The advisor and investor model cycles from pessimism to optimism

Key points:

- The Advisor and Investor Model (AIM) cycled from < 10% to > 80%

- After similar reversals in sentiment, the S&P 500 tends to consolidate over the next few months

- Don't lose sight of the big-picture, as the long-term results are solid

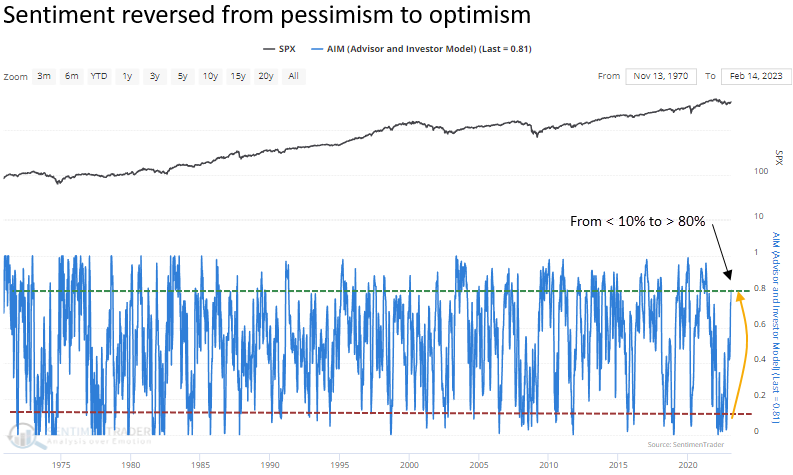

A sentiment-based composite shifts from pessimism to optimism

In a note last week, I shared a study that showed a reversal in sentiment for the Investors Intelligence % bulls survey. While the II data is one of the longest-running series, it only measures sentiment for newsletter writers.

Luckily for us, Jason created a composite model that measures a broader set of sentiment measures known as the Advisor and Investor Model (AIM). With the latest update to the model this week, the AIM indicator recovered from near the bottom of its range to the upper 19% of it.

Let's assess the outlook for stocks after the AIM series cycles from < 10% to > 80%.

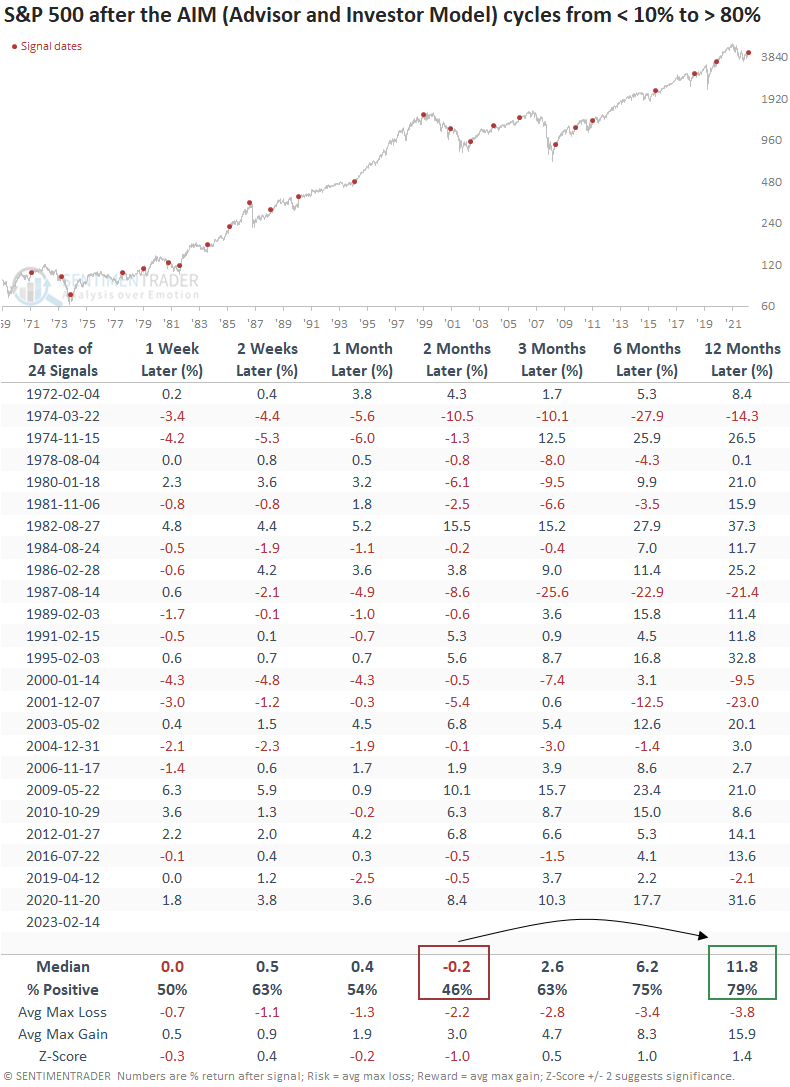

Similar reversals in sentiment preceded bullish long-term results for the S&P 500

When the AIM indicator cycles from < 10% to > 80%, the S&P 500 struggles over the next few months. However, the setup is most likely a pause that refreshes. A year later, the index was higher 79% of the time, with only two untimely whipsaw signals during a countertrend move in a bear market.

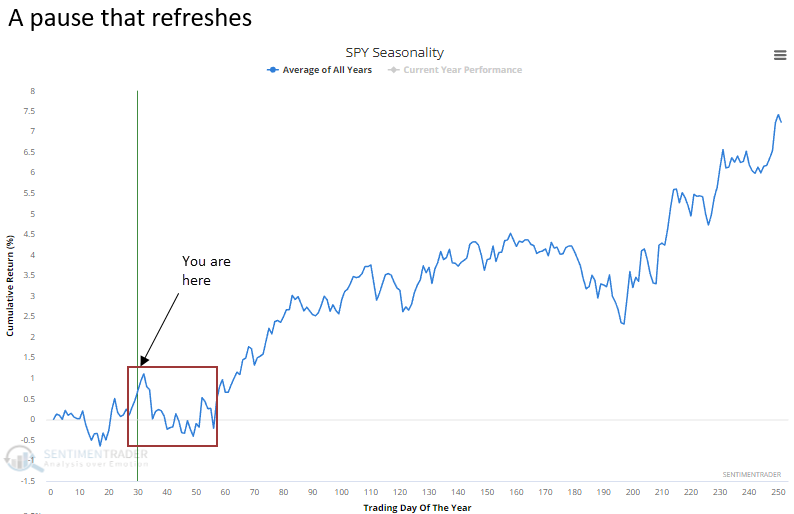

Seasonality turns unfavorable

A weak seasonal period for stocks is about to start, which provides additional evidence of a potential churning period that should set the stage for another advance.

What the research tells us...

We continue to see subtle signs that the market could pause in the next month or so to digest the gains since October 2022. However, the evidence from a big-picture perspective is still undoubtedly bullish. Don't lose sight of the forest for the trees. The SentimenTrader Advisor and Investor Model (AIM) cycled from < 10% to > 80%, which suggests the market could undergo a pause that refreshes a bullish long-term backdrop.