The "day after" and its impressive record

One day doesn't make a trend. Usually.

That's a pretty sound principle, as we often one-day reactions reversed going forward, especially surrounding major events. Turns out that hasn't been the case so much with presidential elections.

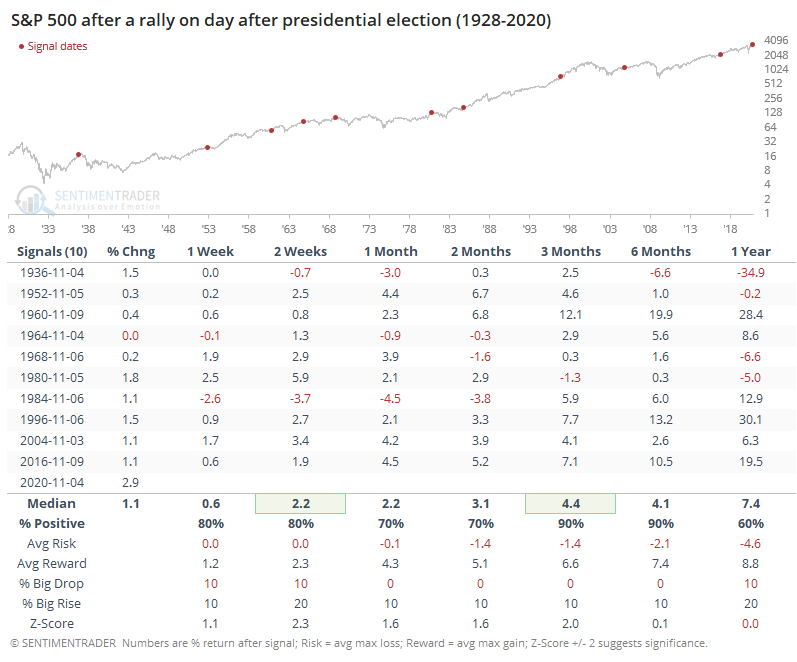

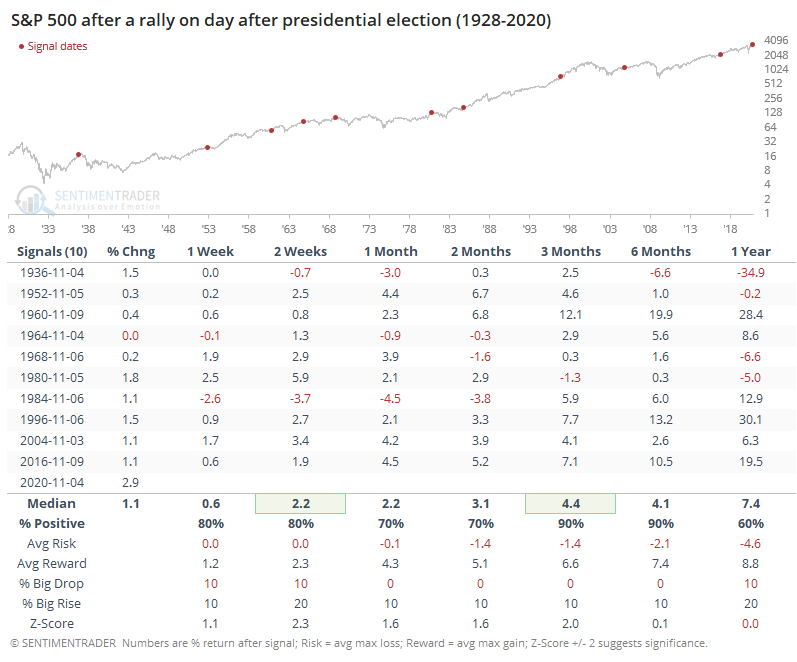

Below, we can see every time the S&P 500 rallied in relief the day after an election.

The returns in the table are as of the day after, so it indicates further gains, not including the gain on the day after. It was impressively consistent, with only a single loss 3 months later, and a positively skewed risk/reward ratio. As of the time this was published, the S&P was up by about 3%, the best gain in its history. The magnitude seemed to matter less than the direction.

