The 4th Widest Spread Against Emerging Markets

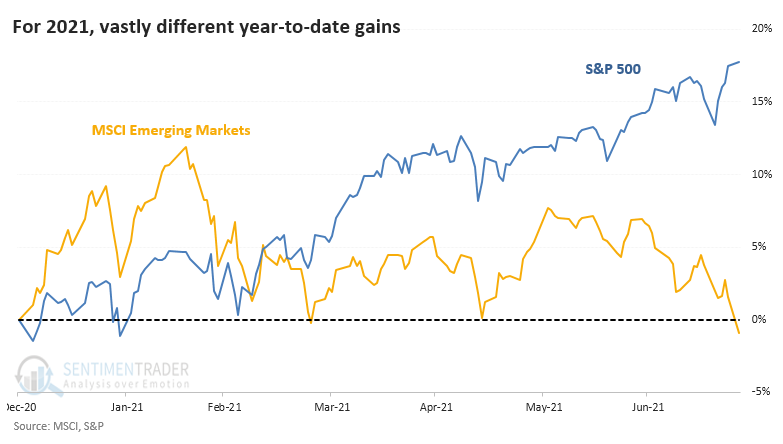

The most widely benchmarked index in the world has enjoyed a historically consistent and persistent rally in 2021. For many of its stocks, and especially for stocks outside the U.S., it's been a much different story.

Even while the S&P 500 has set record after record, stumbles in some Chinese stocks have helped to drag down emerging market indexes. The MSCI Emerging Markets Index has now turned negative for the year.

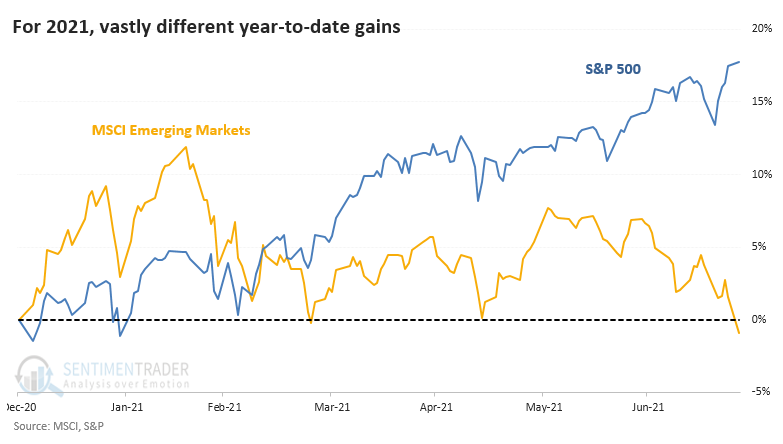

Through the end of July (or close to it, anyway), this is the 4th-widest difference in returns between the S&P and emerging markets.

There is a tendency to think that we should see some mean reversion through the end of the year. Bulls outside of the U.S. would want to think that impressive returns in the S&P would prompt investors to re-allocate to lagging markets. It wasn't to be.

