Thanksgiving Bias After A Rally

In the summary section of recent reports, I've noted that whatever bearish implications are out there at the moment (such as a severely split market between winners and losers) are facing a headwind as we head into the positive seasonal stretch ahead of Thanksgiving.

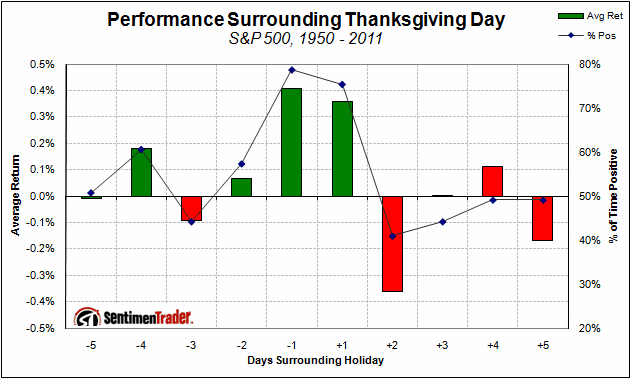

The holiday has seen a consistent positive bias over the years:

We can see the positive skew before the Thanksgiving break and the weakness afterward.

We've been asked several times about the rally we've seen over the past couple of weeks - doesn't that take some of the traditional buying power away?

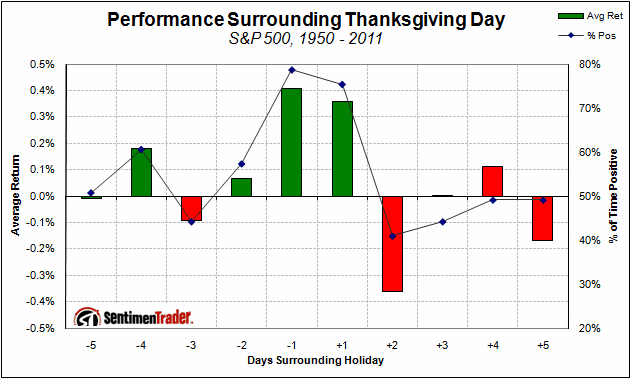

Let's to back to 1950 and look at it a couple of different ways. First, we'll look at times the S&P rallied at least 2% over the past two weeks, leading up to the three days prior to Thanksgiving. The table shows how the S&P performed in the final three days leading up to the holiday break, and then the week after:

The positive pre-holiday edge was not dulled at all. Stocks rose the Monday, Tuesday, and Wednesday leading up to the holiday 15 out of 19 times, with an average maximum gain more than twice the average maximum decline. But the week after wasn't so hot, with only 7 winners, a negative average return and more risk than reward.

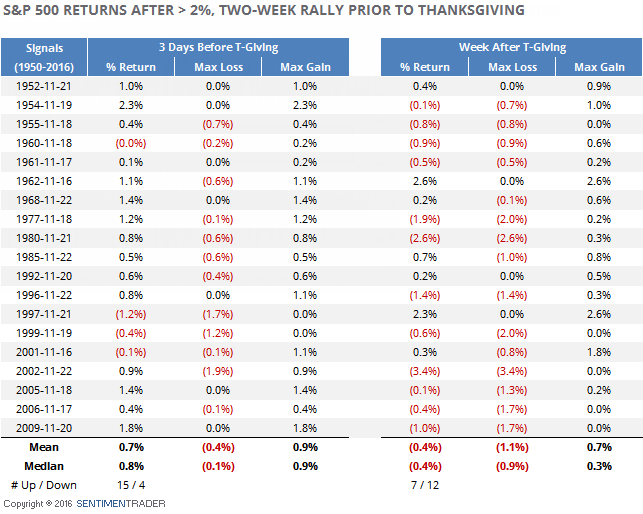

The same pattern holds if we look at times when the S&P closed at a 52-week high prior to Thanksgiving week. If we relax the parameters and only require that the S&P be within 1% of a 52-week high, then it doesn't change much.

Seasonality is a tiny influence on stocks the vast majority of the time. Around major holidays, it becomes more of a factor, probably due to self-reinforcement. "Everyone" knows these biases, and acts accordingly. There is a tendency to think that since they're so well-known, they are less likely to work, but that's been said for decades and yet some of them, like around Thanksgiving, have remained consistent.

It suggests that the rally over the past couple of weeks hasn't take the wind out of bulls' sails just yet, and weakness is more likely to hit after the holiday.