The Dow's Dominant Stock

As mentioned last week, we've started a private Twitter feed for premium subscribers, and so if you're reading this post as it's published, you have access to that feed at @SenTrader_Prem. Just request to follow that account on Twitter and send us an email at admin "at" sentimentrader.com to notify us of your Twitter handle so we can accept it.

It's a much better platform for much of what I personally look at during a regular trading day rather than longer-form Notes like these. Plus, I'm conscious of plugging up your email inbox.

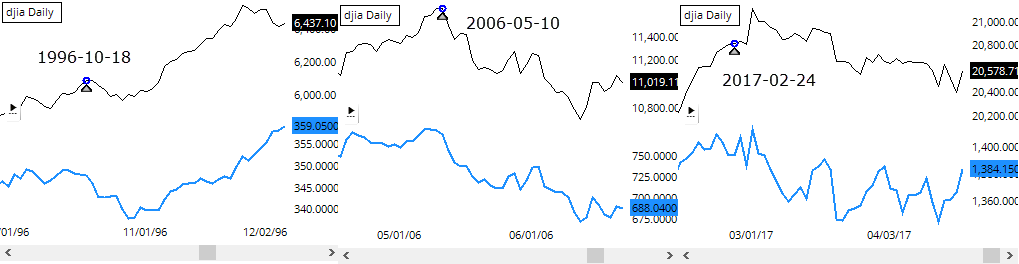

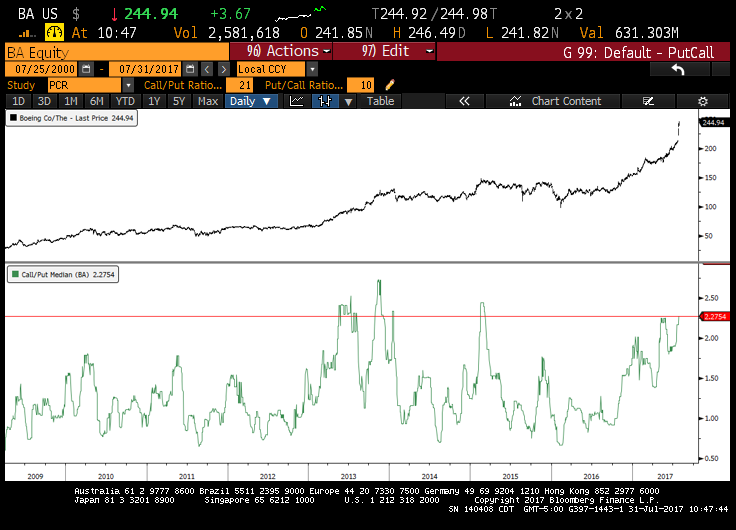

Today's moves, in the Dow, anyway, are dominated by Boeing and it's worth noting some of the developments around that. First, the moves are pushing the Dow to its fourth straight 52-week high, even though other indexes like the Russell 2000 are suffering their fourth straight decline. That's never happened before. There were three times it went 3 days in a row (NOTE: the following charts are pulled from the premium Twitter feed and are not optimized for this format so the might appear a bit blurry).

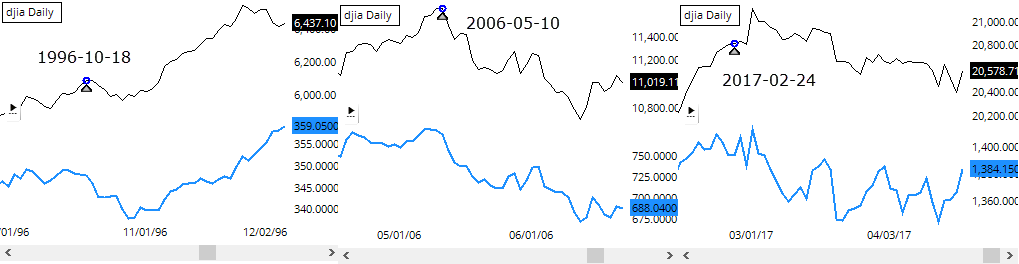

Again, the Dow's streak is being triggered by BA, which has accounted for 57% of the Dow's advance over the past month. That's 322 of the Dow's 563 point gain.

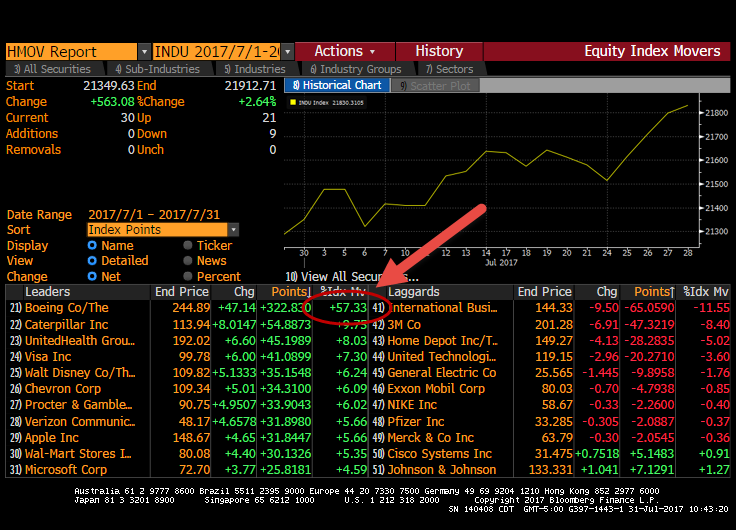

The move in BA is historic. Since 1980, it has managed to rally 15% in a week and move to a new 52-week high during only one other time period - August/September 2000.

Options traders have taken note, trading twice as many calls as puts.

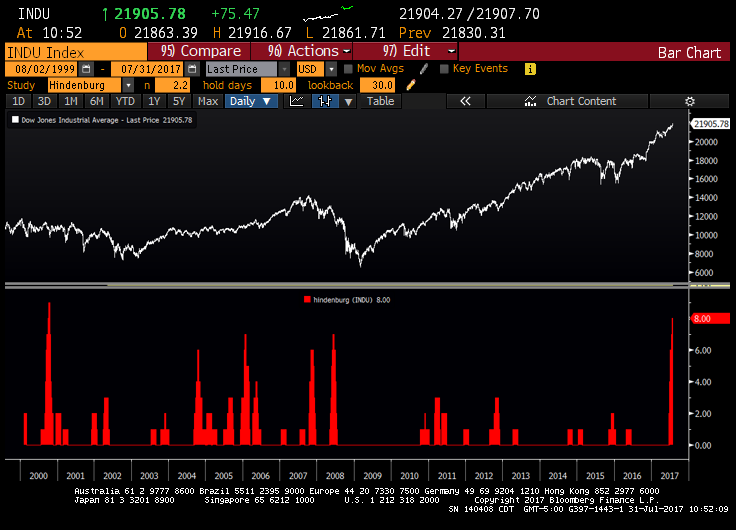

Because that one stock is causing so much of the Dow's advance, there is a structural crack in its rally. There have been 8 Hindenburg Omen signals triggered in the Dow over the past 30 days, matched only one other time since 1999. That was in October 2000.

The run in BA is historic, so who knows if it's about to take a breather. Seems like it should be. But the broader Dow index is vulnerable because of its reliance on that single stock that is pushing its historic boundary.