The equity only put call ratio triggered a new buy signal

Key points:

- Equity-only put volume increased relative to call volume

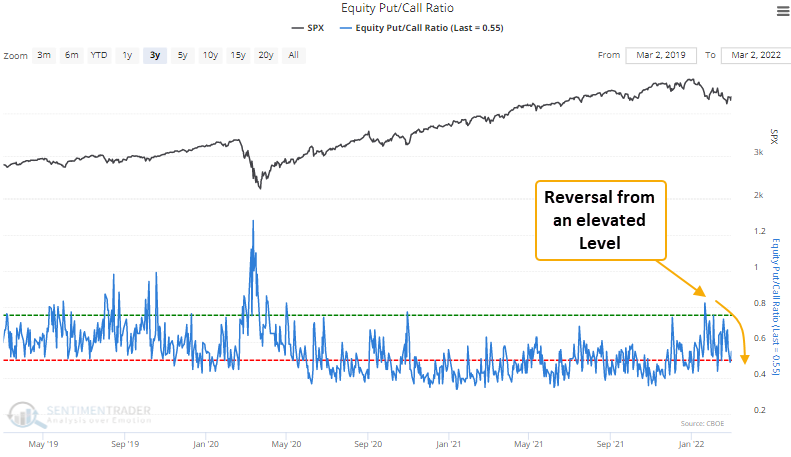

- The put/call ratio has now reversed lower from an elevated level

- The S&P 500 has rallied 77% of the time after other signals

The put-call ratio as a contrary sentiment indicator

When investors are bullish on stocks, they buy call options to bet on rising prices. Conversely, when they are bearish on stocks, they purchase put options to bet on declining stocks. The equity-only put/call ratio can be used as a contrary indicator to identify an environment where sentiment has become too pessimistic on the future direction of stocks. When opinions become too bearish, stocks tend to rally.

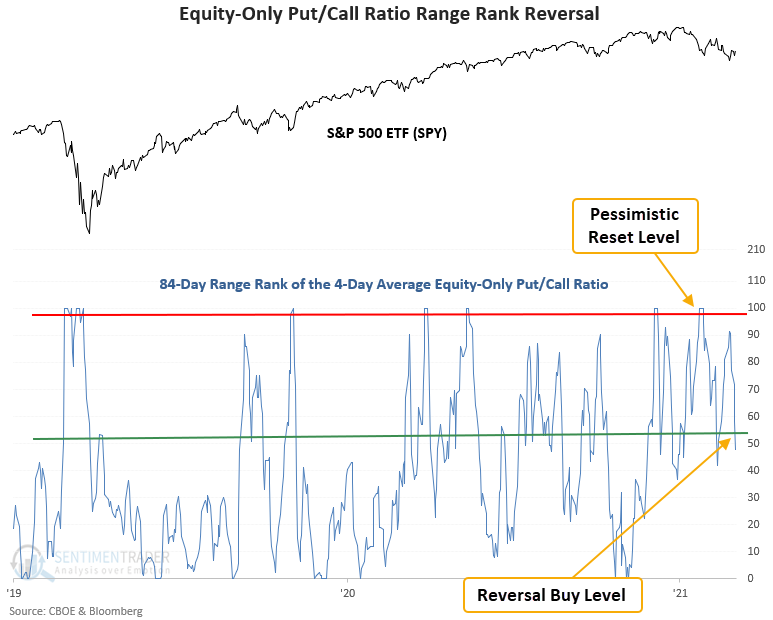

A trading model that identifies a reversal in the put/call ratio

The trading model applies an 84-day range rank to the 4-day moving average of the CBOE equity-only put/call ratio. The pessimistic reset condition is confirmed when the range rank indicator crosses the 99th percentile. A new buy signal occurs when the range rank crosses below the 54th percentile. Within 5 days of the cross, the 5-day rate of change for the S&P 500 must be >= 3%. i.e., market momentum is positive.

The signal did not trigger when the range rank crossed below the threshold level in February because the momentum condition was invalid.