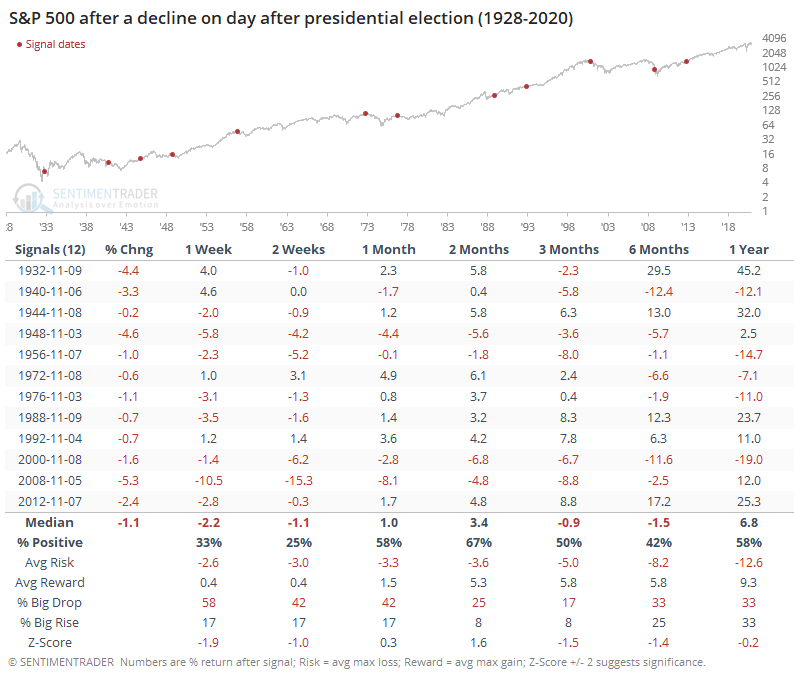

Now consider those years when investors were less enthused about their new leader.

After these signals, the S&P had a hard time reversing to the upside over the next 1-2 weeks. Even 3-6 months later, it was consistently negative and with a very poor risk/reward ratio. The only post-election letdown that reversed itself completely going forward, with no losses on any time frame, was after Bill Clinton's first win.

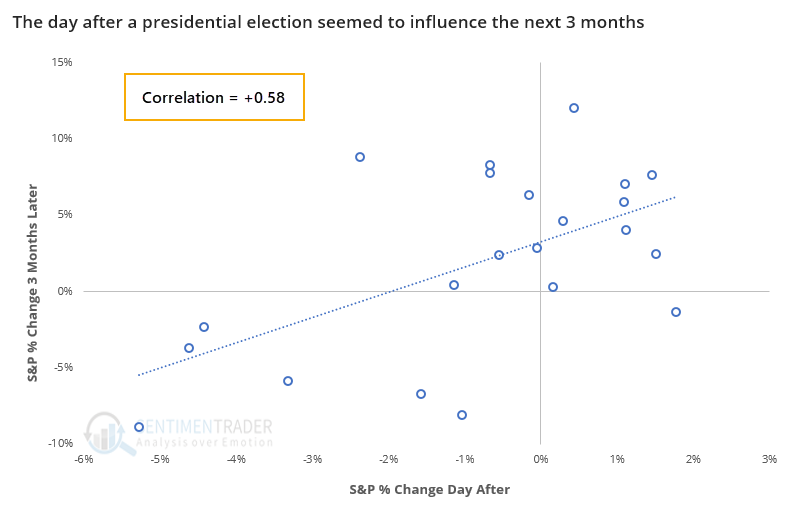

Overall, there was a strong positive correlation between the S&P's day-after return and its additional gain or loss over the next 3 months.

When investors had been anticipating a good result on election day, they were often disappointed. But a good initial reaction following the election has been a very good sign. We don't often see such good returns both the day of and day after an election - this is the first time in history the S&P 500 rallied more than 1.5% on both days.

It's always questionable to extrapolate very short-term movements to longer-term returns. With that warning, these results should give a little comfort to bulls.