Testing Oversold Small-Caps

With the introduction of our backtesting engine, it's now possible to determine how a market (or almost any market) has responded to various conditions from our indicators.

Let's go over a use case with the small-cap Russell 2000 ETF, IWM.

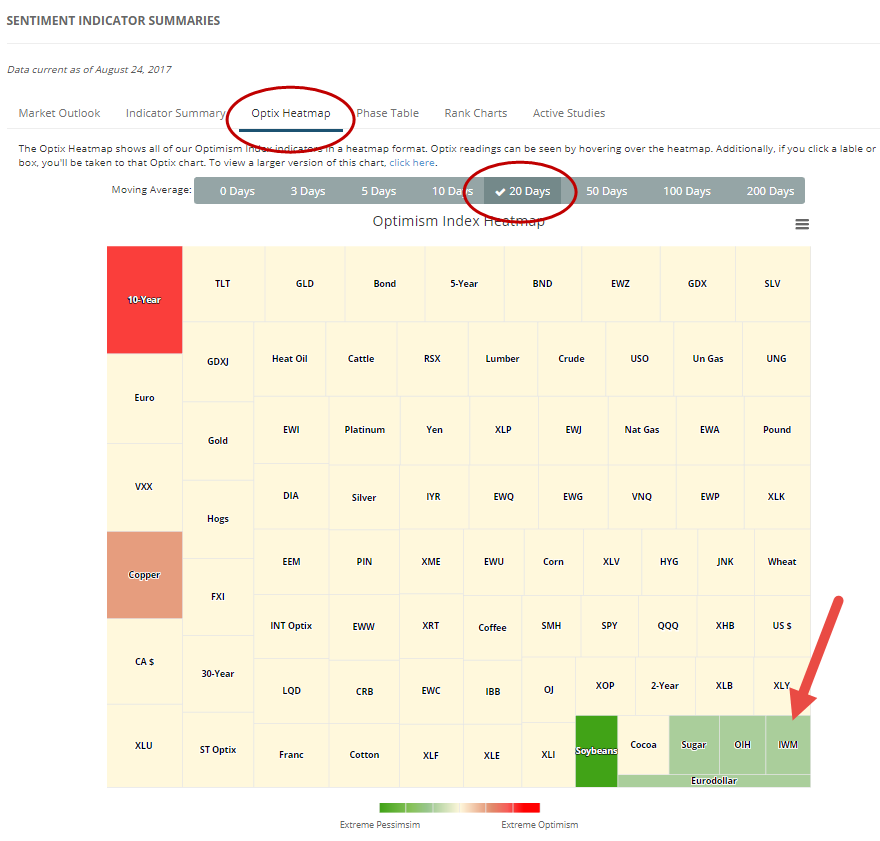

From the Dashboard, if we click on the Optix Heatmap and then reorganize it by the 20-day average of the Optimism Index, we can see that IWM is among the most hated of all markets over the past month.

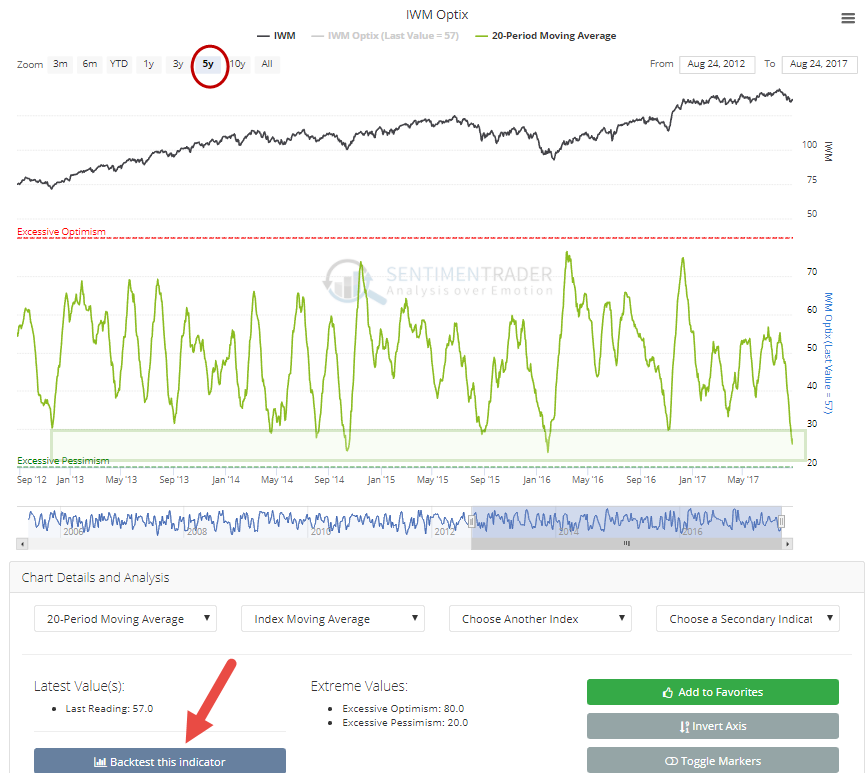

If you click that IWM tile, it will bring up the chart of the Optimism Index for IWM. From the drop-down box below the chart, choose the 20-day average and it will show up on the chart. To isolate it, in the legend click IWM Optix, which will make everything disappear. Again in the legend, click 20-Period Moving Average and only the moving average will now appear in the chart. We can see that it's just curling up from a low level of around 26.

Zoom out on the chart by using the window below the chart, or select 5Y from the boxes to have the chart re-scale and show the past 5 years of history. We can see that the current 20-day average is among the lowest we've seen during that time frame. To see how IWM has performed after similar extremes, click the Backtest This Indicator button.

