The Composite Washout Model triggers a new alert

Key points:

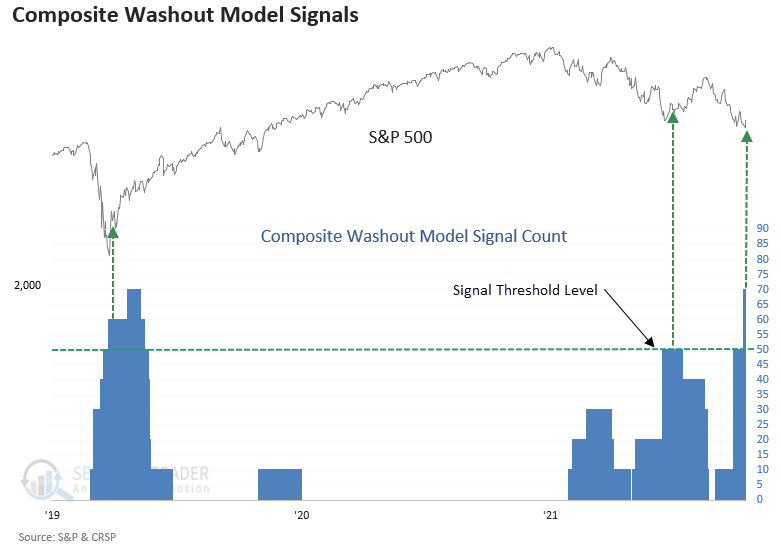

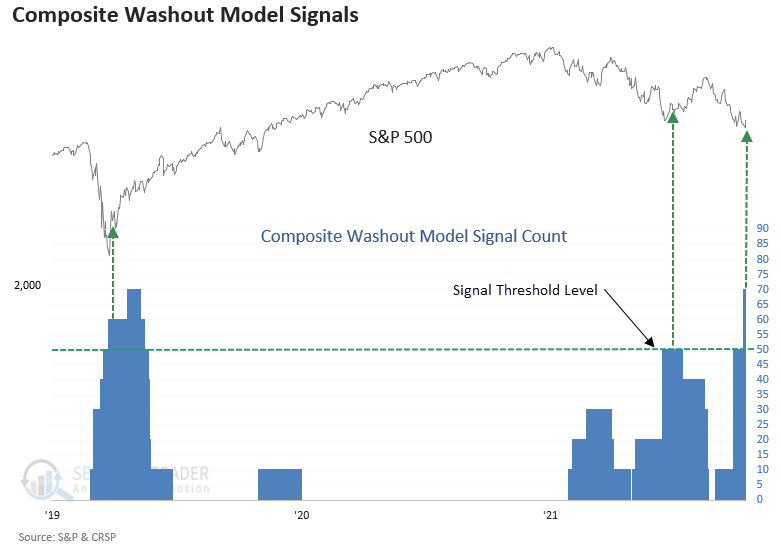

- The TCTM Composite Washout Model exceeded the signal threshold level on September 27

- Market momentum turned positive on October 13, triggering a new alert

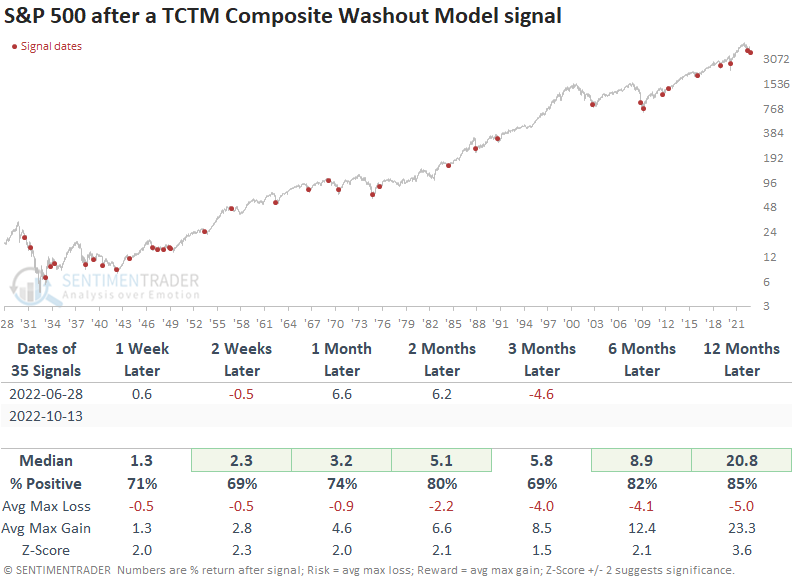

- The S&P 500 rallied 80% of the time over the next two months after other signals

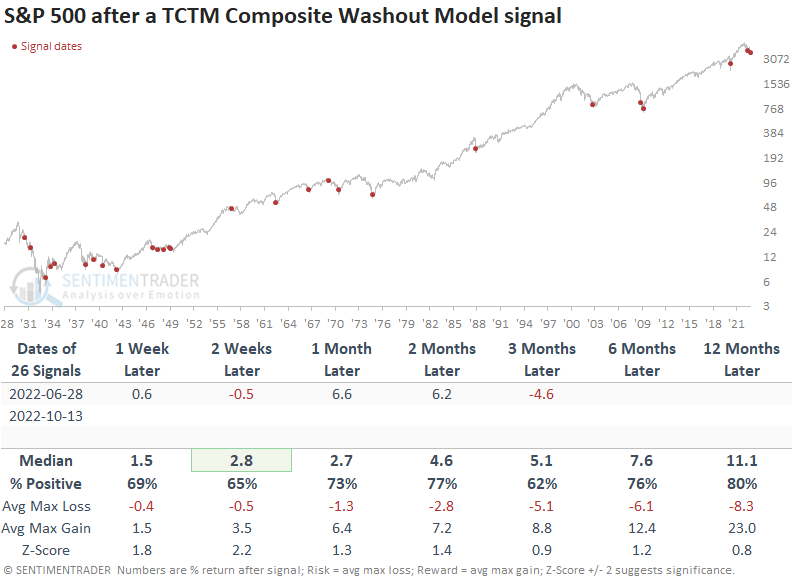

- Signals associated with a bear market rallied 77% of the time over the next two months

The Composite Washout Model - A weight of the evidence approach

For only the 36th time since 1930, the Composite Washout Model triggered a new alert when the 10-day rate of change for the S&P 500 turned positive on Thursday.

The previous alert occurred in June, leading to a 13% rally when measured from the publish date to the August peak in the S&P 500.

As a reminder, I created the Composite Washout Model to identify potential turning points in drawdown phases. What a trader or investor does with the market message depends on one's investment approach and risk tolerance.

Washout signals preceded positive returns

Washout signals show a consistent upward bias in returns across all time frames with solid win rates and z-scores. The alert shows a gain at some point in the first two months in 31 out of 35 instances. And the max drawdown across that time frame was -12.2%, which occurred in 1931.

Signals associated with a bear market

Bear market signals show an upward return bias, with solid win rates and z-scores. However, the outlook is slightly less favorable than all signals, which is not surprising given the higher levels of volatility associated with significant market drawdowns. Once again, consistency still looks good, with 23 out of 26 winners at some point in the first two months.

What the research tells us...

Besides a handful of short-lived rallies, stocks have come under significant duress since the August peak in the S&P 500. The selling pressure has been severe enough to trigger an alert for 70% of the components in the TCTM Composite Washout Model. With price momentum turning positive on Thursday, the composite issued a counter-trend buy signal. While the outlook for a bounce looks favorable, we must remember the long-term trend for the S&P 500 is negative, and a recession seems more likely.