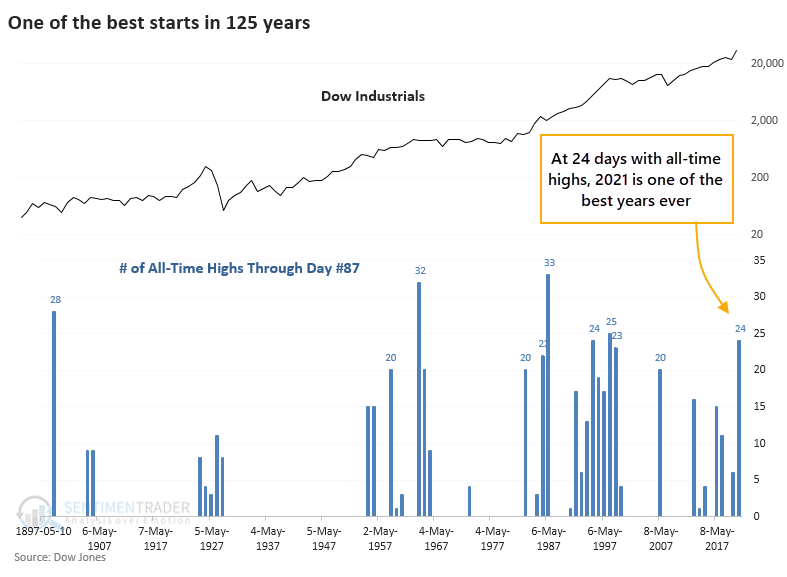

The Dow's 6th-Best Start in 125 Years

The Dow just keeps chugging along.

Despite some tumult under the surface and weakness in tech stocks and other speculative areas, the Dow Industrials Average has held up its reputation as a stalwart. The venerable index has been consistently strong enough to score 24 record closing highs this year alone. Through trading day #87, this is tied for the 6th-best year since 1896.

The big question is always, "So what?"

For investors, the most important factor isn't where we've been; it's what it might mean going forward. When we look at the Dow's future returns after the most all-time days through 87 trading days of a year, it showed a split. One interesting wrinkle is how many of the years ended up having a "crash event" at some point during the year.

| Stat Box On Monday, the Nasdaq Composite fell more than 1%, while the Dow Industrials closed within 0.1% of an all-time high. Of the 15 times that's happened in 50 years, the Nasdaq continued to underperform the Dow over the next month 80% of the time. |

What else we're looking at

- Full details after the Dow sets 24 record highs in the first 87 days of a year

- Future returns after lesser extremes

- What happens after the Nasdaq drops while the Dow sits near a record high

- An update to industry, sector, and country relative and absolute trends

- The Backtest Engine shows how our Risk Level in gold is effective versus the Japanese yen