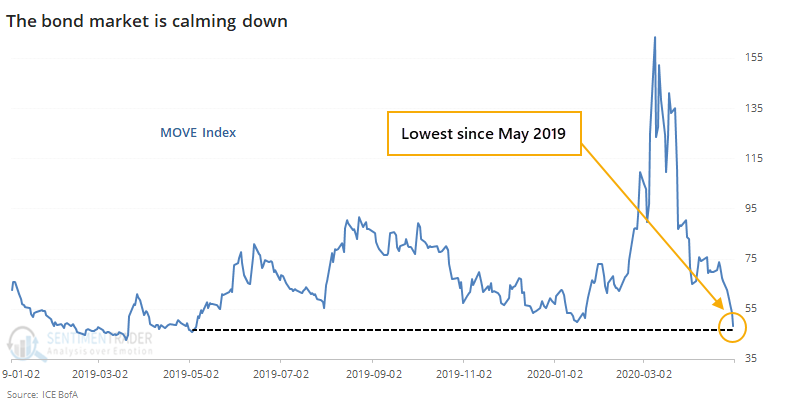

The bond market calms down

The bond market is calming down. That market's equivalent of the VIX "fear gauge" has now dropped below its levels from early this year, before the pandemic.

The bond market is about 25% larger than the stock market, and its moves can drive massive flows between assets. Theoretically, a drop in volatility in this massive market should calm investors across all assets.

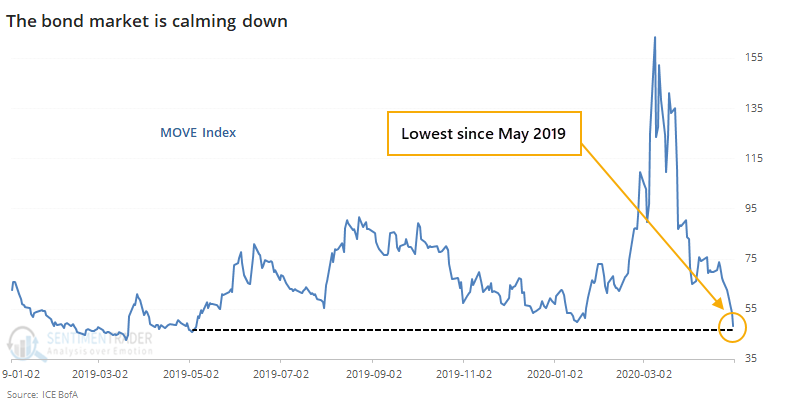

For the MOVE Index itself, when it cycles from a multi-year high to a one-year low, it has tended to perk up again at some point during the next 1-2 months.

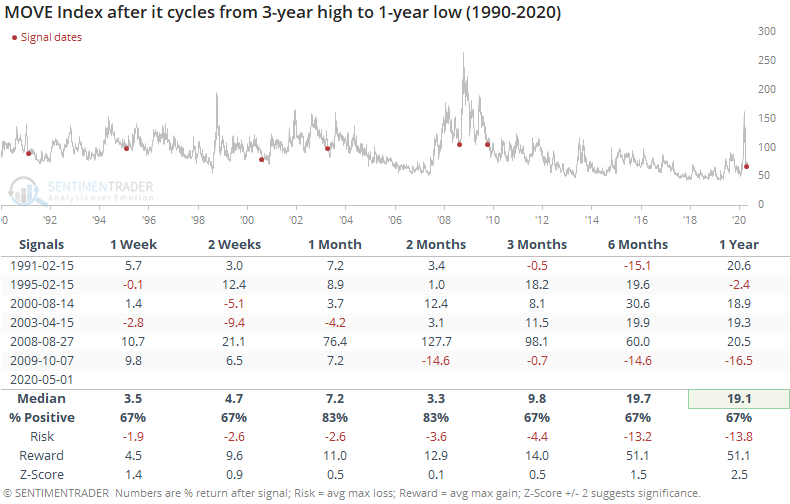

Unlike the stock market, where there is a more consistent inverse relationship between stock prices and volatility, there isn't such a close relationship in other assets like bonds. Even though the MOVE Index tended to rebound after a cycle like this, it didn't necessarily mean losses on bonds.

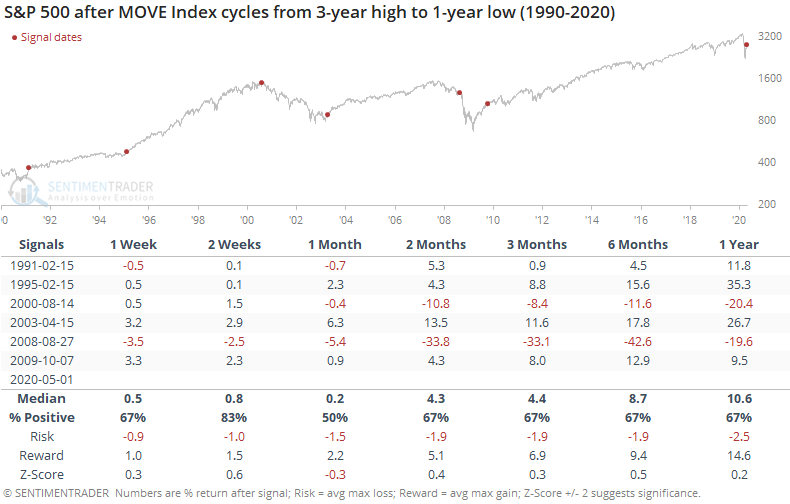

For the stock market, a calmer bond market was mostly a good thing, but not a panacea. It would have given us a false and awful sense of confidence in 2000 and the summer of 2008.

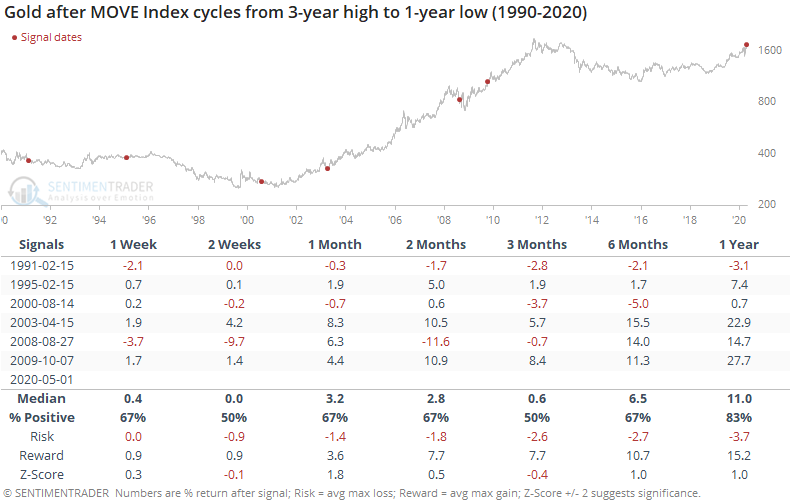

We might reasonably assume that if the bond market is calming down, then investors may not see much of a demand for safe havens like gold. That assumption did not prove to be effective.

While the metal did lose some luster after a couple of the signals, it mostly rose in the months ahead.

Lower volatility is, almost by definition, a good thing. That's almost always true in the stock market. In other assets, it's not quite as clear but still generally holds true. In the case of bonds, when we see a spike and then calmer conditions, it's still mostly a good sign, we just shouldn't make too many assumptions about how good it is, and how much it translates to other assets like stocks.