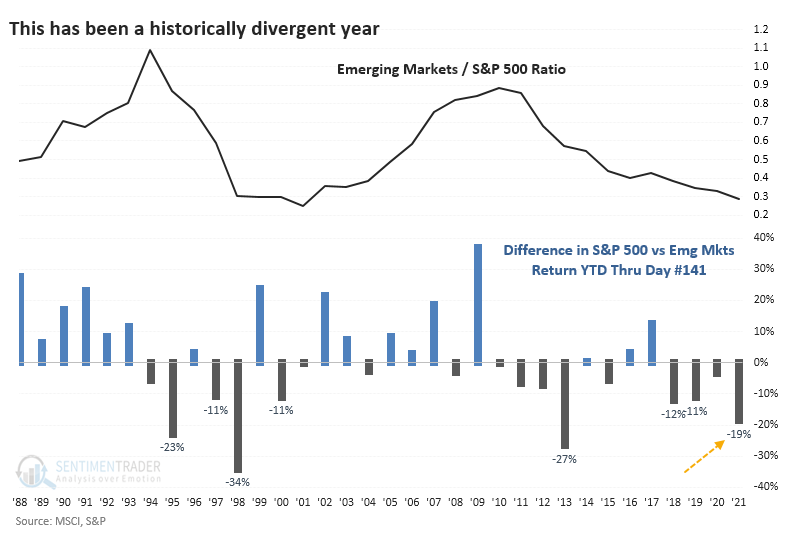

EMERGING MARKETS HAVE TENDED TO KEEP STRUGGLING

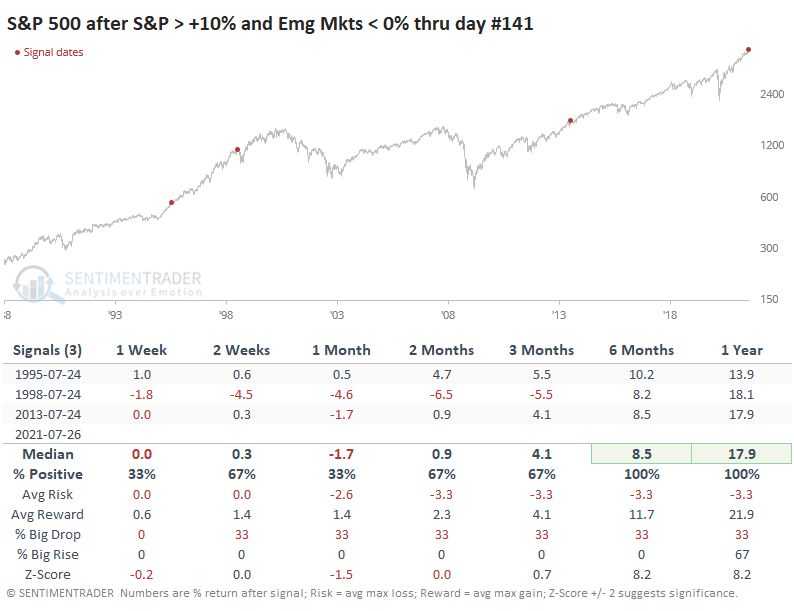

The table below shows the few other times when the S&P 500 was up by double digits through late July while emerging markets were in negative territory for the year. All three times, emerging markets fell further in the month(s) ahead.

The S&P kept plugging away. It suffered a big dip in 1998 during the fall crash but quickly made back lost ground.

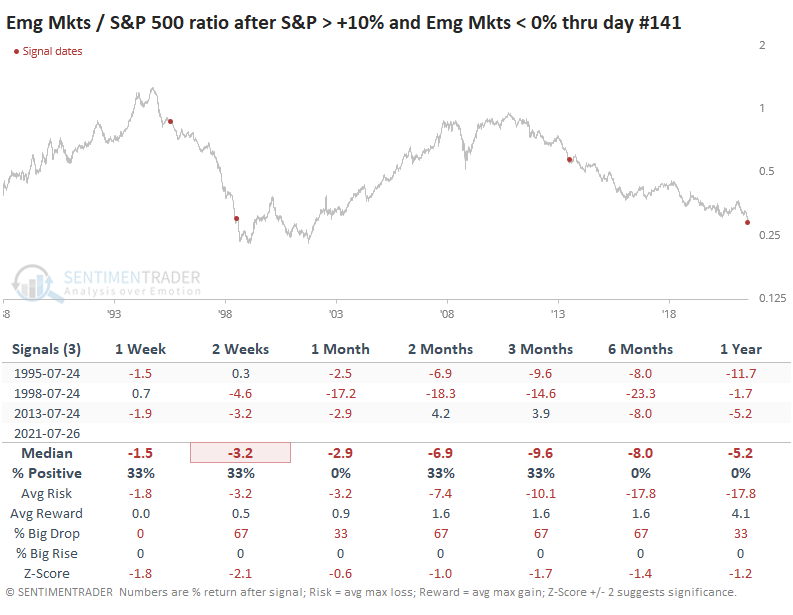

This means that the ratio between emerging markets and the S&P kept slipping.

Across all time frames, the three precedents underperformed random returns for the ratio between the two markets with a risk / reward that was heavily skewed to the "risk" side.

