The equal-weighted S&P 500 Industrials sector closed at a new all-time high

Key points:

- The S&P 500 equal-weighted Industrials sector closed at a new all-time high on Tuesday

- Industrials and the S&P 500 performed slightly better than average over the next year

- Other cyclical sectors like Technology and Consumer Discretionary outperformed

Another bullish development for the Industrials sector

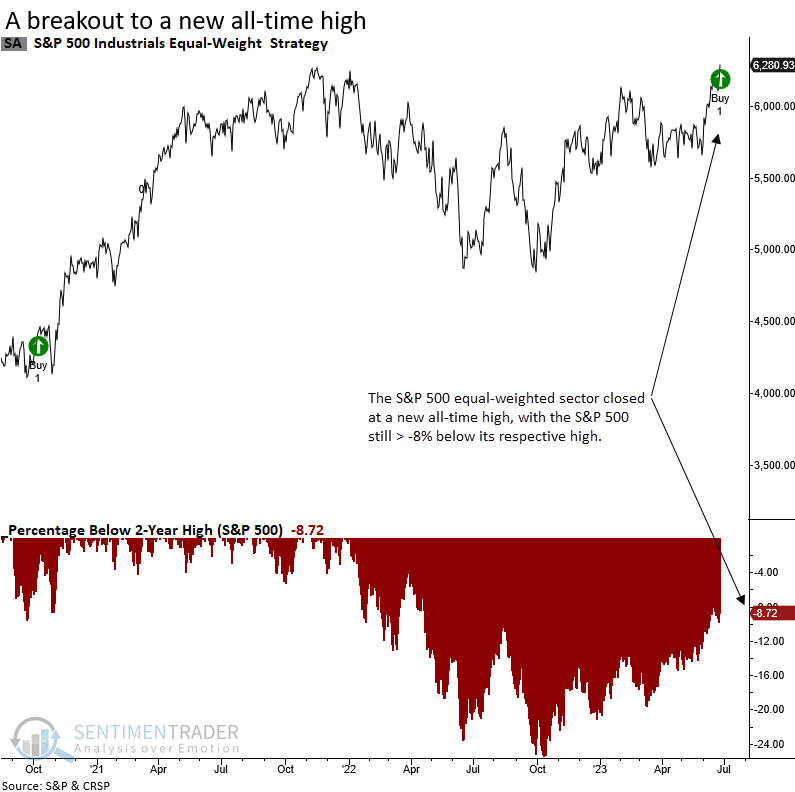

The S&P 500 Industrials recovery continued this week, culminating in a new all-time high for the equal-weighted index on Tuesday, making it the first large-cap index or sector to achieve this milestone.

With internal participation from industrial sector stocks on solid footing and now external price confirmation at the index level, the weight of the evidence for industrials looks favorable.

When cyclical sectors like Industrials are behaving well, more often than not, it's a bullish sign for the broad market.

