The dollar's largest monthly losses

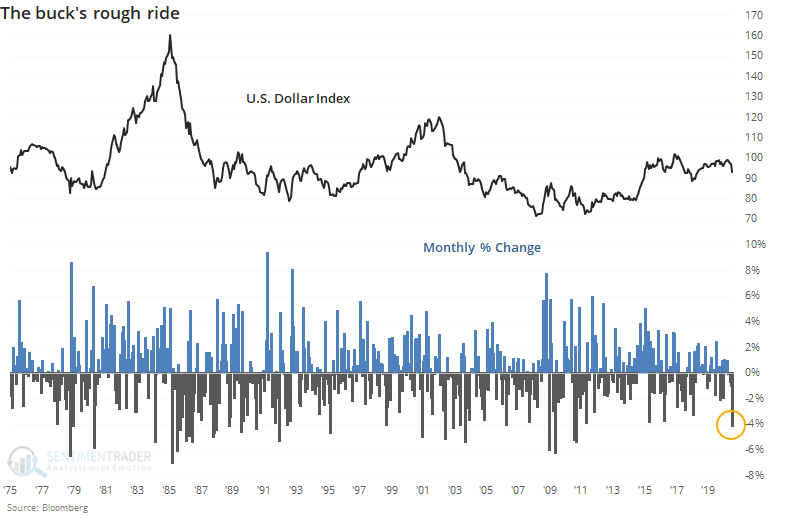

The dollar has had a really, really bad month.

Unless it makes a stunning reversal on Friday, the buck is on track for one of its largest monthly losses in a decade, amid a drop to at least a two-year low.

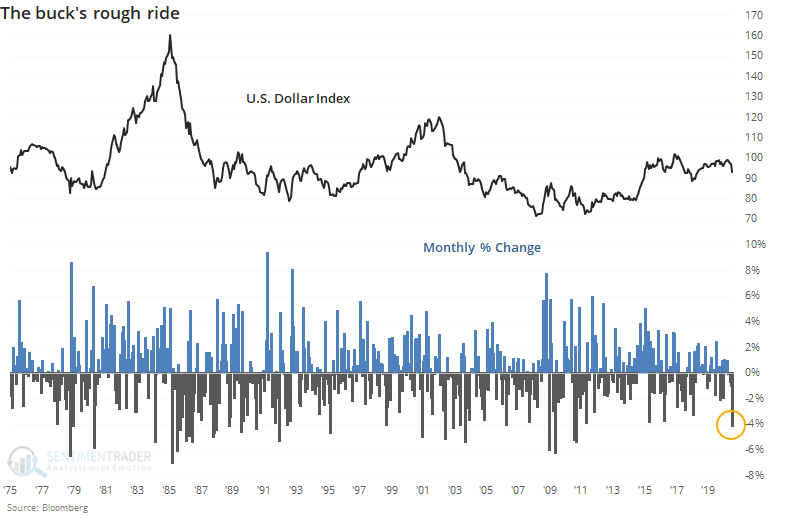

At multiple points in recent weeks, Troy has noted that downside momentum in the dollar hasn't necessarily had a tendency to lead to mean-reversion. Unlike what we often see in stocks, extreme moves in one direction aren't a great predictor for contrary moves in the other direction.

That's been the case for large monthly declines, as well.

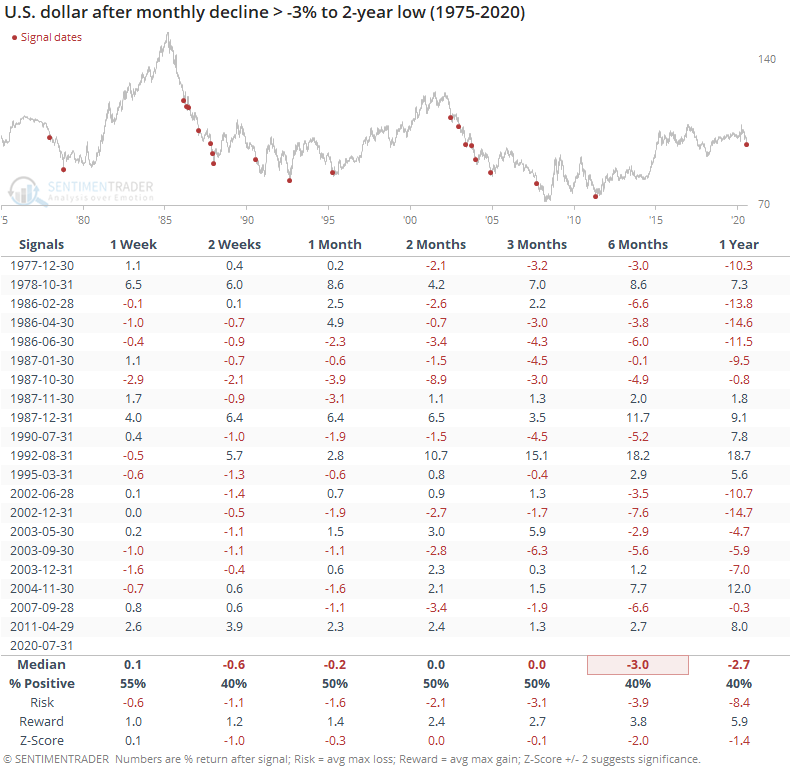

If the dollar tends to decline, and its relationship with gold tends to be inverse, then gold should benefit from this downside momentum in the dollar. That wasn't the case, however.

