The April Barometer (Part II)

In Part I, we highlighted that a bullish month of April has tended to be a positive sign for the rest of the calendar year. Part II will look at how the market has performed during May through December after the stock market shows significant strength during the first full four months of the year.

THE TEST AND THE BENCHMARK

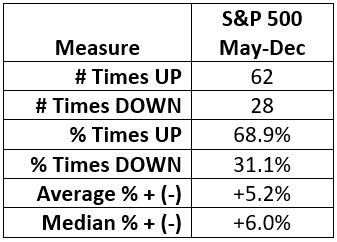

- Our test in Part II will identify those times when the S&P 500 Index gained +10% or more (using price only data) during the first four months of the year

- We will then look at the performance for the S&P 500 Index during the remainder of the year (May through December)

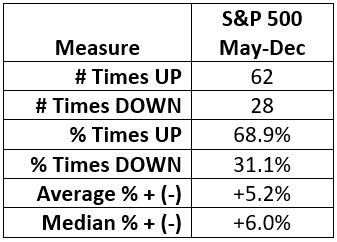

- First - as a reminder from Part I - let's benchmark how the S&P 500 typically performs from May through December

FIRST FOUR MONTHS OF THE YEAR UP +10% OR MORE

The table below displays only those years since 1931 when the S&P 500 showed a price gain of +10% or more during January through April. As you can see, only twice did the market show a loss during the last 8 months of the year after the first four months showed a gain of +10% or more.

In sum:

- Up 18 times (90% of the time)

- Down 2 times (10% of the time)

- Average May-Dec gain = +10.1%

- Average May-Dec loss = (-8.1%)

- Median May-Dec gain = +9.6%

- Median May-Dec loss = (-8.1%)

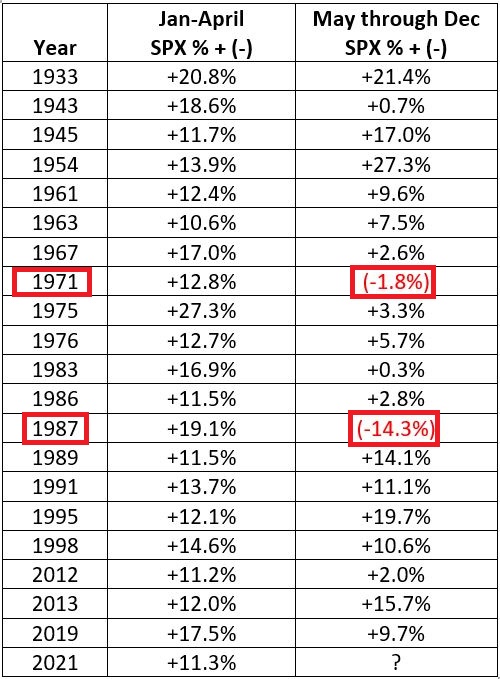

The chart below displays the cumulative price gain for the S&P 500 Index held ONLY during May through December of the years listed in the table above to provide a sense of consistency.

SUMMARY

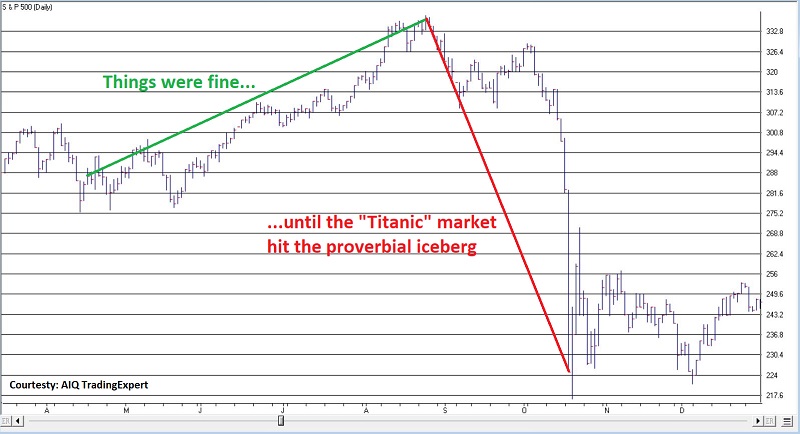

Does the S&P 500 Index rising +11.3% through April 2021 ensure that the rest of 2021 is "smooth sailing" for stocks? Not at all. The chart below displays the performance of the S&P 500 during 1987.

Note that:

- everything was smooth sailing until about the middle of August

- by the close on October 19th, the S&P had declined over 33% from peak-to-valley

- the last 8 months of the year witnessed a -14.3% decline for the S&P 500

So, remember this:

- A strong performance during the first four months of the year lends bullish weight to the overall weight of the evidence

- But there are never (even in this current runaway bull market) any "sure things" in the market