The DAX Takes a Pause

A month ago, we saw that not only were major industries and sectors in the U.S. recovering in a major way, so were global indexes.

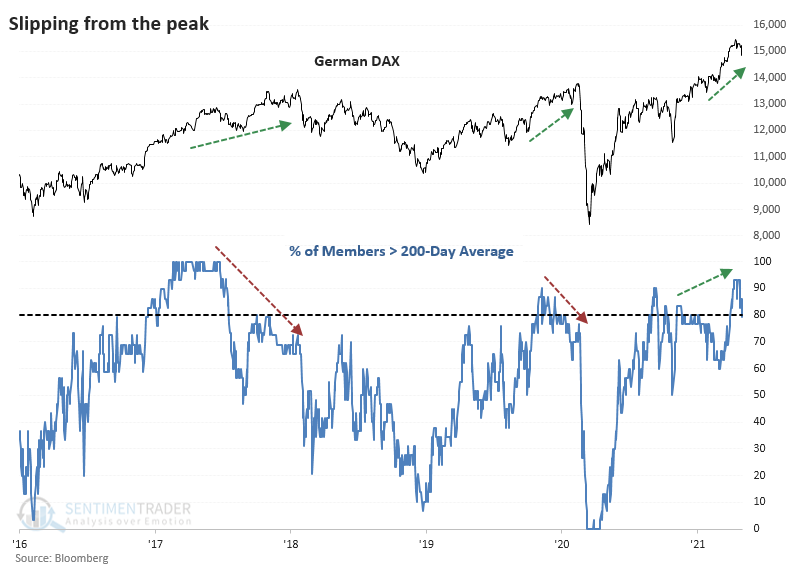

That has started to ebb in a minor way in recent days. And among those major global indexes, the German DAX is showing some of the worst deterioration.

That's all relative, of course, because the deterioration isn't much to speak about. Still, for the first time in a month, fewer than 80% of stocks in the DAX are trading above their 200-day moving averages.

As the DAX was peaking in early 2018 and early 2020, there were pronounced internal divergences with the percentage of its members above their long-term averages. We're not seeing that same kind of divergence now because the measure just hit its highest level in several years.

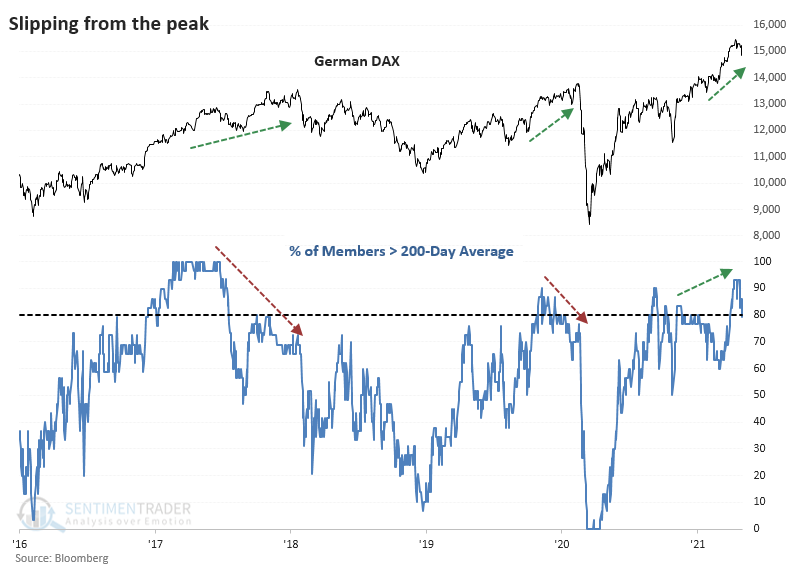

Below, we can see what the future held for the DAX once fewer than 80% of its members were trading above their 200-day averages for the first time in at least several weeks.

It tended to rally most of the time, and by two months later, its returns were significantly above random. Most of the risk over the next year was concentrated within the first couple of months. Over the next year, its average risk (worst loss at any point during the year) was only -3.6%, versus an average reward (best gain at any point during the year) was a healthy +23.8%.