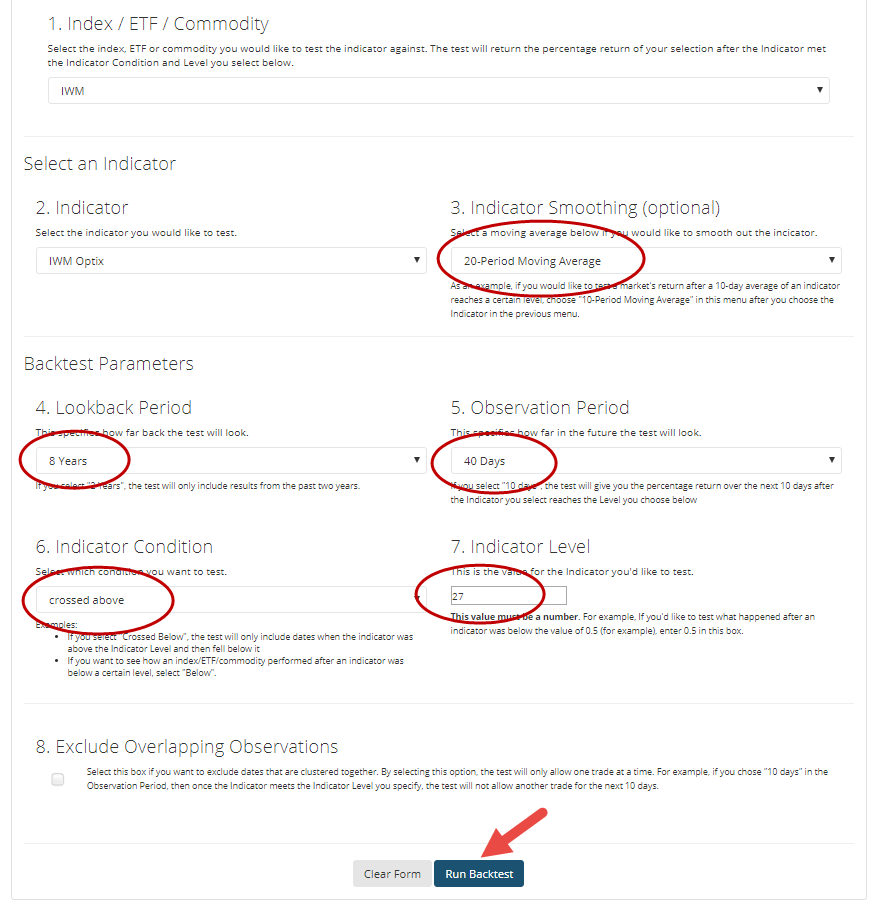

The fund and indicator will already be chosen for you. Then select the 20-period moving average, for the past 8 years (regular subscribers will see history up to the past 5 years, premium tier members can test the whole history), let's look at the next 40 days (not important), and how the market has done after the indicator "crossed above" the level of 27. Then click Run Backtest.

When the results pop up, click the Multi-Timeframe Results tab.

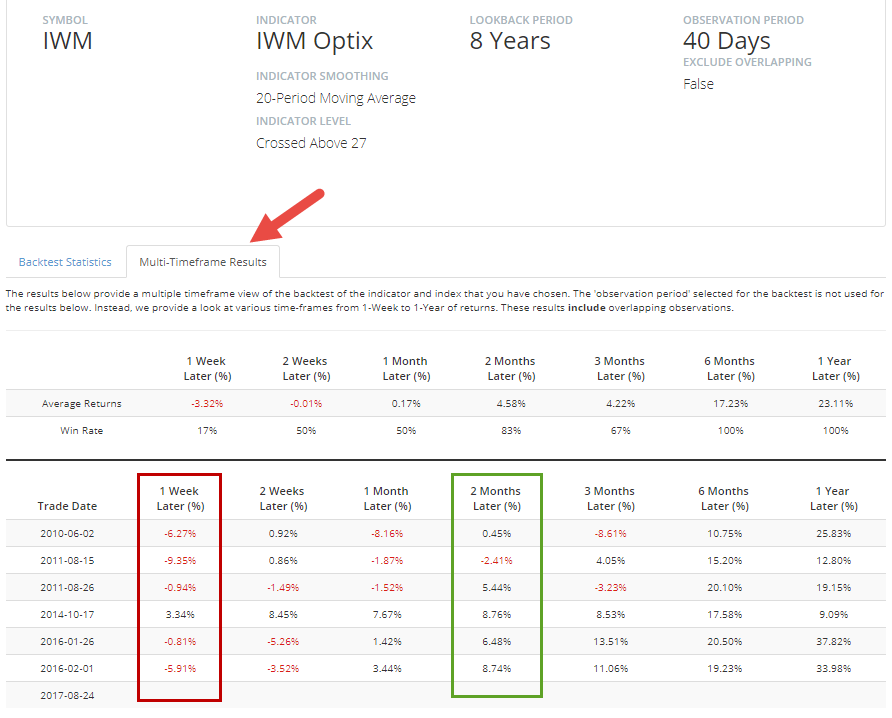

From there, we can see that during this bull market, when IWM has been as hated as it was recently over the past month and sentiment has begun to recover, a week later IWM actually sold off every time but once, and a few of them were stiff. But by two months later, it was higher every time, suggesting that buying into a short-term pullback has been a winning bet after sentiment started to recover from a pessimistic level.

This won't work as well (or at all) during a bear market, but if you go back further you can see how it performed in 2007-2008 as well, to better determine what kind of risk was normal.