Up to two months later, the median return for gold was negative, with a higher probability for a loss than a gain. The risk/reward was unimpressive up to three months later. Over the past 30 years, 8 out of 11 signals showed a negative return between 1-3 months later.

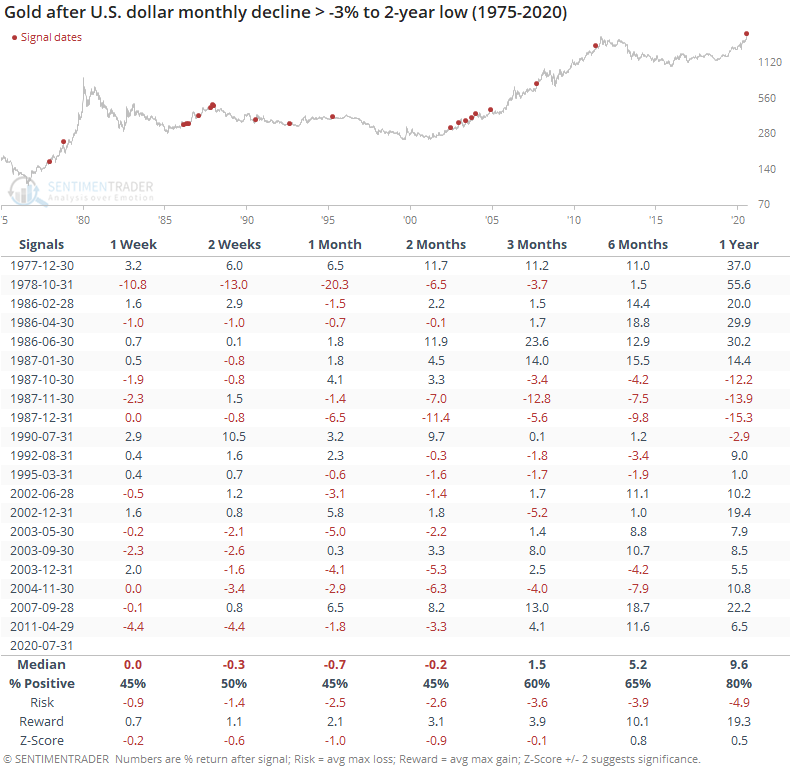

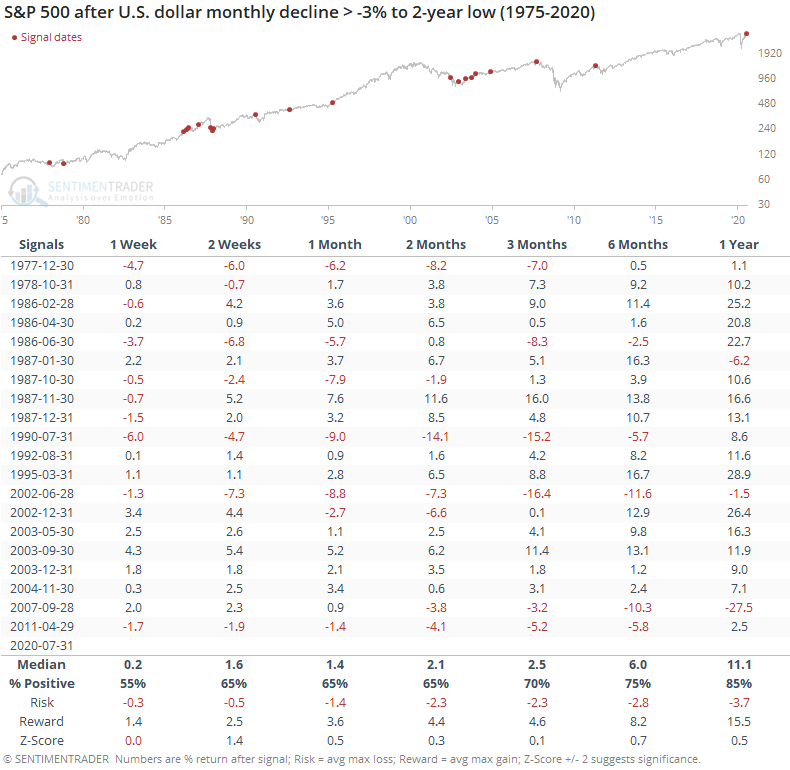

For stocks, there was no consistent relationship whatsoever.

The last couple of signals bode ill for the S&P, but prior to that, there was no consistent positive or negative bias. All the stats are about in line with random over the study period.

If recent correlations hold (always a risky bet), and if the dollar fulfills its historical pattern by continuing to decline after such a large loss (also a risky bet with the current level of extreme pessimism) then this should be a positive for stocks. That's two big "ifs", however, and seems like a shaky input for a bullish bias on stocks.