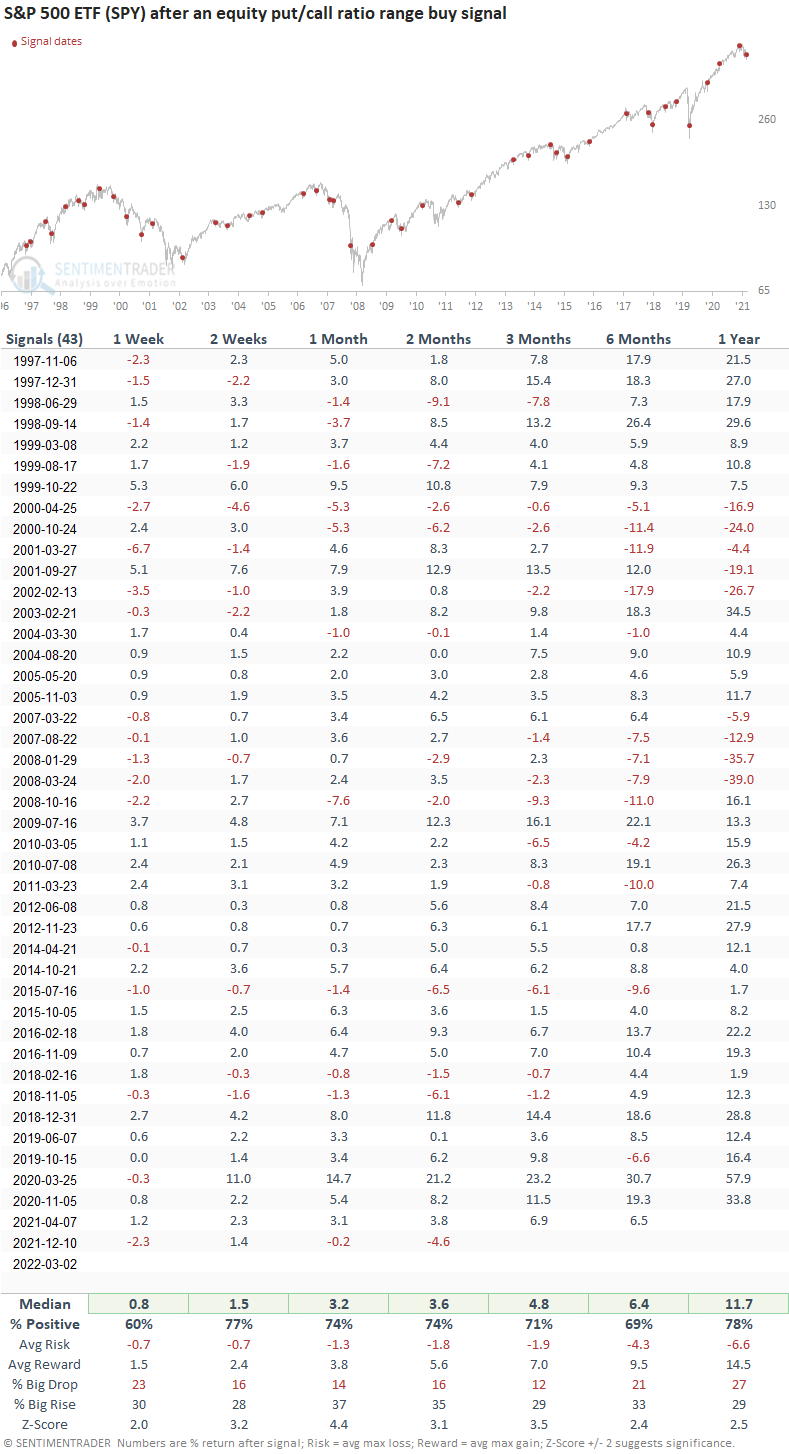

Similar reversals in the put/call ratio have preceded gains 77% of the time

This signal triggered 43 other times over the past 25 years. After the others, S&P future returns, win rates, and risk/reward profiles were excellent across all time frames. The signal shows positive performance at some point in the first month in 41 out of 43 instances. And, the max drawdown of 7.6% occurred within the depths of the global financial crisis.

What the research tells us...

When equity-only put volume increases relative to call volume, traders have become too pessimistic on the outlook for stocks. Stocks are likely to trade higher when the pessimistic extreme reverses. Similar setups to what we're seeing now have preceded rising prices for the S&P 500 ETF (SPY), with a 2-week win rate of 77%. Drawdowns were relatively benign, even in nasty bear markets.

I've shared several sentiment-based buy signals since the correction started in January. The energy ones have worked well. However, most broad market signals have shown a tepid response. I continue to believe that a better risk/reward outlook for the overall market will come when we see panic buying that lifts all stocks.