The "Energizer" Rally Keeps Going Despite Rising Jobless Claims

The Energizer rally

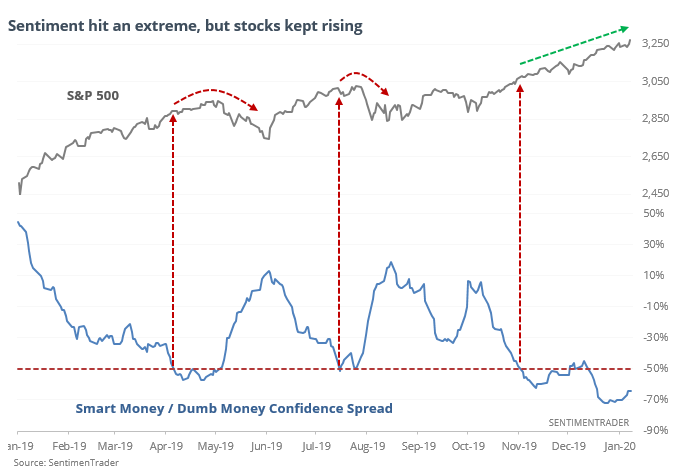

Despite extremes in sentiment which started to pop up in November, stocks continued to rally. After the spread between Smart and Dumb Money fell to -50%, the S&P has since enjoyed almost uninterrupted upside. This is the best reaction in 20 years after such extreme sentiment.

Instead of ignoring failures, we pay special attention to them, because sometimes it tells us something important about what's going on and if the risk/reward skew has changed.

In this case, it doesn't seem to be. There were only four times when such a wide spread failed like this, and each of them saw any further upside erased in the weeks ahead, and with high risk relative to reward up to 3 months later.

Claims climbing

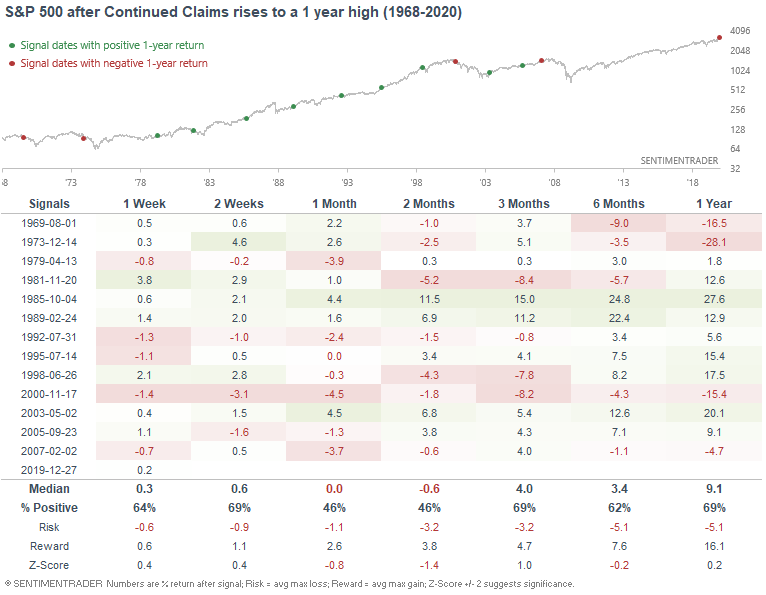

Continued Claims in the U.S. has risen to the highest level since April 2018.

This is somewhat worrisome because Initial Claims and Continued Claims tend to trend higher during a recession and bear market. The following table illustrates what happened next to the S&P 500 after Continued Claims increased to a 1 year high:

Returns were even worse during late-cycle periods, like when claims were still below several million.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- There is a 15-year high in money-losing stocks within the Russell 3000

- 2019 was only the 2nd year since 1980 with so many money-losing IPOs and those back by venture capital

- There is a 5-year high in the number of days with twice as many call options traded as put options

- The German DAX is within spitting distance of a new high

- What happens after the Nasdaq has rallied 13 out of 15 weeks

- Emerging markets are overbought

- The S&P 500 hasn't had a 1% move for 3 months