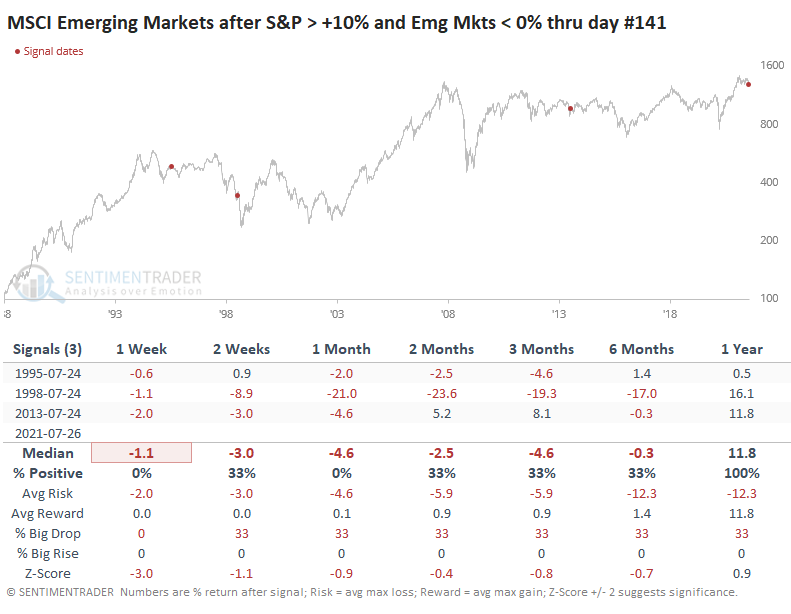

EXPANDED SAMPLE SIZE, SAME CONCLUSION

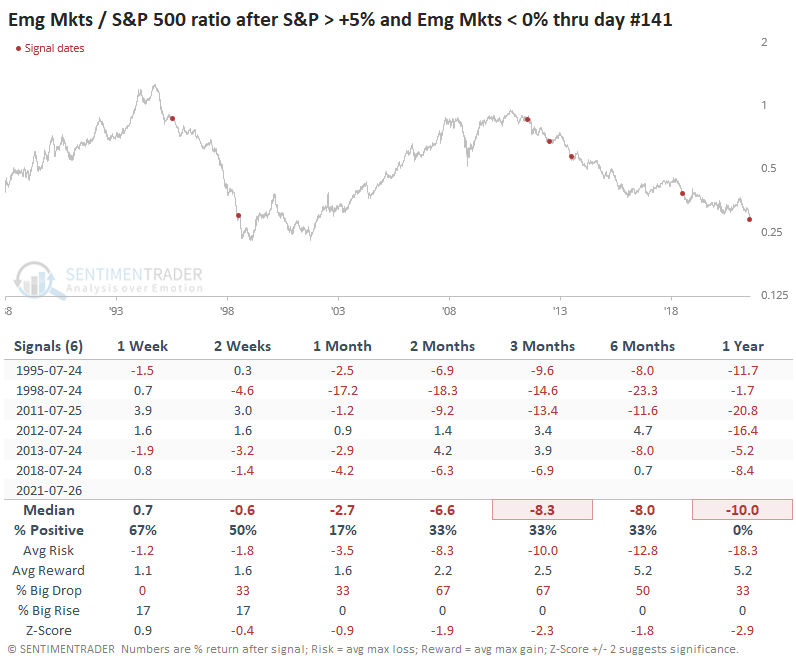

It's really had to put much weight on a sample size of three, so if we expand the sample by looking at 5% or larger YTD gains in the S&P while emerging markets showed losses, we do generate more signals, but the sample is still tiny. And the conclusion was the same.

None of these years saw emerging markets suddenly, and sustainably, turn around their relative underperformance. While they made a concerted effort in 2012 and 2013, ultimately the trend continued to favor the dominance of the U.S. markets.

Pessimism is building in emerging markets, and Chinese stocks in particular. It may soon reach capitulative levels, which may help turn the current trend favoring the U.S. Until we see more signs of that, however, this momentum and seasonal bias toward the U.S. has a solid historical backing.