Tech's Perfect Signal

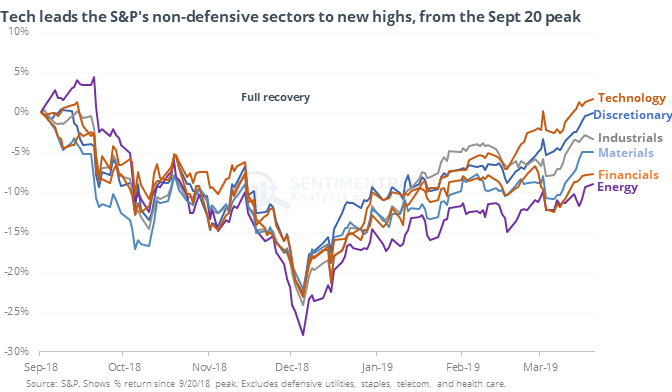

Tech’s fully recovery

Out of the S&P 500’s 11 major sectors, only one has made a fully recovery from the December decline, and it’s an important one. The information technology group has fully recovered from its decline of more than 24%.

Other times it fully recovered a drop of 20% or more within a six-month window, it showed excellent returns going forward. Most impressively, a year later the sector was higher by at least 13% every time. Returns were excellent for the S&P 500 itself, as well.

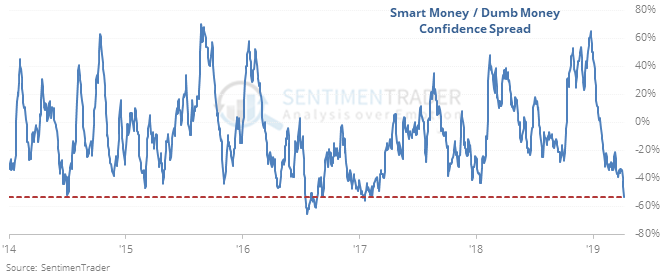

Sentiment spread

The persistent bid under stocks has buoyed sentiment, and the spread between Smart and Dumb Money Confidence hit a multi-year low this week.

When it first hits this wide of a spread, it has not been a negative, but as the days progress with this kind of extreme, the risk/reward quickly turns negative.

A down day!

The S&P lost more than 0.5% on Tuesday for only the 9th time since the December 24 bottom. After 7 of those other 8 down days, the S&P rebounded over the next two days and returned an average of more than 1%.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.