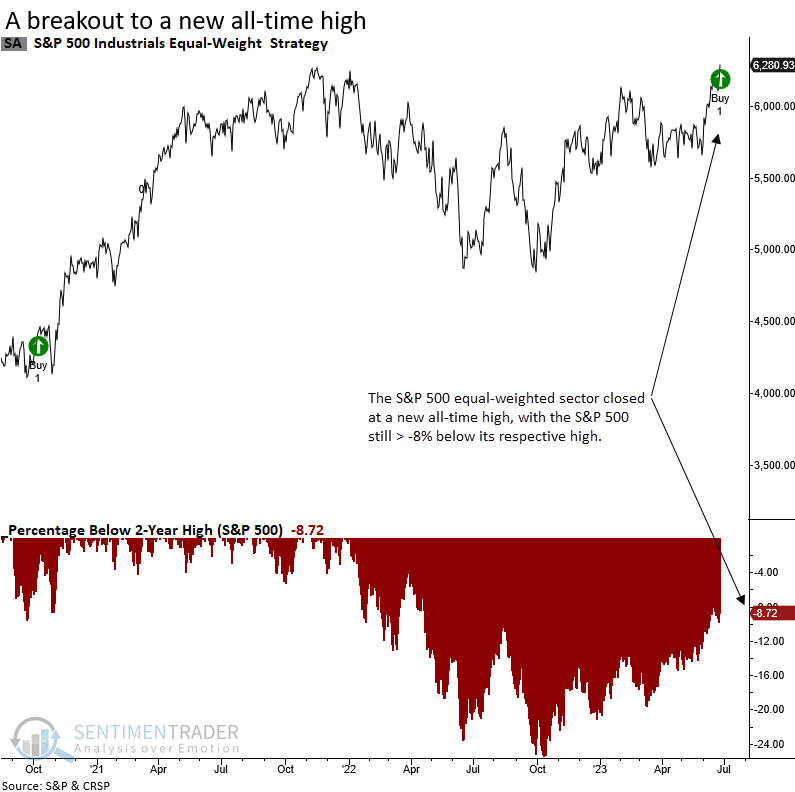

The equal and cap-weighted S&P 500 Industrial sectors occupy the two top spots when measuring the distance below a 2-year high. So opportunities exist outside of Technology.

