The Big Money is Buying

According to some of the largest and most sophisticated investors in the world, stocks are a good place to be. But we may have to suffer some trouble first.

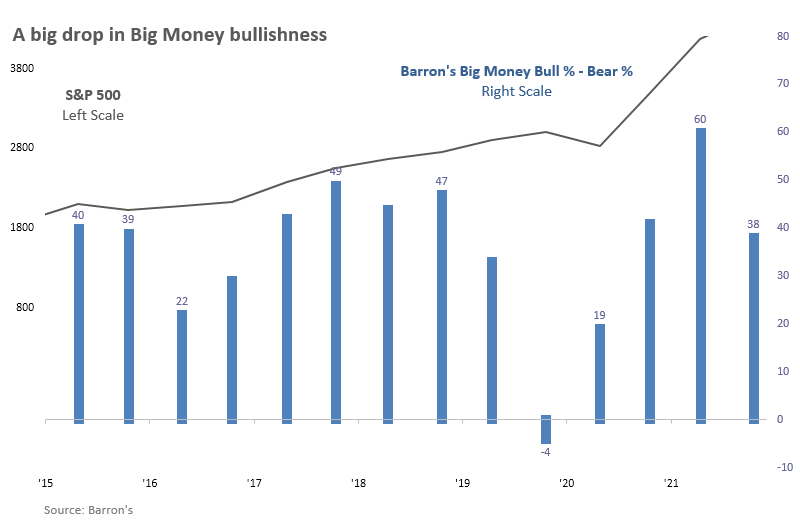

According to the latest issues of Barron's:

America's money managers are optimistic about the long-term outlook for the economy, the financial markets, and the recovery from the Covid pandemic. It's the short-term prognosis that concerns them.

Monetary and fiscal policies are in flux. Supply-chain bottlenecks and labor shortages are igniting inflation and threatening corporate profit margins, and the economic recovery from 2020's recession-so robust until now-is decelerating. Add pricey stock valuations and rising bond yields, and the immediate future suddenly looks more challenging than the recent past.

In the survey that went out about a month ago, more managers became concerned about stocks. The Bull Ratio fell from 60% in April to 38% now.

The scatter plot below shows returns in the S&P 500 from one survey to the next versus the Big Money Bull Ratio. The trendline slopes up and to the right, suggesting that the more bullish the Big Money is, the better the S&P's future returns were. There is a lot of variability, though.

What else we're looking at

- Forward returns when the Big Money is bullish...and not

- A look at another survey of "smart money" managers

- An in-depth look at upcoming commodity seasonality

| Stat box Cannabis stocks have had a tough time of it. Through mid-week, the MSOS fund declined for 9 consecutive days. Since the fund's inception, there were two other times it suffered such relentless selling pressure (both preceded quick 9% rallies FWIW). |

Etcetera

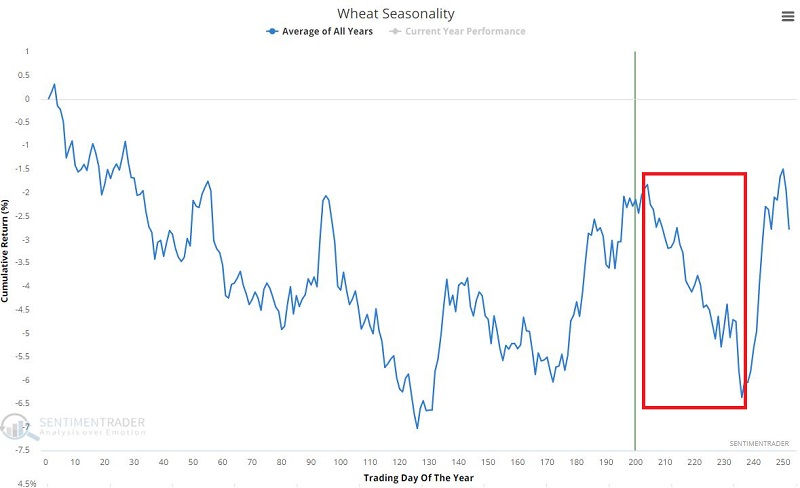

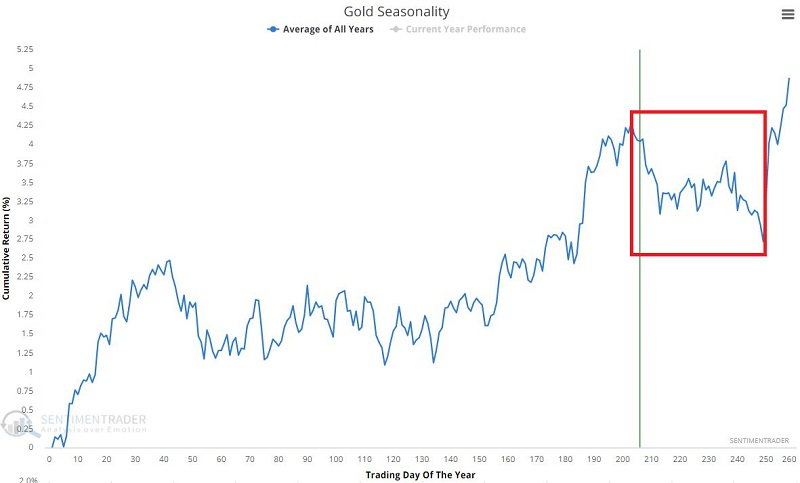

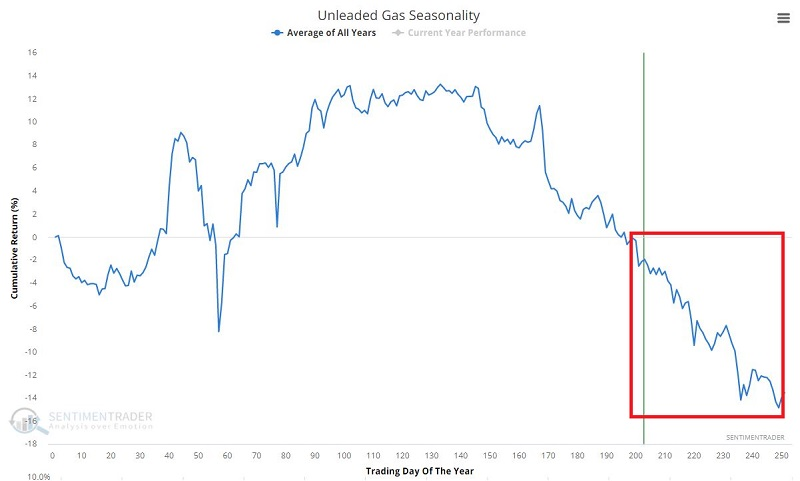

Commodity headwinds. Jay took a look at various commodity markets and how the seasonal trends for many of them have reached their typical fall peak. Each year can be widely variable, of course, but it shows that many of these markets have had a tough time holding gains during this time of year.

Including gold.

And unleaded gas.

And wheat.