The All-Important Investment Concept of "LLUR"

The most reliable way to achieve and maintain long-term investment success is to generate an equity curve that moves steadily from the lower left to the upper right (hence, LLUR). The more often your equity dips, the bigger the dips, the longer the sideways periods - the more likely you are to abandon your investment approach. And by the way - human nature being what it is, this tends to happen at exactly the wrong time.

Many investors focus almost entirely on the nitty-gritty of when to buy and sell and fail to recognize that in the long run, it is the relative smoothness of their equity curve or lack thereof that will ultimately determine their success.

In a sense, all investing can be boiled down to two key factors:

- Developing a plan that allows you to achieve long-term success

- Having the financial and emotional wherewithal to follow the plan

All the while, the most important reality is that the three things most likely to derail your investment plan are:

- Volatility

- Drawdowns

- Your own aversion to the above items

STEP #1: DEVELOPING THE PLAN (i.e., The Hard Part)

Step #1 involves deciding - among other things:

- What areas to consider for investment (stocks, bonds, real estate, etc.)

- How broadly to diversify across and within the various areas, i.e., how to allocate capital

- What - if any - timing methods will be used to determine when actually to buy and sell

- Tax implications

In its fullest form, this type of effort is certainly not a small undertaking. Yet, the reality is that it is also imminently doable for virtually any investor. For investors who are not comfortable doing it themselves, some professional advisors can help them establish a plan with a better than average chance of achieving long-term success.

The bottom line is that while there is no "one size fits all" financial/investment plan, the ability to formulate a plan that gives an individual the potential to reach his or her financial goals is within reach of virtually everyone.

That's the good news.

Step #2: FOLLOWING THE PLAN (i.e., The Really Hard Part)

Here is where things get a little trickier. The second step of the equation - actually following the plan devised in Step #1- is where people can get into trouble. Having the "financial wherewithal" to "follow the plan" means, at a minimum, coming up with enough money to invest to make the plan viable. For many people, this is half the battle (or more). Part of the reason IRAs, 401k's, etc., are so popular is that in many cases, they "force" an individual to invest money without having to "think about it" or to actively take steps to move money around on any regular basis. For whatever reason, writing a check or transferring money into an investment account each month is a pretty easy thing NOT to do.

Another aspect to having the financial wherewithal involves:

- Taking steps to minimize downside risk

- And/or to limit the amount of any actual losses that occur

The key here is to plan. In the long run, it is far better for an investor to determine in advance that, "If this investment loses x% or more I will automatically get out and cut my losses." than it is to not plan in advance and suddenly shout, "Oh my gosh, I'm down x%! What the heck do I do now?"

This lack of planning regarding how to handle the inevitable losing trades can have an insidious effect on how well a person executes their long-term plan because it can throw off one's "emotional wherewithal."

ASSESSING RISK TOLERANCE

The bottom line is that every person has their own specific level of risk tolerance. And the spectrum is wide:

- Some investors cannot seem to tolerate any risk at all

- Others are - for lack of a better phrase - big swingers, i.e., people who can handle big swings in equity and keep on keeping on

- And then, of course, there is every level in between

One of the most important decisions each investor makes - in some cases consciously in other cases subconsciously - is in deciding where they fit along this "risk tolerance spectrum."

And it is a critical decision for many reasons:

- An investor who can tolerate little or no risk may struggle to reach their financial goals as they will never allow themselves enough opportunity to grow their capital

- At the other extreme, an individual who deems themselves a "big swinger" but who in reality is unable to tolerate the attendant volatility is setting themselves up for inevitable disaster, as they will quite likely "pull the plug" someday at exactly the wrong time.

THE KEY TO STAYING ON THE PATH TO SUCCESS

Ponder for one moment this assertion:

The volatility of the equity fluctuations in your account will have a greater impact on your long-term success than any other factor.

You may or may not agree with this assertion at first blush, but the facts remain:

- "Swing too little," and the returns never quite add up

- "Swing too much," and the risk of losing one's emotional wherewithal - and reacting emotionally to one's own detriment - skyrockets

THE ALL IMPORTANT CONCEPT OF "LLUR"

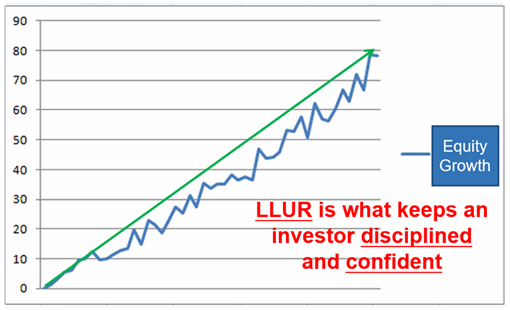

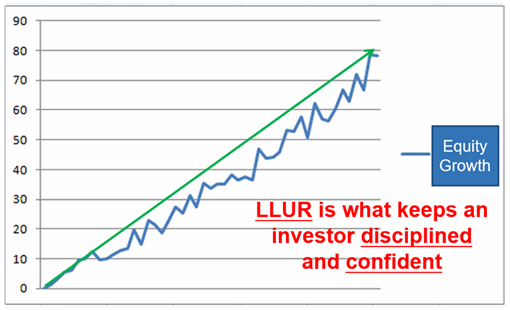

The concept to embrace is something I refer to as "LLUR," which stands for "Lower Left to Upper Right." As displayed in the chart below, LLUR is the type of equity curve that ensures that an investor maximizes the likelihood of reaching their long-term goals.

The more closely an investor's equity curve resembles that in the chart above, the higher the likelihood that they will stick with their well-thought-out investment plan that they devised way back in Step #1.

FOCUS ON THE TRADEOFF BETWEEN REWARD AND RISK

One last concept to implant in the back of your brain is this: Everyone wants to make as much money on their investments as they reasonably can. That is human nature. But the reality is that if one takes on too much risk in attempting to achieve the maximum gain, something bad almost invariably ends up happening.

As such, your ultimate goal as an investor should NOT be: a) to maximize return; nor, b) to minimize risk; but rather, c) to maximize the tradeoff between reward and risk.

One of the most effective ways to smooth out an equity curve is to combine trading methods which - in highly technical terms - when one "zigs" the other "zags." As long as each method has a positive expectation, combining methods with a low correlation can keep the overall equity curve moving in the right direction.

And keeping your overall equity curve moving in the right direction is - more than anything else - what will keep you in the game long enough to achieve your investment goals.