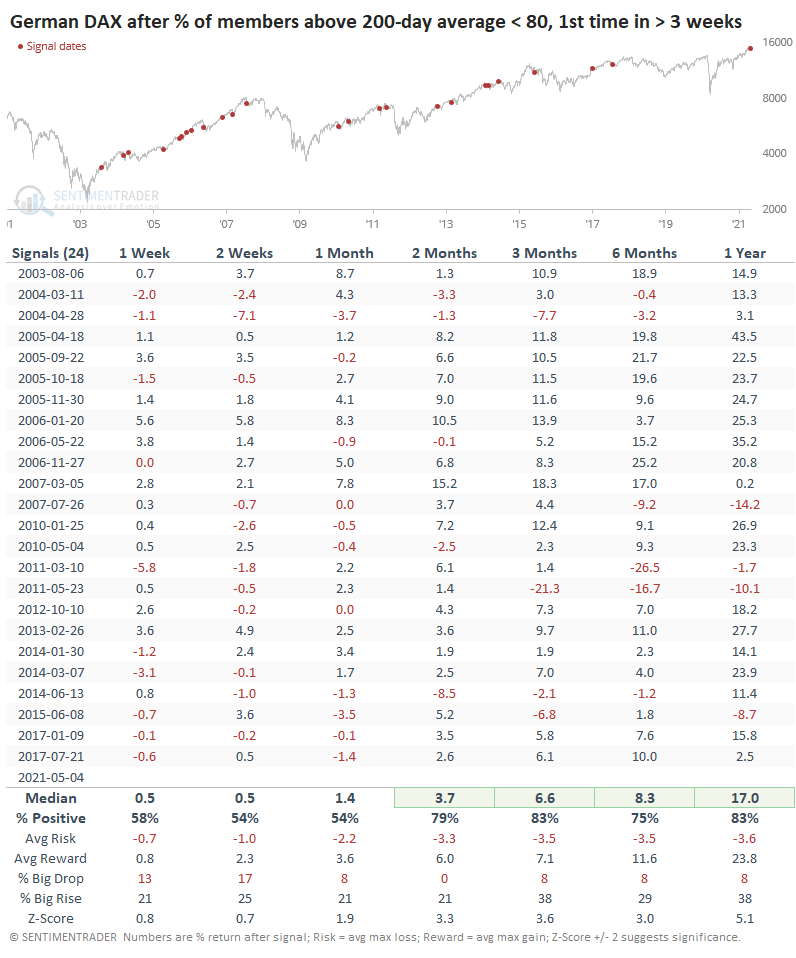

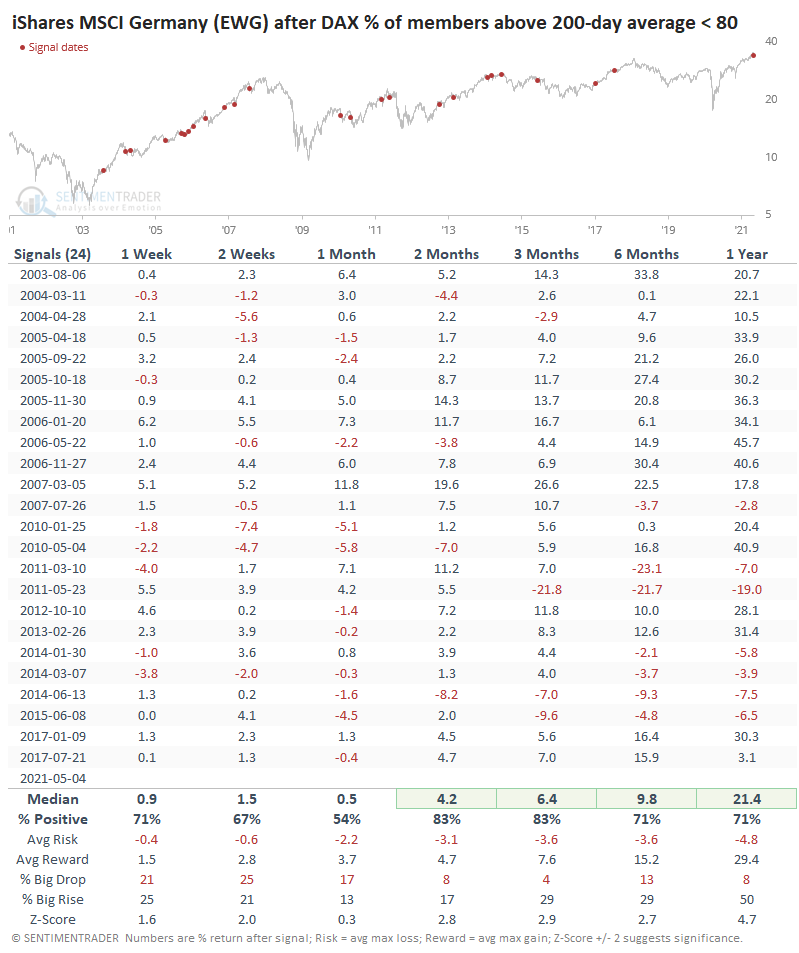

For U.S.-based investors, the iShares MSCI Germany ETF (EWG) is by far the go-to choice for trading German stocks as a whole.

Even though it's traded in dollars instead of euros, EWG showed as good - or even better - returns. Over the next 3 months, EWG rallied 83% of the time with a large average return of +6.4%. It was much more likely to show a big rise during those months than a big drop. That's not to say there was no risk, with a rally in 2011 leading to a harrowing drop. A couple of others neared a 10% decline over the next 3-6 months, but again those were clearly exceptions.