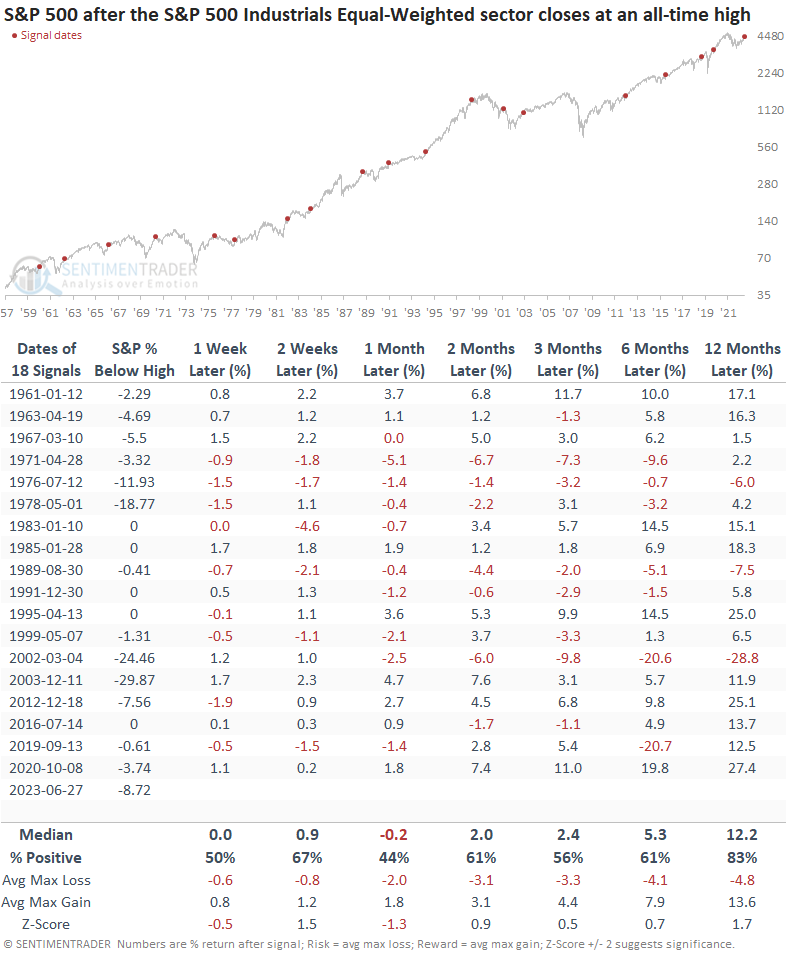

Similar breakouts led to an upward bias in price

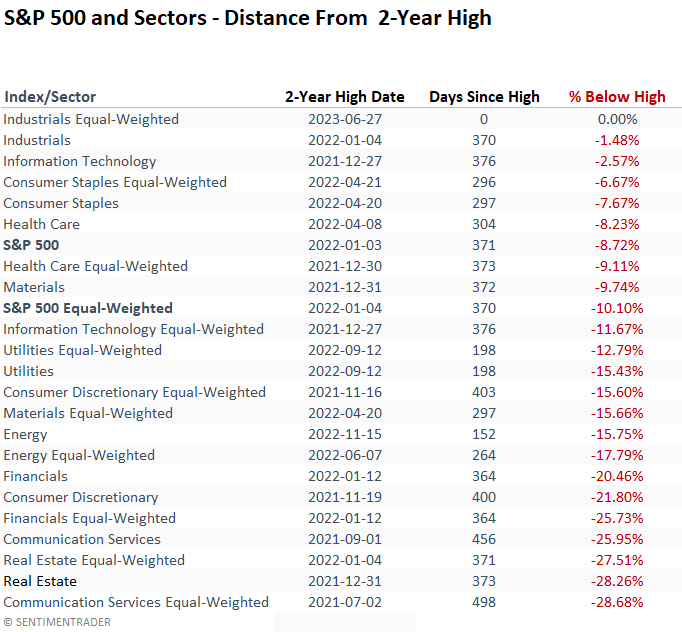

The S&P 500 Industrial sector tends to rise over the next year when the group registers its first new all-time high after a 1-year low. Precedents in 1971, 1989, and the 2000-202 bear market were the only cases when the new high marked an almost immediate peak in price.

Historically, whenever the ISM Manufacturing PMI has been in contraction territory, such as now, the S&P 500 has consistently recorded positive returns over the subsequent three-month period. The sole exception occurred in 1989.

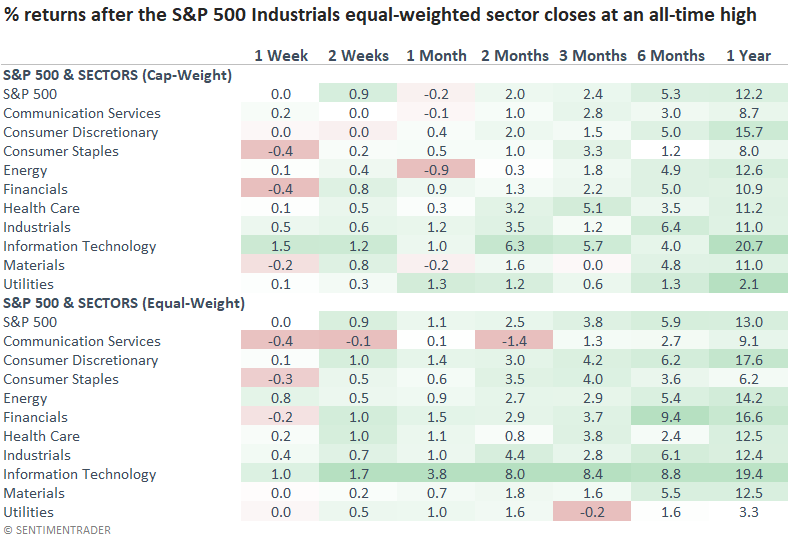

Broad market results

Returns and win rates are slightly less favorable across short and medium-term time frames when compared to the industrial results, particularly within the 1-month horizon. Relative to history, S&P 500 returns are marginally better than average from two to twelve months later.

There have been several instances where the Industrials have closed at a new all-time high, as the S&P 500 remained considerably below its respective high.

Sector performance tilts toward cyclical growth groups

The Technology and Consumer Discretionary sectors outperform all other groups over the next year. So, what's good for one cyclical group tends to be bullish for others.

What the research tells us...

The S&P 500 Industrial sector soared to a record-breaking high, becoming the first group to achieve this feat following the 2022 downturn. Similar reversals from a 1-year low to a new all-time high preceded positive returns for the Industrials and the broad market over the next year. The Technology and Consumer Discretionary sectors tend to outperform, which aligns with current relative trends.