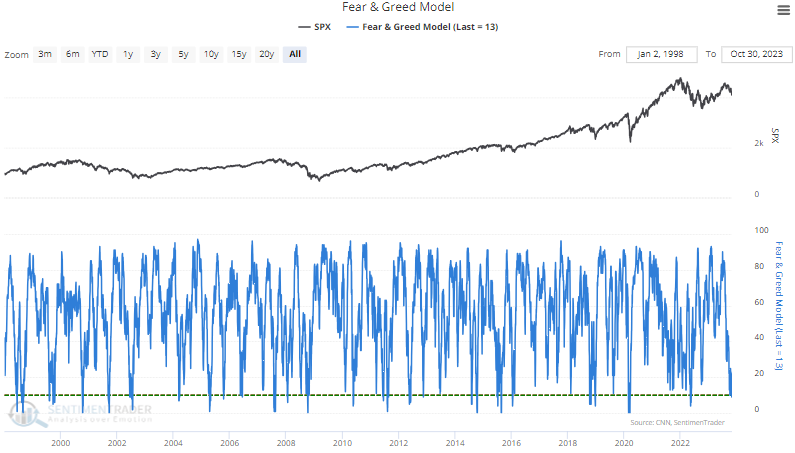

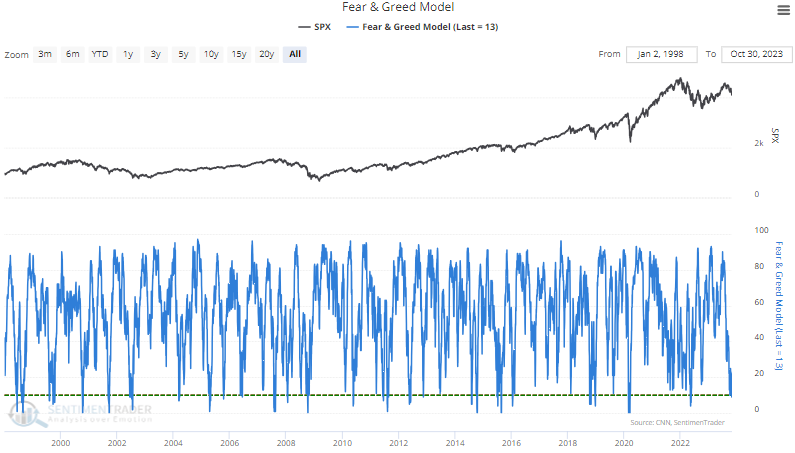

The Fear & Greed Model suggests extreme fear

Key points:

- The Fear & Greed Model, a sentiment indicator, declined to one of the lowest levels in history

- After similar signals, the S&P 500 struggled over the subsequent two months

- A more favorable setup occurs after the model cycles from less than 10% to greater than 51%

Sentiment indicators work best when they reverse from an extreme

Similar to what I've shared with market breadth indicators over the last week, sentiment measures are increasingly revealing a growing sense of pessimism in an environment that already exhibits a lack of confidence in the stock market's prospects.

One of those indicators, the Fear & Greed Model, dropped below 10% for only the 25th time since 1999, suggesting a heightened level of fear among investors.

Similar sentiment extremes suggest the S&P 500 could struggle

Whenever the Fear & Greed Model dips below 10%, the S&P 500 encounters difficulties in the following two months. At some point over that same time frame, the large-cap index was negative in 19 out of 24 precedents.

Almost 60% of the signals occurred in a bear market or a correction that exceeded -14% from peak to trough.

I used a reset above 50% to screen out repeats.

Wait for the Fear & Greed Model to reverse

I conducted a test to assess what level produced the best outlook for the S&P 500 after the Fear & Greed Model declined below 10%, like now. The study returned a reversal above 51% as the optimal threshold with a holding period of 42 trading days.

What the research tells us...

The Fear and Greed Model dropped to one of the lowest levels in history, indicating fear among traders. Such pessimistic situations tend to occur in substantial market corrections and bear markets. Therefore, it's unsurprising to see the S&P 500 struggle over the following few months, as periods of pessimism can lead to a negative feedback loop. Whether sentiment or breadth-based measures, the best risk/reward setups occur when indicators reverse from an extreme. Patience is paramount in oversold conditions exhibiting pessimism.