The aggregated XLE put/call ratio triggered a new buy signal

Key points:

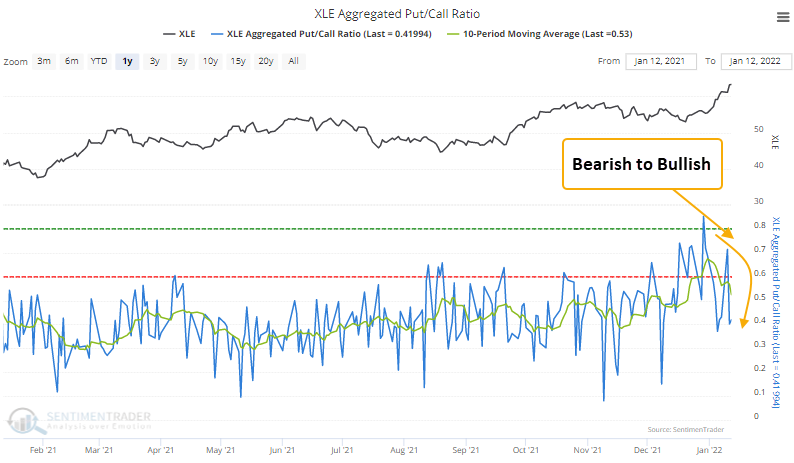

- XLE constituent put volume increased relative to call volume

- The aggregated XLE put/call ratio has now reversed lower from an elevated level

- Energy stocks have rallied 100% of the time 2 months later after other signals

The aggregated put-call ratio as a contrary sentiment indicator

When investors are bullish on stocks, they buy call options to bet on rising prices. Conversely, when they are bearish on stocks, they purchase put options to bet on declining stocks. The put/call ratio can be used as a contrary indicator to identify an environment where sentiment has become too pessimistic on the future direction of stocks. When opinions become too bearish, stocks tend to rally.

The aggregated put/call ratio indicator measures the summed options data for constituents of the index/ETF.

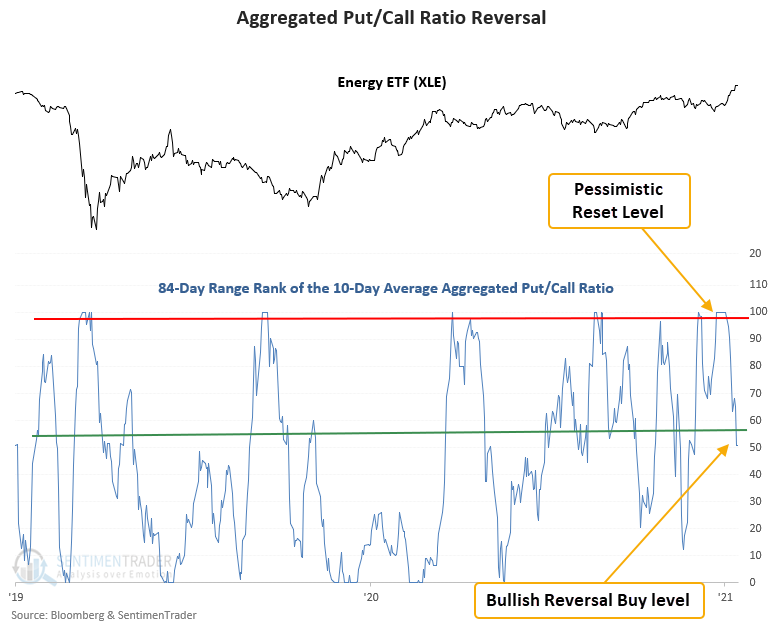

A trading model that identifies a reversal in the aggregated put/call ratio

The put/call ratio trading model applies an 84-day range rank to a 10-day moving average of the XLE aggregated put/call ratio. The pessimistic reset condition is confirmed when the range rank indicator crosses the 99th percentile. A new buy signal occurs when the range rank crosses back below the 57th percentile. At the same time, the 5-day rate of change for the XLE ETF must be >= 3%. i.e., market momentum is positive.

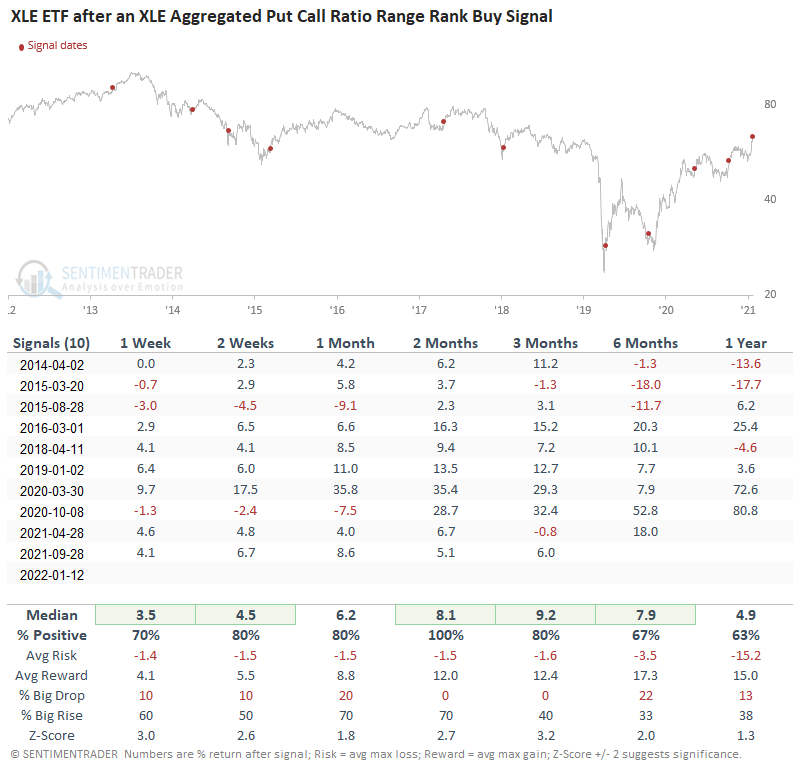

Similar reversals in the put/call ratio have preceded gains 100% of the time

This signal has triggered 10 other times over the past 8 years. After the others, XLE future returns, win rates, and z-scores were excellent across all time frames, especially the 2-month window. The aggregated ETF put and call volume data are new time series with a start date in 2013. Therefore, the sample size is small.

I've highlighted several bullish signals for the energy sector since 1/5/22. So, I would use this signal as additional confirmation of a bullish trend for energy stocks.

What the research tells us...

When put volume increases relative to call volume, traders have become too pessimistic on the outlook for stocks. Stocks are likely to reverse higher when the pessimistic extreme reverses. Similar setups to what we're seeing now have preceded rising prices for the energy sector ETF (XLE), with a 2-month win rate of 100%.